Algo Trading for US Stocks

1. What is algo trading?

Algo trading uses a computer program that follows a pre-defined set of instructions (an algorithm) to place a trade. The algorithm defines variables such as the timing, price, volume, or any mathematical model. Algo trading will automatically monitor stock prices and place buy and sell orders when the pre-defined conditions are met.

2. Algo order types

Algo orders placed with Moomoo MY include Time-Weighted Average Price (TWAP) and Volume-Weighted Average Price (VWAP) orders.

TWAP order

A TWAP order splits one large order into smaller orders based on the TWAP algorithm that aims to achieve an execution price close to the intraday TWAP over a defined time period.

VWAP order

A VWAP order splits one large order into smaller orders based on the VWAP algorithm that aims to achieve an execution price close to the intraday VWAP over a defined time period.

3. How to place an algo order

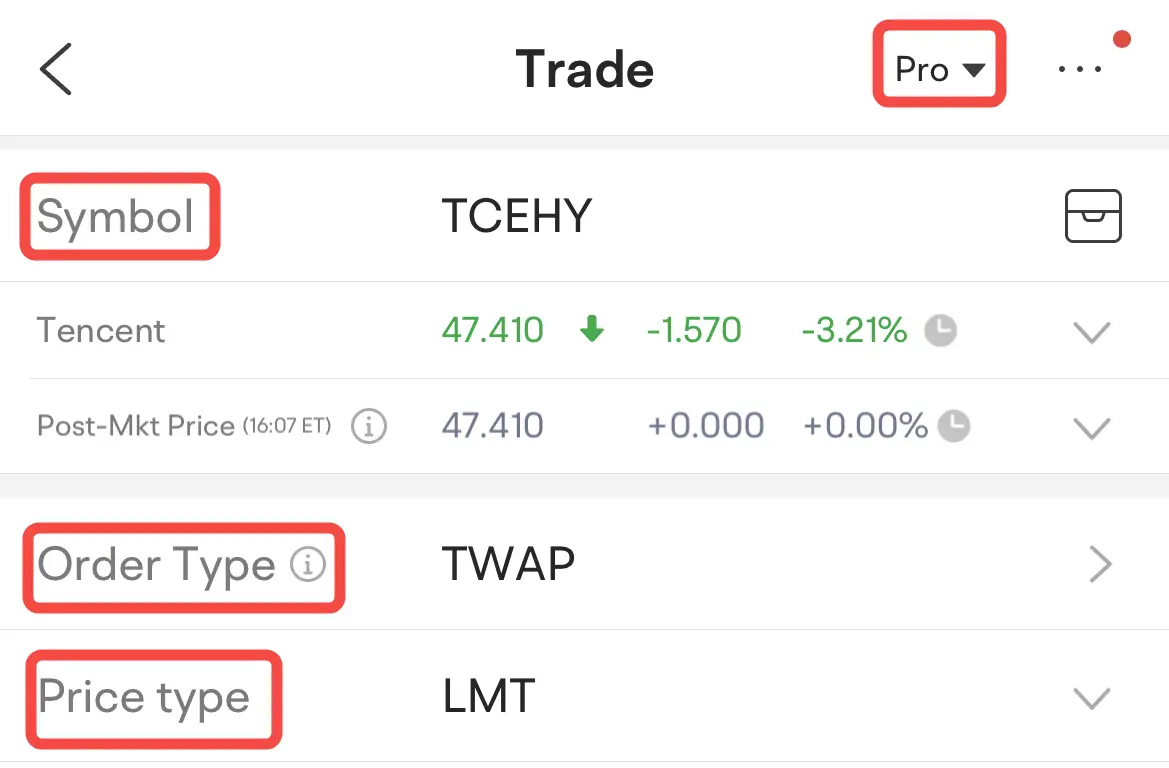

To place an algo order for US stocks, go to:

● Trade page > Order Type

● Find TWAP and VWAP orders in the drop-down box

● Set a Market (MKT) or Limit (LMT) price type

Note: If you want the order to be executed at a specific price, select LMT. If you want the order to be executed at the market price, please select MKT.

*The above pictures are for illustration purposes only and do not constitute any investment advice.

If you choose TWAP:

● Select the price type

● Enter a price (for LMT only)

● Enter the quantity

● Set the start time and end time for order execution

● Tap Buy or Sell to submit the order.

If you choose VWAP:

● Select the price type

● Enter a price (for LMT only)

● Enter the quantity

● Set the start time and end time for execution

● Enter the Max % to control the maximum order size to be filled in proportion to the predicted trading volume

● Tap Buy or Sell to submit the order

4. Symbols available for algo orders

The symbols, or stocks available to trade with algo orders may be adjusted from time to time, and the details are subject to what is shown on the Trade page when placing an order.

5. Algo Trading Fees

There is no additional charge for US stocks. Fees are charged based on the Standard US Stock Trading Fees.

6. Risk disclosure on algo trading

There are special characteristics and risks associated with algo trading. Read the risk disclosure statement in relation to algo trading before entering into any transactions. Understand these risks and determine whether algo trading is appropriate in light of your objectives and experience.

(1) Technical Errors: Algorithmic trading can be effected when your systems, the Company's systems or the Exchanges' systems are experiencing technical difficulties. Risks include possible delays or failures in (i) availability of your connection to the Company's services and of the Company's services to the relevant Exchange; (ii) the operation of databases and internal transfers of data; (iii) the provision of data feeds (accuracy of data and stability of data connections); (iv) possible hardware failures; (v) usage loads, bandwidth limitations, and other bottlenecks inherent in computerized and networked architectures; (vi) issues, disputes, or failures of third party vendors and other dependencies; and (vii) other general risks inherent in computer-based operations. Any of these could lead to delays or failures in order execution, incorrect order execution and other problems.

(2) Software and Design Flaws: All software is subject to inadvertent programming errors and bugs embedded in the code comprising that software.

Algorithmic order types may contain logical errors in the code to implement them. Errors may exist in the data used for testing the algorithm or the applicable model of the market. Despite testing and monitoring, inadvertent errors and bugs may still cause algorithmic order types to fail or behave incorrectly.

(3) Market Impact and Events: Market conditions will impact the execution of algorithmic orders. Possible adverse market conditions include lack of liquidity, price swings, late market openings, early market closings, market chaos, and mid-day trading pauses, and other such disruptive events. The execution of an algorithm can itself have an impact on the market, including causing lack of liquidity or abrupt and unwarranted price swings.

(4) Losses: Losses can happen more quickly with electronic and algorithmic trading compared to other forms of trading. Any or all of the other risk factors could cause more significant trading losses when using algorithmic trading compared to other forms of trading.