Zylox-Tonbridge Medical Technology Co., Ltd. (HKG:2190) shareholders should be happy to see the share price up 25% in the last month. But that's small comfort given the dismal price performance over the last year. Specifically, the stock price slipped by 67% in that time. The share price recovery is not so impressive when you consider the fall. Arguably, the fall was overdone.

While the last year has been tough for Zylox-Tonbridge Medical Technology shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Zylox-Tonbridge Medical Technology

Because Zylox-Tonbridge Medical Technology made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Zylox-Tonbridge Medical Technology increased its revenue by 167%. That's well above most other pre-profit companies. Meanwhile, the share price slid 67%. Typically a growth stock like this will be volatile, with some shareholders concerned about the red ink on the bottom line (that is, the losses). We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

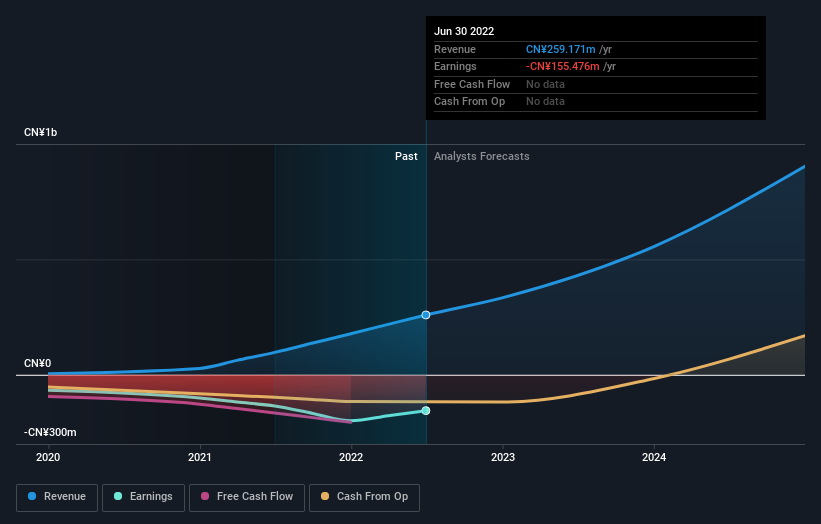

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

SEHK:2190 Earnings and Revenue Growth August 17th 2022

SEHK:2190 Earnings and Revenue Growth August 17th 2022We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We doubt Zylox-Tonbridge Medical Technology shareholders are happy with the loss of 67% over twelve months. That falls short of the market, which lost 17%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Putting aside the last twelve months, it's good to see the share price has rebounded by 16%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Zylox-Tonbridge Medical Technology by clicking this link.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.