Shanghai Gench Education Group Limited (HKG:1525) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

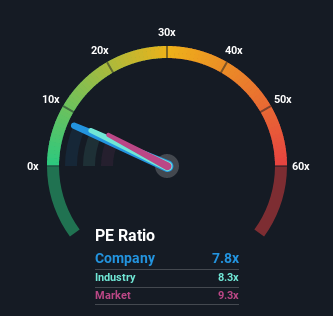

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Shanghai Gench Education Group's P/E ratio of 7.8x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Shanghai Gench Education Group's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Shanghai Gench Education Group

SEHK:1525 Price Based on Past Earnings July 6th 2022 Keen to find out how analysts think Shanghai Gench Education Group's future stacks up against the industry? In that case, our free report is a great place to start.

SEHK:1525 Price Based on Past Earnings July 6th 2022 Keen to find out how analysts think Shanghai Gench Education Group's future stacks up against the industry? In that case, our free report is a great place to start. What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Shanghai Gench Education Group's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 8.1%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 19% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 20% per annum as estimated by the one analyst watching the company. With the market only predicted to deliver 15% each year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Shanghai Gench Education Group is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Shanghai Gench Education Group's P/E?

Shanghai Gench Education Group appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shanghai Gench Education Group currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 1 warning sign for Shanghai Gench Education Group that you need to take into consideration.

If these risks are making you reconsider your opinion on Shanghai Gench Education Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.