Passive investing in index funds can generate returns that roughly match the overall market. But investors can boost returns by picking market-beating companies to own shares in. For example, the Shanghai Yanpu Metal Products Co.,Ltd (SHSE:605128) share price is up 24% in the last 1 year, clearly besting the market decline of around 9.7% (not including dividends). That's a solid performance by our standards! Shanghai Yanpu Metal ProductsLtd hasn't been listed for long, so it's still not clear if it is a long term winner.

In light of the stock dropping 8.7% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

Check out our latest analysis for Shanghai Yanpu Metal ProductsLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months, Shanghai Yanpu Metal ProductsLtd actually shrank its EPS by 41%.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

We doubt the modest 0.2% dividend yield is doing much to support the share price. Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

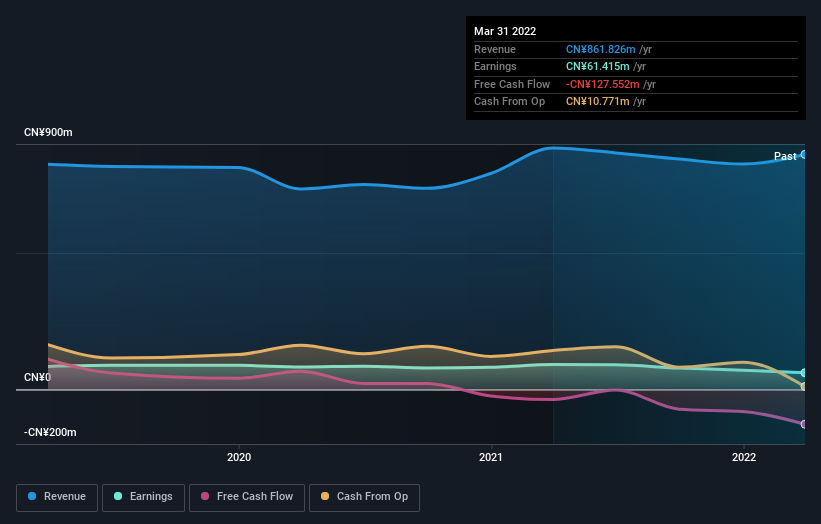

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

SHSE:605128 Earnings and Revenue Growth August 17th 2022

SHSE:605128 Earnings and Revenue Growth August 17th 2022If you are thinking of buying or selling Shanghai Yanpu Metal ProductsLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Shanghai Yanpu Metal ProductsLtd boasts a total shareholder return of 25% for the last year (that includes the dividends) . A substantial portion of that gain has come in the last three months, with the stock up 105% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Shanghai Yanpu Metal ProductsLtd (at least 2 which are significant) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.