For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like China Starch Holdings (HKG:3838). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for China Starch Holdings

How Quickly Is China Starch Holdings Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. China Starch Holdings managed to grow EPS by 14% per year, over three years. That's a good rate of growth, if it can be sustained.

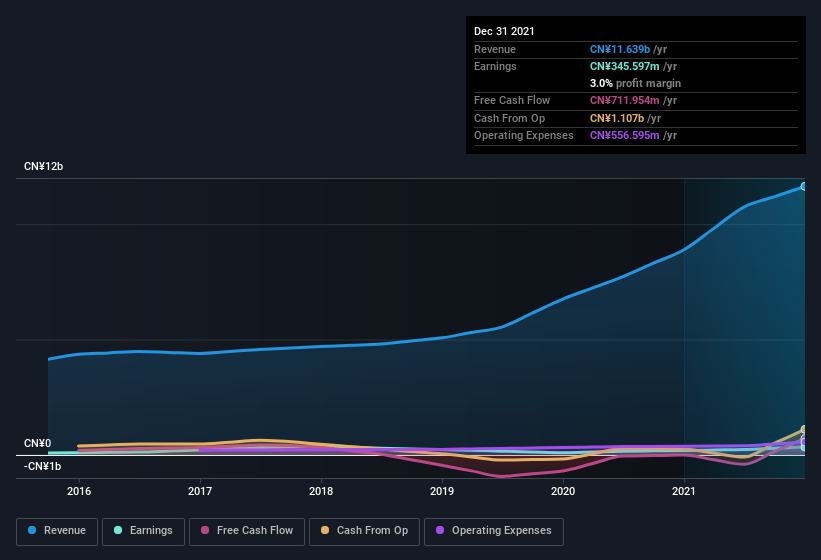

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note China Starch Holdings achieved similar EBIT margins to last year, revenue grew by a solid 31% to CN¥12b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

SEHK:3838 Earnings and Revenue History July 28th 2022

SEHK:3838 Earnings and Revenue History July 28th 2022China Starch Holdings isn't a huge company, given its market capitalisation of HK$1.7b. That makes it extra important to check on its balance sheet strength.

Are China Starch Holdings Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. For companies with market capitalisations between CN¥676m and CN¥2.7b, like China Starch Holdings, the median CEO pay is around CN¥2.0m.

The China Starch Holdings CEO received total compensation of just CN¥535k in the year to December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does China Starch Holdings Deserve A Spot On Your Watchlist?

As previously touched on, China Starch Holdings is a growing business, which is encouraging. On top of that, our faith in the board of directors is strengthened by the fact of the reasonable CEO pay. So all in all China Starch Holdings is worthy at least considering for your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for China Starch Holdings (of which 1 can't be ignored!) you should know about.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.