Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Yue Yuen Industrial (Holdings) Limited (HKG:551) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Yue Yuen Industrial (Holdings)

How Much Debt Does Yue Yuen Industrial (Holdings) Carry?

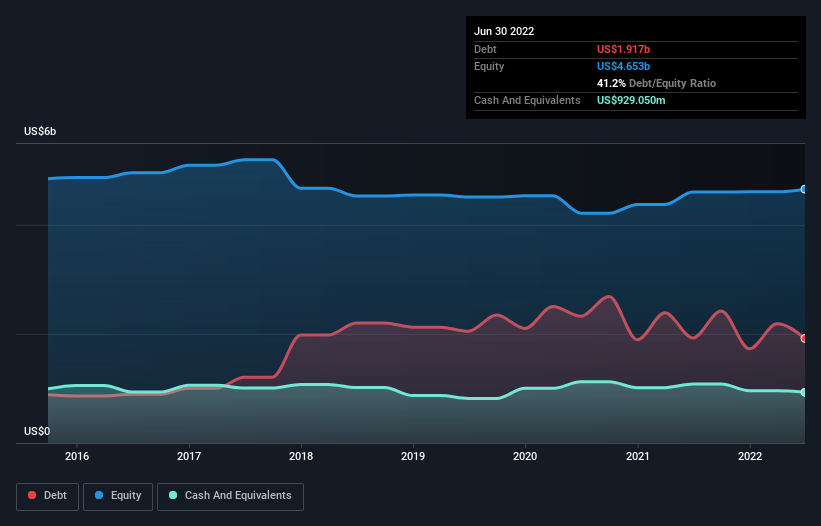

The chart below, which you can click on for greater detail, shows that Yue Yuen Industrial (Holdings) had US$1.92b in debt in June 2022; about the same as the year before. However, it does have US$929.1m in cash offsetting this, leading to net debt of about US$987.5m.

SEHK:551 Debt to Equity History August 15th 2022

SEHK:551 Debt to Equity History August 15th 2022A Look At Yue Yuen Industrial (Holdings)'s Liabilities

According to the last reported balance sheet, Yue Yuen Industrial (Holdings) had liabilities of US$2.37b due within 12 months, and liabilities of US$1.50b due beyond 12 months. On the other hand, it had cash of US$929.1m and US$1.81b worth of receivables due within a year. So it has liabilities totalling US$1.13b more than its cash and near-term receivables, combined.

Yue Yuen Industrial (Holdings) has a market capitalization of US$2.31b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Yue Yuen Industrial (Holdings) can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Yue Yuen Industrial (Holdings) had a loss before interest and tax, and actually shrunk its revenue by 8.0%, to US$8.4b. That's not what we would hope to see.

Caveat Emptor

Over the last twelve months Yue Yuen Industrial (Holdings) produced an earnings before interest and tax (EBIT) loss. Indeed, it lost US$23m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. On the bright side, we note that trailing twelve month EBIT is worse than the free cash flow of US$177m and the profit of US$120m. So one might argue that there's still a chance it can get things on the right track. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Yue Yuen Industrial (Holdings) has 3 warning signs (and 1 which is significant) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.