Source: Wind Information

Niuniu knocks on the blackboard:

Niuniu knocks on the blackboard:

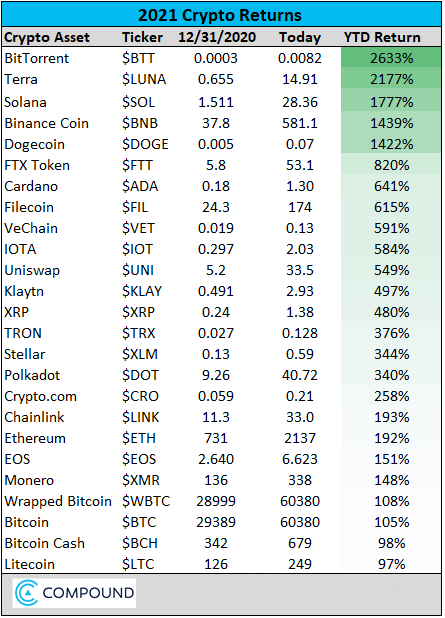

From the beginning of the year to April 12, the biggest increase of all digital currencies was BitTorrent's token BTT. In second place is LUNA, a stable currency created by Terra.

On April 13, US Eastern time, the digital currency exchange Coinbase officially landed on the Nasdaq Stock Exchange, and the stock symbol COIN, is expected to be valued at about $100 billion. The market's high valuation is entirely due to the huge increase in digital currency. Bitcoin, the most well-known currency, rose more than 100% in the first quarter of this year, but the doubling performance is only the third from the bottom of all cryptocurrencies!

Bitcoin market prices have risen rapidly since the end of January, from $30423.10 to a high of $57492.90, up nearly 90 per cent in just one month. In mid-March, the price of Bitcoin soared to more than $60,000, more than tenfold since last year's low.

From the beginning of the year to April 12, the biggest increase of all digital currencies was BitTorrent's token BTT. BitTorrent, headquartered in San Francisco, USA, is a familiar download software for post-80s otaku in China. In the first decade of the 21st century, this famous download software BitTorrent had a wide user base in the Chinese market, until it was replaced by Xunlei and Kuaobao.

In July 2018, Sun Yuchen announced the completion of the acquisition of BitTorrent and all its products. According to foreign media reports at that time, the purchase price was 140 million US dollars, equivalent to 900 million yuan. After the acquisition, BitTorrent was listed on the digital money market and partnered with Yuan an, the world's largest digital currency exchange. BitTorrent launched the token BTT, to officially log on to the digital money market at the end of January 2019 for trading.

According to the listed white paper, BitTorrent is a groundbreaking distributed communication protocol invented by Bram Cohen in 2001. BTT is a TRC-10 token issued in the wave field network and launched by BitTorrent under the wave field. The goal is to improve the download speed and resources of network shared content through token incentives. BTT can be used to expand and purchase content, reward live anchors and crowdfunding for new works. BTT allows content creators to interact with their own hands, consume and earn digital money without a middleman.

The BTT currency, which debuts at $0.00034309 and closes at $0.0082 on April 12, has risen more than 25-fold in just two years since it was listed on the digital money market at the end of January 2019.The price of the BTT currency has risen more than 25-fold in just two years since it was listed on the digital money market at the end of January 2019.

In second place is LUNA, a stable currency created by Terra. Terra is a stable currency platform created by Korean entrepreneur Danial Shin. The goal of Terra is to connect digital currency with practical applications, to grow into an open platform for an innovative financial decentralization application, (dApp), and to achieve real growth of blockchain economy. The original token LUNA has been launched on the exchanges of currency an, Fire coin, Bithumb, Upbit, KuCoin, Bittrex, Gate, BKEX, MXC, CoinEx and so on.

At present, LUNA can circulate within the Terra Alliance payment Union, and stable currency payment is mainly achieved through CHAI and Meme Pay payment tools. CHAI is the key product of Terra to stabilize the currency ecology, which brings huge trading volume and users to Terra.

Terra contains a number of stable coins anchored with legal tender, which can be used for mining, financial management and e-commerce payments. Take the e-commerce payment scenario as an example, Terra online payment can be published to the merchant account within 6 seconds, and the fee for using Terra is 0.6%.

LUNA traded at $0.655 at the start of the year, up more than 2000% from $14.91 on April 12.

Various digital currencies are not only trading objects, central banks around the world are also studying virtual currencies based on blockchain technology. The people's Bank of China has been conducting research on digital currency since 2014, and clearly proposed in 2019 that the name of the digital currency of the people's Bank of China is DCEP (Digital Currency Electronic Payment), also known as "digital RMB". At the end of 2019, the pilot and test of digital RMB were launched in Shenzhen, Suzhou, Xiongan, Chengdu and the Beijing Winter Olympic Games. By October 2020, six pilot test areas including Shanghai, Hainan, Changsha, Xi'an, Qingdao and Dalian have been added. At present, the scope of the digital RMB pilot project is being expanded in an orderly manner, the application scenarios are gradually enriched, and the pilot population is also accelerating its expansion.

Many countries around the world have begun to develop central bank digital currency. So far, at least 33 countries, including China, South Korea, Japan, Russia and Thailand, have started the process of developing digital currency. On April 2, local time, the Central Bank of Thailand announced a timetable for the promotion of digital currency and consulted the community on the retail digital currency. According to the timetable, the Bank of Thailand will conduct a retail digital currency test in 2021-2022.

On April 5, local time, the Bank of Japan said it would launch the central bank's digital currency experiment, which will last for a year. The first phase of the proof-of-concept of the Bank of Japan on digital money began today, and the experiment on the issue, distribution and redemption of digital money will continue until March 2022.

With regard to the US market, which is the most actively traded digital currency in the world, Federal Reserve Chairman Colin Powell said that the Fed has a responsibility to be at the forefront of understanding the technical challenges, costs and benefits of digital currency. But Powell said there is no rush to issue digital money, and the Fed does not have to be the first central bank to launch digital money. Because once released, the digital dollar may have a huge impact in the United States and even around the world.

In addition to central banks, Wall Street is also actively embracing digital currencies. According to CNBC, Goldman's internal memo says it plans to offer bitcoin and other digital asset investment vehicles to clients in the second quarter. It is understood that Goldman Sachs has submitted an application to provide notes that may be linked to ETF related to cryptocurrencies, especially bitcoin. Goldman plans to issue $15.7 million of ETF-linked bonds, with payments closely linked to ARK Innovation ETF's performance, according to SEC filings. ARK Innovation ETF indirectly invests in development zone chains and other similar disruptive technologies.

Just half a month ago, Morgan Stanley announced that it would launch a bitcoin investment fund to its clients, becoming the first large US bank to provide a bitcoin fund to its clients.

Edit / lydia