The Founder Holdings Limited (HKG:418) share price has fared very poorly over the last month, falling by a substantial 25%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 27% in that time.

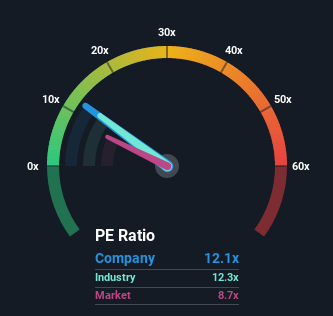

In spite of the heavy fall in price, Founder Holdings may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 12.1x, since almost half of all companies in Hong Kong have P/E ratios under 8x and even P/E's lower than 4x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Founder Holdings over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for Founder Holdings

SEHK:418 Price Based on Past Earnings August 3rd 2022 Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Founder Holdings will help you shine a light on its historical performance.

SEHK:418 Price Based on Past Earnings August 3rd 2022 Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Founder Holdings will help you shine a light on its historical performance. Is There Enough Growth For Founder Holdings?

The only time you'd be truly comfortable seeing a P/E as high as Founder Holdings' is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. This means it has also seen a slide in earnings over the longer-term as EPS is down 50% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 15% shows it's an unpleasant look.

In light of this, it's alarming that Founder Holdings' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Founder Holdings' P/E

Founder Holdings' P/E hasn't come down all the way after its stock plunged. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Founder Holdings currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You need to take note of risks, for example - Founder Holdings has 2 warning signs (and 1 which is concerning) we think you should know about.

If these risks are making you reconsider your opinion on Founder Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.