Sichuan Huiyuan Optical Communication Co., Ltd. (SZSE:000586) shares have continued their recent momentum with a 27% gain in the last month alone. Looking further back, the 22% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

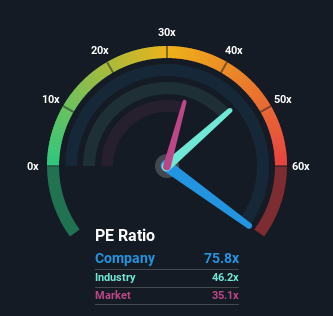

After such a large jump in price, Sichuan Huiyuan Optical Communication may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 75.8x, since almost half of all companies in China have P/E ratios under 35x and even P/E's lower than 20x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

As an illustration, earnings have deteriorated at Sichuan Huiyuan Optical Communication over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Sichuan Huiyuan Optical Communication

SZSE:000586 Price Based on Past Earnings August 10th 2022 Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sichuan Huiyuan Optical Communication will help you shine a light on its historical performance.

SZSE:000586 Price Based on Past Earnings August 10th 2022 Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sichuan Huiyuan Optical Communication will help you shine a light on its historical performance. What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Sichuan Huiyuan Optical Communication would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 37% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Sichuan Huiyuan Optical Communication's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Sichuan Huiyuan Optical Communication's P/E

Sichuan Huiyuan Optical Communication's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Sichuan Huiyuan Optical Communication revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Sichuan Huiyuan Optical Communication with six simple checks on some of these key factors.

If you're unsure about the strength of Sichuan Huiyuan Optical Communication's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.