Yixin Group Limited (HKG:2858) shareholders will doubtless be very grateful to see the share price up 37% in the last quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 35% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

The recent uptick of 7.3% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

View our latest analysis for Yixin Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Yixin Group became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

Arguably the revenue decline of 17% per year has people thinking Yixin Group is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

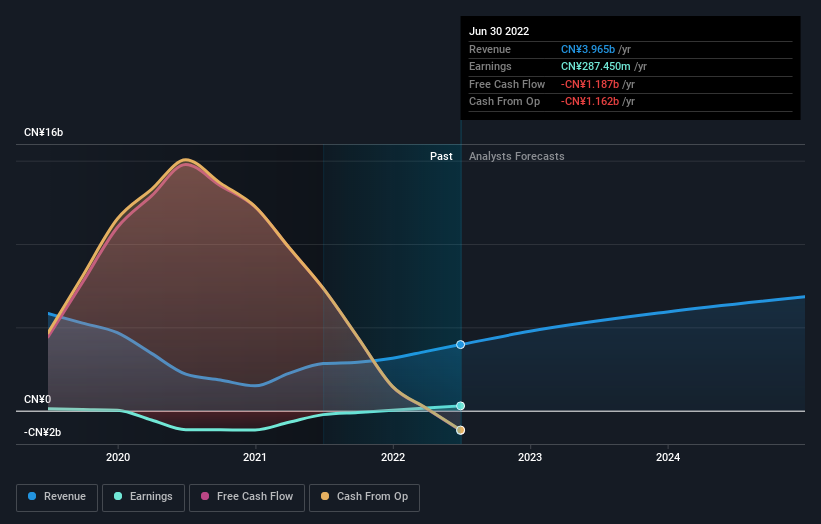

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

SEHK:2858 Earnings and Revenue Growth August 26th 2022

SEHK:2858 Earnings and Revenue Growth August 26th 2022It is of course excellent to see how Yixin Group has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Yixin Group shareholders are down 35% for the year, falling short of the market return. Meanwhile, the broader market slid about 19%, likely weighing on the stock. Shareholders have lost 10% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Yixin Group (1 is potentially serious) that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.