It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like LifeTech Scientific (HKG:1302). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for LifeTech Scientific

LifeTech Scientific's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that LifeTech Scientific has managed to grow EPS by 31% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

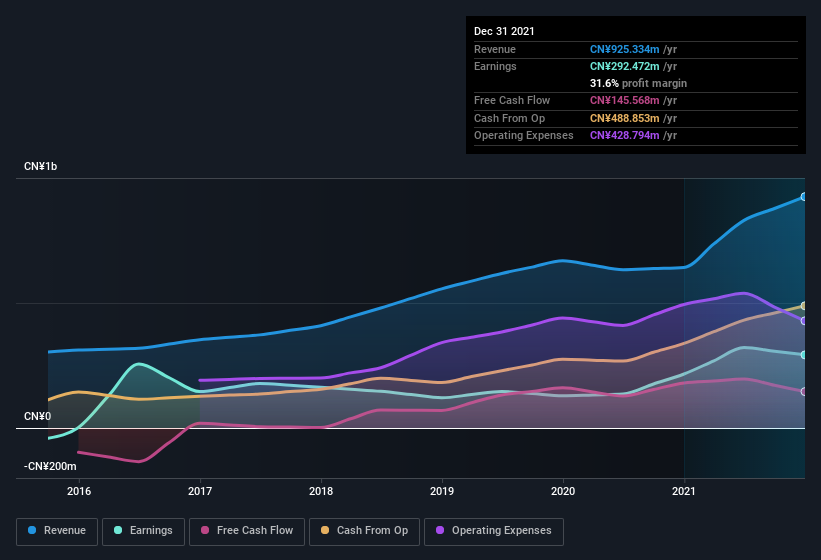

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of LifeTech Scientific shareholders is that EBIT margins have grown from 10% to 40% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

SEHK:1302 Earnings and Revenue History August 1st 2022

SEHK:1302 Earnings and Revenue History August 1st 2022While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check LifeTech Scientific's balance sheet strength, before getting too excited.

Are LifeTech Scientific Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own LifeTech Scientific shares worth a considerable sum. Indeed, they have a considerable amount of wealth invested in it, currently valued at CN¥2.0b. That equates to 17% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Is LifeTech Scientific Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into LifeTech Scientific's strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in LifeTech Scientific's continuing strength. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of LifeTech Scientific.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.