Ethereum short squeeze: $3,600 rally wipes out $80 million!

- Ethereum was trading at over $3,600 as of this writing.

- Over $80 million was liquidated in short positions with the recent price rise.

Ethereum [ETH] has recently surged above $3,000 once more. With ETH surpassing this mark, it could establish a new support level, as many addresses have acquired it at this price.

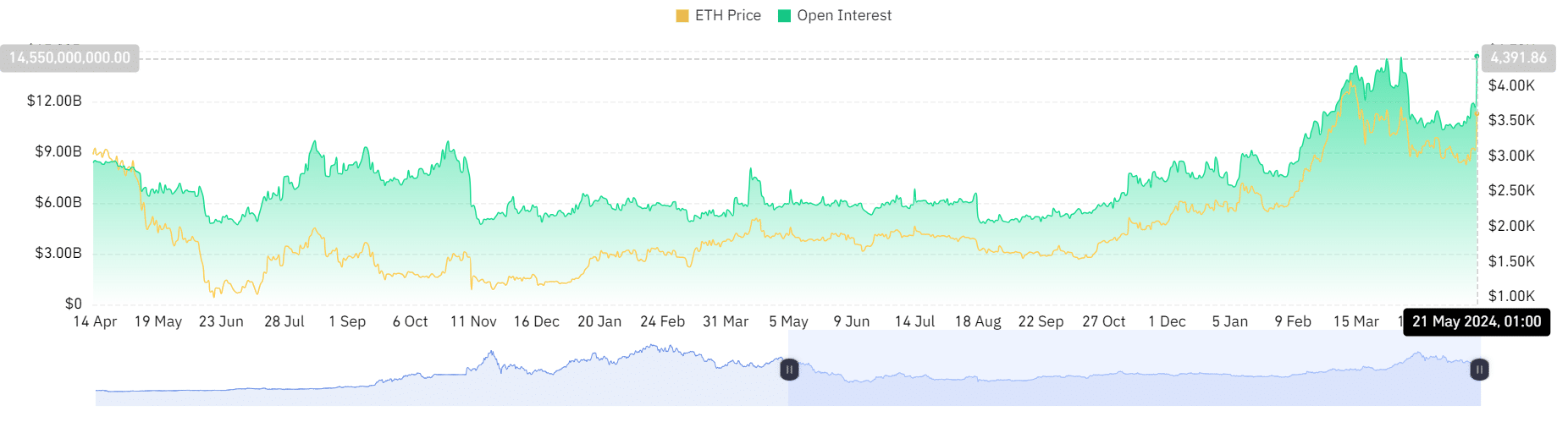

This potential new support level was further supported by a significant spike in ETH Open Interest, which has reached its highest level in months.

Ethereum price hits demand zone

According to data from IntoTheBlock, Ethereum’s recent rise above $3,000 has placed it in a significant demand zone.

The data indicated that at this price range, ETH experienced historic accumulation, with over 5 million ETH being acquired by 2.96 million addresses. This accumulated volume is now valued at over $18.3 billion at the current price.

At the time of writing, Ethereum’s market cap was approximately $440.5 billion. Given the volume of ETH acquired at this level, the $3,000 price zone could act as a strong support for the cryptocurrency.

