Many investors define successful investing as beating the market average over the long term. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Inspur International Limited (HKG:596) shareholders have had that experience, with the share price dropping 33% in three years, versus a market decline of about 5.6%. The more recent news is of little comfort, with the share price down 27% in a year. On top of that, the share price is down 13% in the last week.

Since Inspur International has shed HK$400m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Inspur International

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Inspur International moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

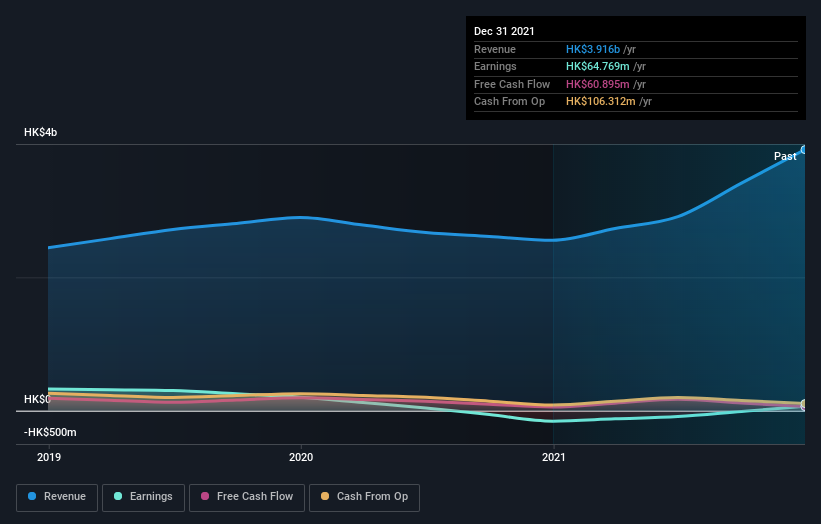

Revenue is actually up 9.8% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Inspur International more closely, as sometimes stocks fall unfairly. This could present an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

SEHK:596 Earnings and Revenue Growth August 11th 2022

SEHK:596 Earnings and Revenue Growth August 11th 2022If you are thinking of buying or selling Inspur International stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 20% in the twelve months, Inspur International shareholders did even worse, losing 27%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Inspur International better, we need to consider many other factors. Take risks, for example - Inspur International has 2 warning signs (and 1 which is potentially serious) we think you should know about.

Of course Inspur International may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.