Even the best investor on earth makes unsuccessful investments. But it should be a priority to avoid stomach churning catastrophes, wherever possible. We wouldn't blame Sunac Services Holdings Limited (HKG:1516) shareholders if they were still in shock after the stock dropped like a lead balloon, down 87% in just one year. A loss like this is a stark reminder that portfolio diversification is important. Sunac Services Holdings may have better days ahead, of course; we've only looked at a one year period. The falls have accelerated recently, with the share price down 27% in the last three months. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

If the past week is anything to go by, investor sentiment for Sunac Services Holdings isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Sunac Services Holdings

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Sunac Services Holdings share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

Sunac Services Holdings' dividend seems healthy to us, so we doubt that the yield is a concern for the market. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Of course, it could simply be that it simply fell short of the market consensus expectations.

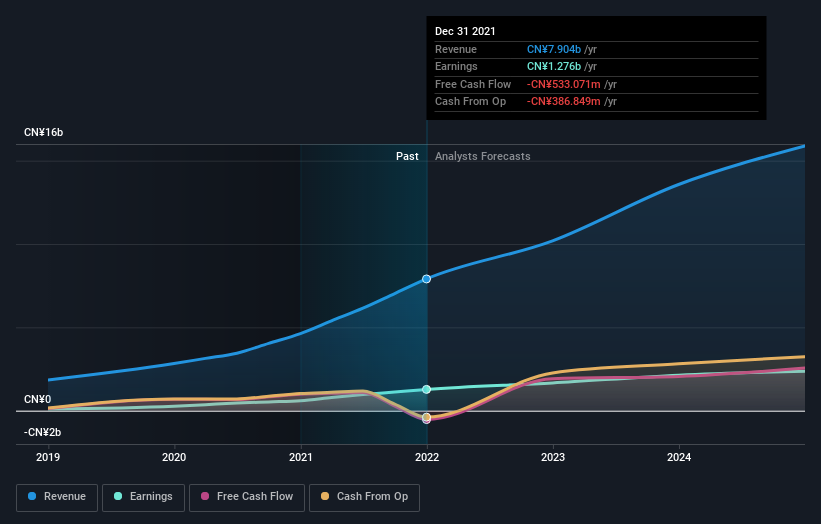

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

SEHK:1516 Earnings and Revenue Growth August 26th 2022

SEHK:1516 Earnings and Revenue Growth August 26th 2022Sunac Services Holdings is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Sunac Services Holdings in this interactive graph of future profit estimates.

A Different Perspective

We doubt Sunac Services Holdings shareholders are happy with the loss of 86% over twelve months (even including dividends). That falls short of the market, which lost 19%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 27% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Sunac Services Holdings is showing 3 warning signs in our investment analysis , and 1 of those is concerning...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.