Statistically speaking, long term investing is a profitable endeavour. But no-one is immune from buying too high. For example, after five long years the Guangshen Railway Company Limited (HKG:525) share price is a whole 67% lower. We certainly feel for shareholders who bought near the top.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Guangshen Railway

Guangshen Railway wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, Guangshen Railway saw its revenue increase by 0.9% per year. That's far from impressive given all the money it is losing. It's likely this weak growth has contributed to an annualised return of 11% for the last five years. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

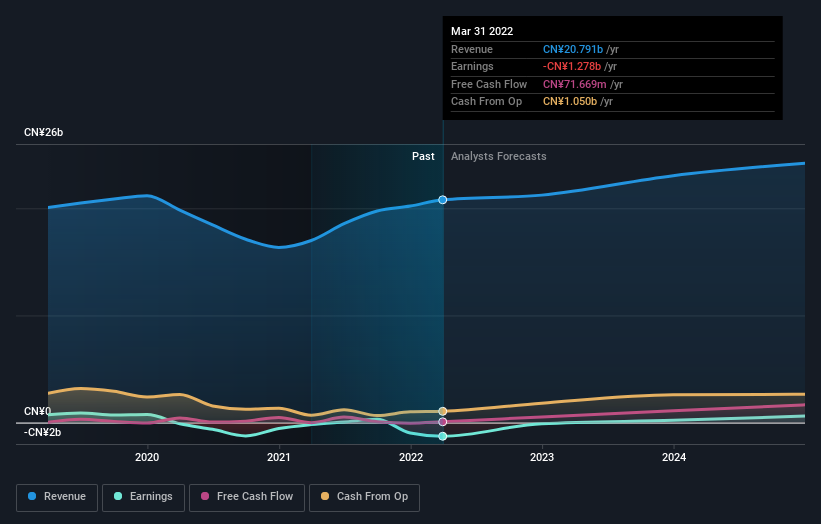

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

SEHK:525 Earnings and Revenue Growth July 25th 2022

SEHK:525 Earnings and Revenue Growth July 25th 2022It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Guangshen Railway stock, you should check out this free report showing analyst profit forecasts.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Guangshen Railway's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Guangshen Railway's TSR, which was a 64% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While it's certainly disappointing to see that Guangshen Railway shares lost 4.4% throughout the year, that wasn't as bad as the market loss of 19%. What is more upsetting is the 10% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Guangshen Railway may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.