By buying an index fund, you can roughly match the market return with ease. But if you pick the right individual stocks, you could make more than that. For example, Xin Yuan Enterprises Group Limited (HKG:1748) shareholders have seen the share price rise 76% over three years, well in excess of the market decline (7.0%, not including dividends).

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Xin Yuan Enterprises Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last three years, Xin Yuan Enterprises Group failed to grow earnings per share, which fell 42% (annualized).

This means it's unlikely the market is judging the company based on earnings growth. Therefore, we think it's worth considering other metrics as well.

It could be that the revenue growth of 6.2% per year is viewed as evidence that Xin Yuan Enterprises Group is growing. In that case, the company may be sacrificing current earnings per share to drive growth, and maybe shareholder's faith in better days ahead will be rewarded.

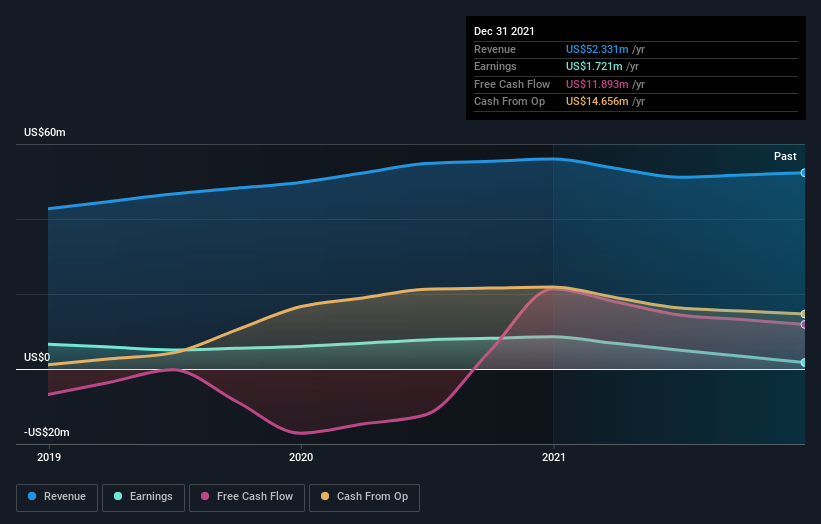

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

SEHK:1748 Earnings and Revenue Growth August 10th 2022

SEHK:1748 Earnings and Revenue Growth August 10th 2022If you are thinking of buying or selling Xin Yuan Enterprises Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Xin Yuan Enterprises Group shareholders are down 25% for the year, falling short of the market return. Meanwhile, the broader market slid about 20%, likely weighing on the stock. Investors are up over three years, booking 21% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with Xin Yuan Enterprises Group (including 2 which can't be ignored) .

We will like Xin Yuan Enterprises Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.