While not a mind-blowing move, it is good to see that the Sinostar Cable Co., Ltd. (SZSE:300933) share price has gained 12% in the last three months. But in truth the last year hasn't been good for the share price. In fact, the price has declined 25% in a year, falling short of the returns you could get by investing in an index fund.

If the past week is anything to go by, investor sentiment for Sinostar Cable isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Sinostar Cable

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unhappily, Sinostar Cable had to report a 24% decline in EPS over the last year. Remarkably, he share price decline of 25% per year is particularly close to the EPS drop. Given the lower EPS we might have expected investors to lose confidence in the stock, but that doesn't seemed to have happened. Instead, the change in the share price seems to reduction in earnings per share, alone.

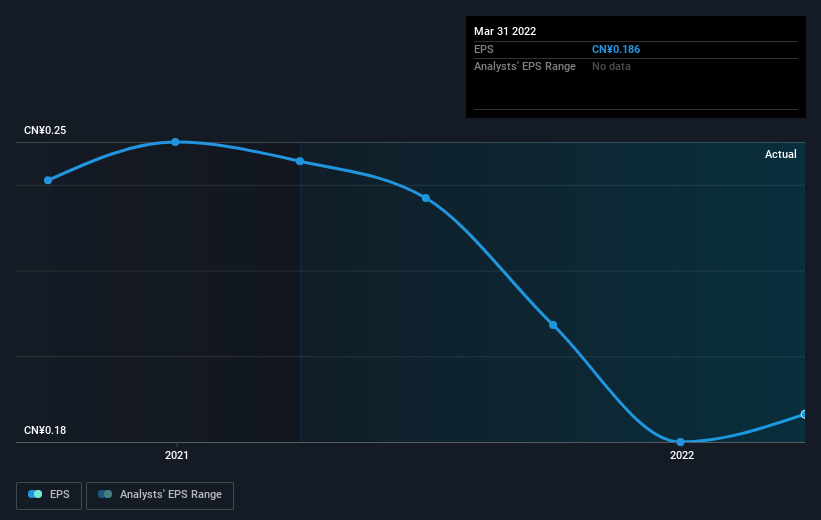

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

SZSE:300933 Earnings Per Share Growth August 25th 2022

SZSE:300933 Earnings Per Share Growth August 25th 2022Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Sinostar Cable shareholders are down 24% for the year (even including dividends), even worse than the market loss of 11%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Putting aside the last twelve months, it's good to see the share price has rebounded by 12%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Is Sinostar Cable cheap compared to other companies? These 3 valuation measures might help you decide.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.