Xinyi Electric Storage Holdings Limited (HKG:8328) shares have continued their recent momentum with a 47% gain in the last month alone. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

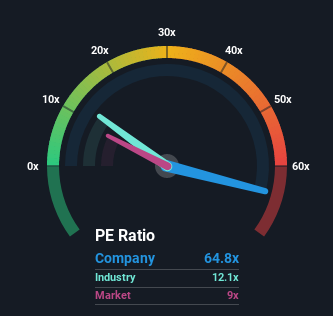

Since its price has surged higher, Xinyi Electric Storage Holdings may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 64.8x, since almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 4x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Xinyi Electric Storage Holdings as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Xinyi Electric Storage Holdings

SEHK:8328 Price Based on Past Earnings July 19th 2022 We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Xinyi Electric Storage Holdings' earnings, revenue and cash flow.

SEHK:8328 Price Based on Past Earnings July 19th 2022 We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Xinyi Electric Storage Holdings' earnings, revenue and cash flow. How Is Xinyi Electric Storage Holdings' Growth Trending?

Xinyi Electric Storage Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 224%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 2.0% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 15% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that Xinyi Electric Storage Holdings' P/E sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On Xinyi Electric Storage Holdings' P/E

Xinyi Electric Storage Holdings' P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Xinyi Electric Storage Holdings revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Xinyi Electric Storage Holdings, and understanding these should be part of your investment process.

If you're unsure about the strength of Xinyi Electric Storage Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.