Blueprint Medicines (NASDAQ:BPMC) pulls back 3.5% this week, but still delivers shareholders notable 85% return over 1 year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Blueprint Medicines Corporation (NASDAQ:BPMC) share price is 85% higher than it was a year ago, much better than the market return of around 26% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! The longer term returns have not been as good, with the stock price only 10.0% higher than it was three years ago.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Blueprint Medicines

Blueprint Medicines wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

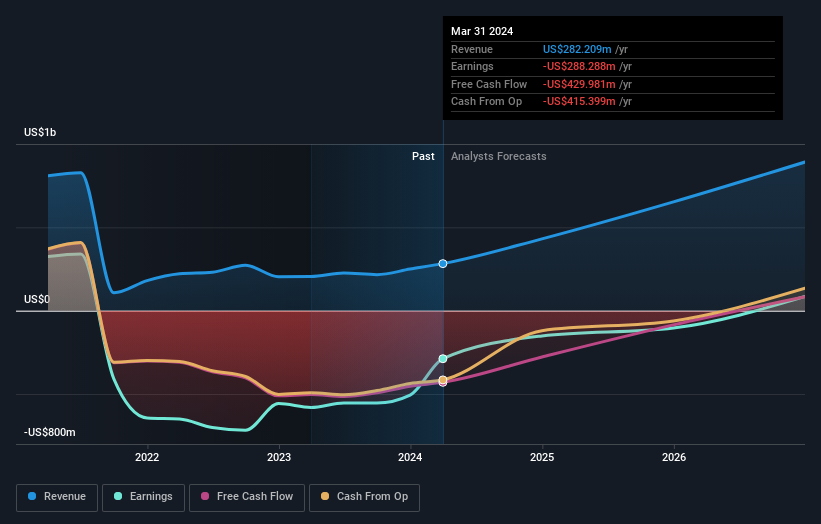

Blueprint Medicines grew its revenue by 38% last year. We respect that sort of growth, no doubt. While the share price performed well, gaining 85% over twelve months, you could argue the revenue growth warranted it. If the company can maintain the revenue growth, the share price could go higher still. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Blueprint Medicines is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's good to see that Blueprint Medicines has rewarded shareholders with a total shareholder return of 85% in the last twelve months. That's better than the annualised return of 4% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Blueprint Medicines that you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.