As every investor would know, you don't hit a homerun every time you swing. But serious investors should think long and hard about avoiding extreme losses. It must have been painful to be a Peijia Medical Limited (HKG:9996) shareholder over the last year, since the stock price plummeted 79% in that time. That'd be enough to make even the strongest stomachs churn. Because Peijia Medical hasn't been listed for many years, the market is still learning about how the business performs. And the share price decline continued over the last week, dropping some 10.0%. However, this move may have been influenced by the broader market, which fell 4.0% in that time.

With the stock having lost 10.0% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Peijia Medical

Because Peijia Medical made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Peijia Medical increased its revenue by 253%. That's a strong result which is better than most other loss making companies. So the hefty 79% share price crash makes us think the company has somehow offended market participants. Something weird is definitely impacting the stock price; we'd venture the company has destroyed value somehow. We'd recommend taking a very close look at the stock (and any available forecasts), before considering a purchase, because the share price is not correlated with the revenue growth, that's for sure. Of course, markets do over-react so share price drop may be too harsh.

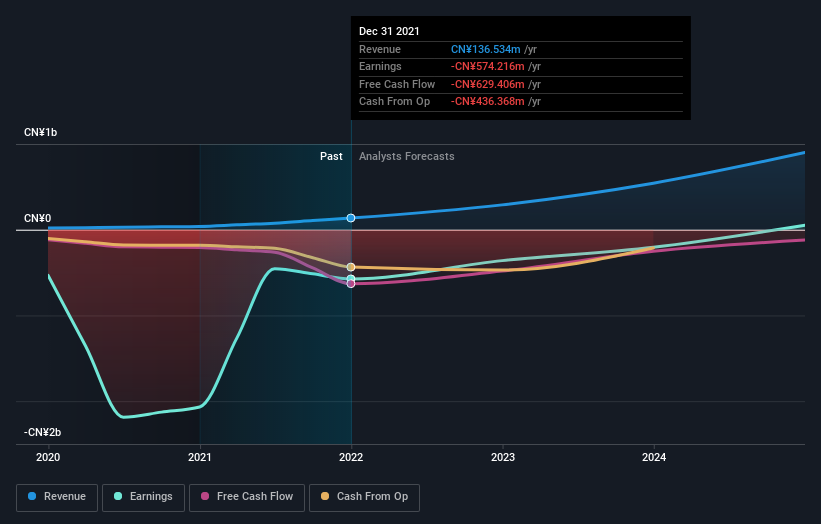

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

SEHK:9996 Earnings and Revenue Growth July 13th 2022

SEHK:9996 Earnings and Revenue Growth July 13th 2022This free interactive report on Peijia Medical's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We doubt Peijia Medical shareholders are happy with the loss of 79% over twelve months. That falls short of the market, which lost 20%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 4.8%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Peijia Medical is showing 1 warning sign in our investment analysis , you should know about...

We will like Peijia Medical better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.