Ethereum sets single-day spike record

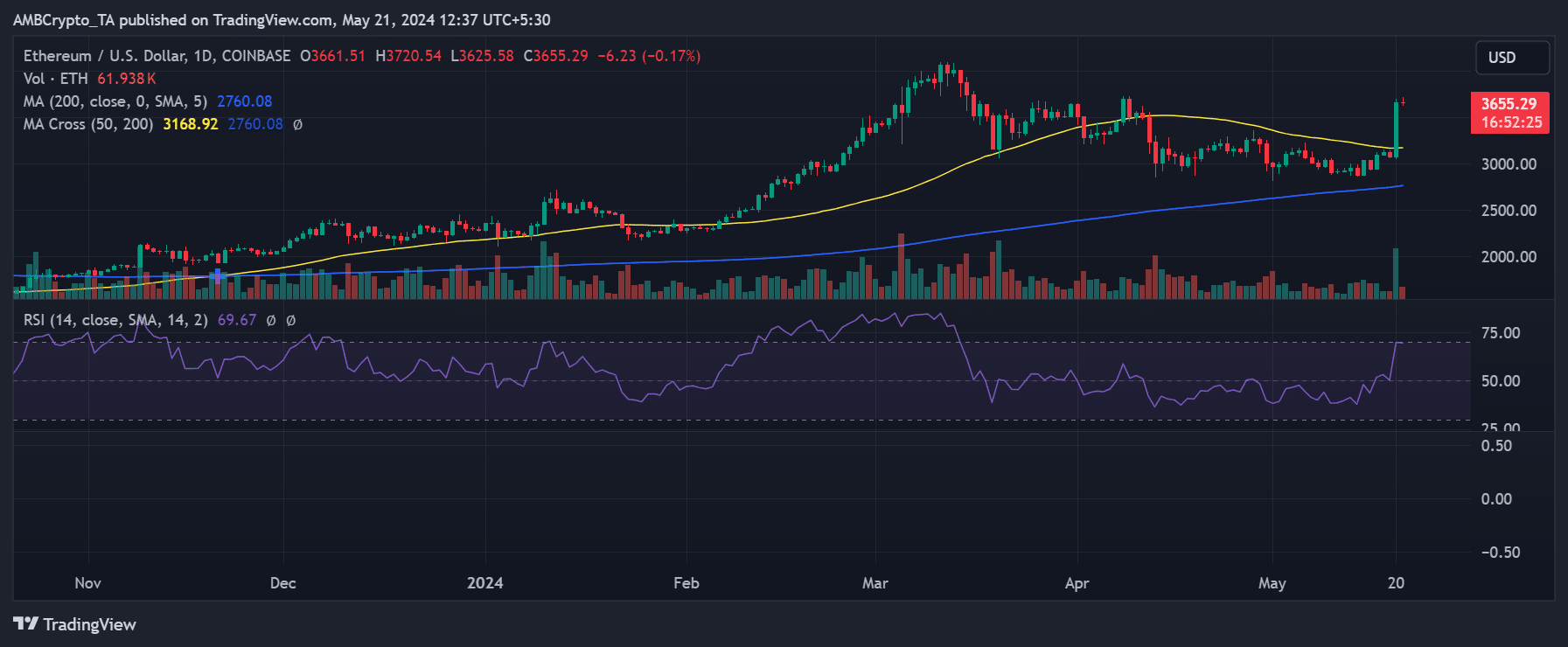

AMBCrypto’s analysis revealed that Ethereum’s price surged by over 19% on 20th May. On the daily chart, the price spiked to over $3,661, marking a 19.23% increase.

This was the first time in over a year that Ethereum experienced a single-day spike of over 19%, and the first time since April that it reached the $3,600 range.

At the time of writing, ETH was trading at around $3,650, with a slight decline of less than 1%. Notably, the price had flipped the small Moving Average (yellow line) to support, which had previously acted as resistance around $3,100.

The number of addresses and the volume of ETH purchased around the $3,000 level could help establish $3,000 as a strong support, as indicated in earlier analysis.

Additionally, whales buying ETH at the current price level might further reinforce this support.

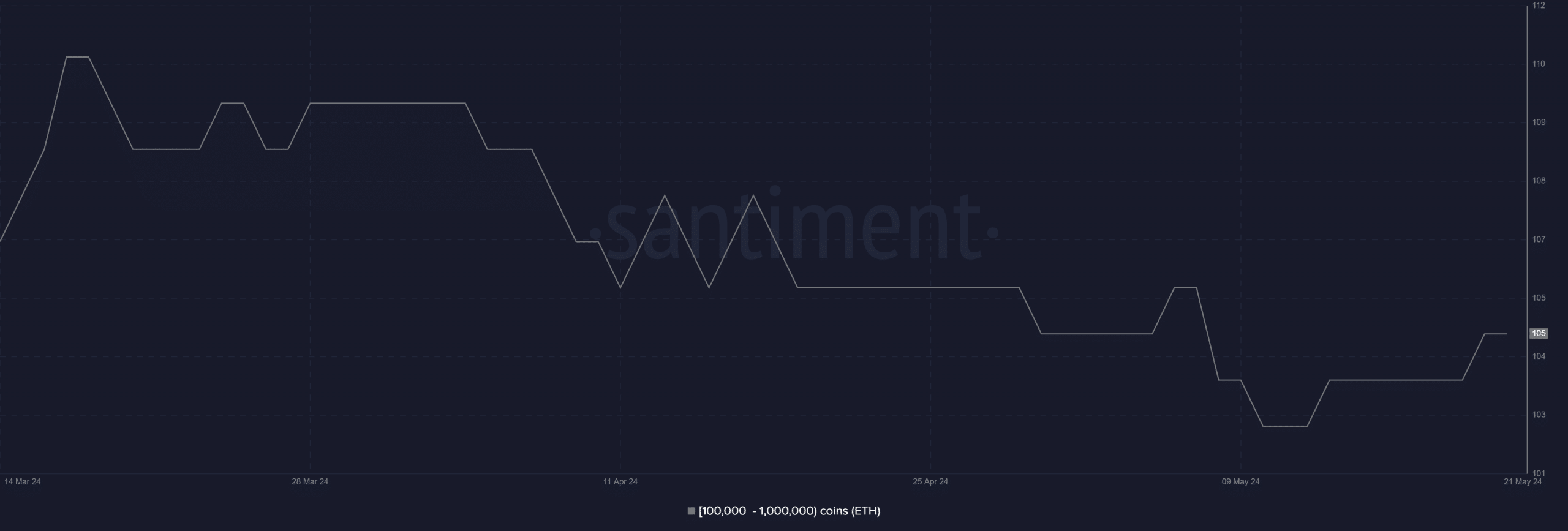

Whales accumulate more ETH

An analysis of Ethereum’s supply distribution revealed increased activity among whales in the last 24 hours. According to AMBCrypto’s analysis of Santiment charts, the number of active addresses has been steadily increasing over the past few days.

In the last 24 hours, whale wallets holding 100,000 to 1 million ETH purchased over 110,000 ETH, valued at over $360 million at the current price.

Another metric indicated that more money continues to flow into Ethereum, further supporting its upward trend.

Ethereum’s Open Interest surge to record-high

An analysis of Ethereum’s Open Interest revealed a significant spike, reaching its highest level in over a year.

According to AMBCrypto’s review of Coinglass charts, ETH Open Interest was approximately $16.8 billion at the time of writing. This surge in Open Interest indicates a substantial cash inflow into Ethereum as its price surpassed the $3,500 mark, signaling a bullish trend.

Read Ethereum (ETH) Price Prediction 2024-25

Further confirming the bullish sentiment was the funding rate, which has risen to its highest point since April. At the time of writing, the funding rate was around 0.02%.

The increase indicates a rise in positive sentiment, with buyers and long position holders dominating the market.