Adaptimmune Therapeutics plc (NASDAQ:ADAP) shareholders will doubtless be very grateful to see the share price up 40% in the last month. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. Indeed, the share price is down 55% in the period. So we're hesitant to put much weight behind the short term increase. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

While the stock has risen 23% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Adaptimmune Therapeutics

Adaptimmune Therapeutics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Adaptimmune Therapeutics saw its revenue shrink by 39% per year. That's definitely a weaker result than most pre-profit companies report. Arguably, the market has responded appropriately to this business performance by sending the share price down 9% (annualized) in the same time period. It's fair to say most investors don't like to invest in loss making companies with falling revenue. This looks like a really risky stock to buy, at a glance.

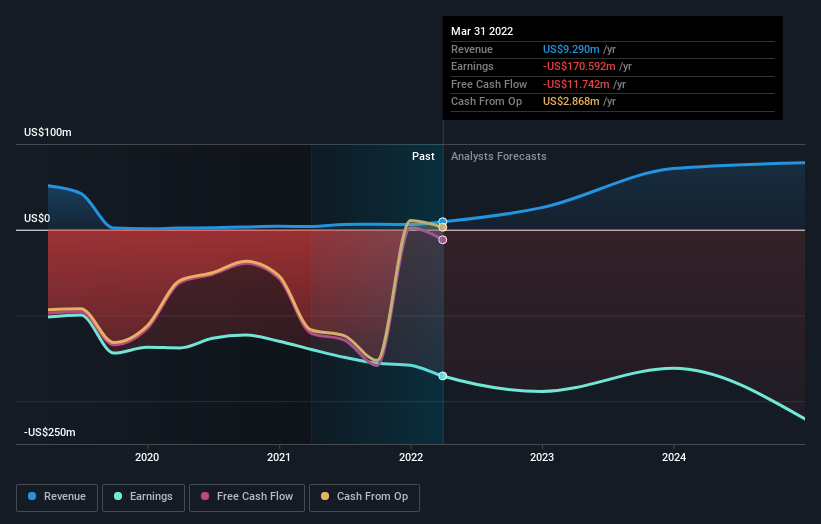

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

NasdaqGS:ADAP Earnings and Revenue Growth August 5th 2022

NasdaqGS:ADAP Earnings and Revenue Growth August 5th 2022Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market lost about 11% in the twelve months, Adaptimmune Therapeutics shareholders did even worse, losing 34%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Adaptimmune Therapeutics is showing 4 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.