For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in 37 Interactive Entertainment Network Technology Group (SZSE:002555). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for 37 Interactive Entertainment Network Technology Group

How Fast Is 37 Interactive Entertainment Network Technology Group Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. 37 Interactive Entertainment Network Technology Group's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 48%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

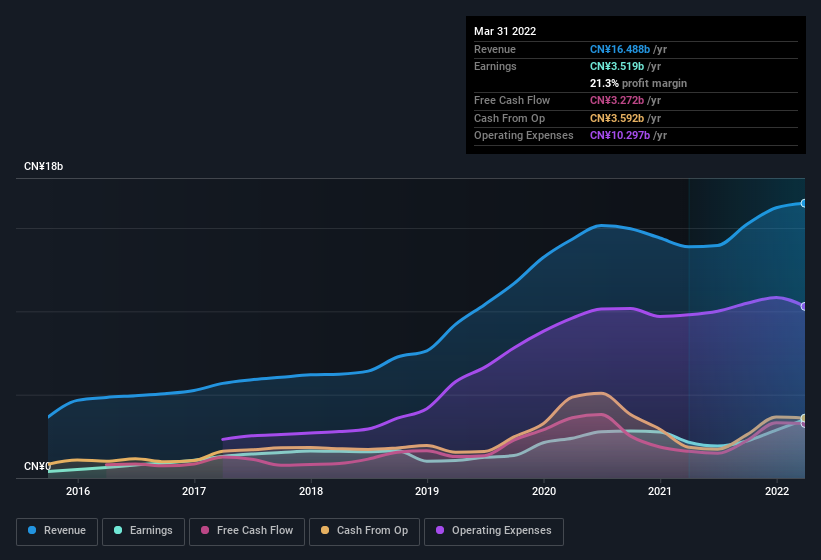

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of 37 Interactive Entertainment Network Technology Group shareholders is that EBIT margins have grown from 16% to 23% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

SZSE:002555 Earnings and Revenue History August 17th 2022

SZSE:002555 Earnings and Revenue History August 17th 2022The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for 37 Interactive Entertainment Network Technology Group's future EPS 100% free.

Are 37 Interactive Entertainment Network Technology Group Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that 37 Interactive Entertainment Network Technology Group insiders own a meaningful share of the business. Actually, with 42% of the company to their names, insiders are profoundly invested in the business. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. At the current share price, that insider holding is worth a staggering CN¥19b. That means they have plenty of their own capital riding on the performance of the business!

Does 37 Interactive Entertainment Network Technology Group Deserve A Spot On Your Watchlist?

37 Interactive Entertainment Network Technology Group's earnings per share have been soaring, with growth rates sky high. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, 37 Interactive Entertainment Network Technology Group is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Even so, be aware that 37 Interactive Entertainment Network Technology Group is showing 1 warning sign in our investment analysis , you should know about...

Although 37 Interactive Entertainment Network Technology Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.