As every investor would know, you don't hit a homerun every time you swing. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. So we hope that those who held Kintor Pharmaceutical Limited (HKG:9939) during the last year don't lose the lesson, in addition to the 78% hit to the value of their shares. That'd be enough to make even the strongest stomachs churn. Kintor Pharmaceutical may have better days ahead, of course; we've only looked at a one year period. Furthermore, it's down 25% in about a quarter. That's not much fun for holders.

The recent uptick of 9.1% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

See our latest analysis for Kintor Pharmaceutical

Because Kintor Pharmaceutical made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

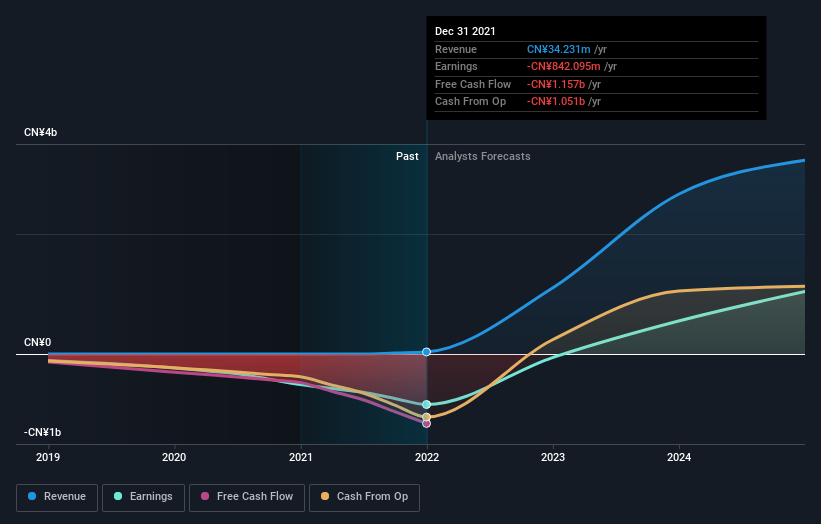

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

SEHK:9939 Earnings and Revenue Growth August 15th 2022

SEHK:9939 Earnings and Revenue Growth August 15th 2022We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Kintor Pharmaceutical shareholders are down 78% for the year, even worse than the market loss of 18%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 25%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand Kintor Pharmaceutical better, we need to consider many other factors. For example, we've discovered 3 warning signs for Kintor Pharmaceutical (1 is a bit concerning!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.