The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. For example, the Longshine Technology Group Co., Ltd. (SZSE:300682) share price has soared 137% in the last three years. How nice for those who held the stock! Also pleasing for shareholders was the 31% gain in the last three months.

Since the stock has added CN¥1.6b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Longshine Technology Group

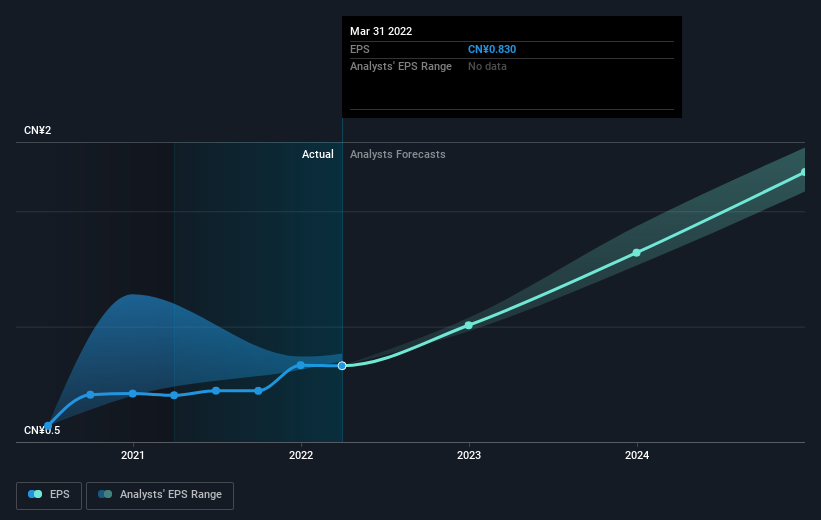

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Longshine Technology Group achieved compound earnings per share growth of 37% per year. We don't think it is entirely coincidental that the EPS growth is reasonably close to the 33% average annual increase in the share price. This observation indicates that the market's attitude to the business hasn't changed all that much. Au contraire, the share price change has arguably mimicked the EPS growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

SZSE:300682 Earnings Per Share Growth July 21st 2022

SZSE:300682 Earnings Per Share Growth July 21st 2022We know that Longshine Technology Group has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Longshine Technology Group's financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Longshine Technology Group the TSR over the last 3 years was 141%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Longshine Technology Group shareholders have gained 72% (in total) over the last year. And yes, that does include the dividend. So this year's TSR was actually better than the three-year TSR (annualized) of 34%. Given the track record of solid returns over varying time frames, it might be worth putting Longshine Technology Group on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Longshine Technology Group (of which 1 is significant!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.