While not a mind-blowing move, it is good to see that the Winner Medical Co., Ltd. (SZSE:300888) share price has gained 19% in the last three months. But that is minimal compensation for the share price under-performance over the last year. In fact the stock is down 37% in the last year, well below the market return.

On a more encouraging note the company has added CN¥1.6b to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

Check out our latest analysis for Winner Medical

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Winner Medical reported an EPS drop of 74% for the last year. This fall in the EPS is significantly worse than the 37% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

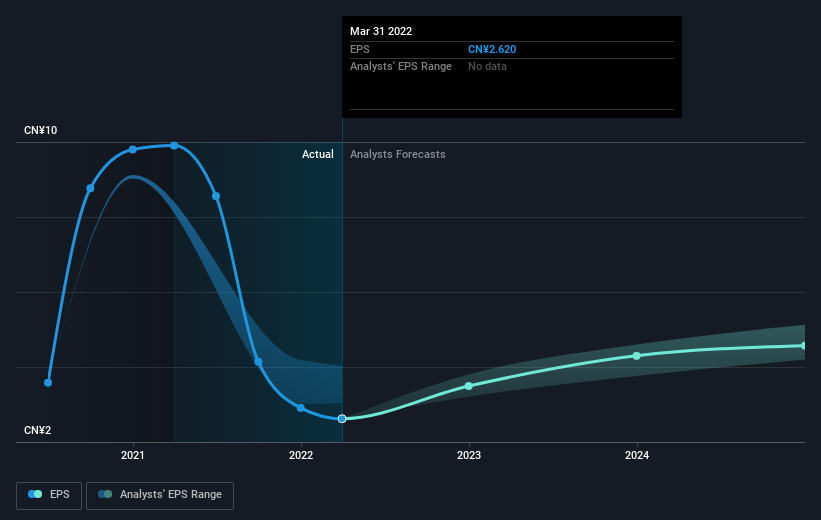

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

SZSE:300888 Earnings Per Share Growth July 12th 2022

SZSE:300888 Earnings Per Share Growth July 12th 2022It is of course excellent to see how Winner Medical has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Winner Medical's financial health with this free report on its balance sheet.

A Different Perspective

Winner Medical shareholders are down 36% for the year (even including dividends), even worse than the market loss of 7.0%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Putting aside the last twelve months, it's good to see the share price has rebounded by 19%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Winner Medical (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.