Exploring Three TSX Dividend Stocks For Your Portfolio

The Canadian market has shown robust growth, climbing 1.1% in the last week and achieving an 11% increase over the past year, with earnings expected to grow by 14% annually. In such a thriving environment, dividend stocks that offer consistent payouts can be particularly appealing for investors looking to capitalize on current market conditions.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.43% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 6.96% | ★★★★★★ |

Power Corporation of Canada (TSX:POW) | 5.72% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.59% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.50% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.49% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.32% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.00% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.80% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.43% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

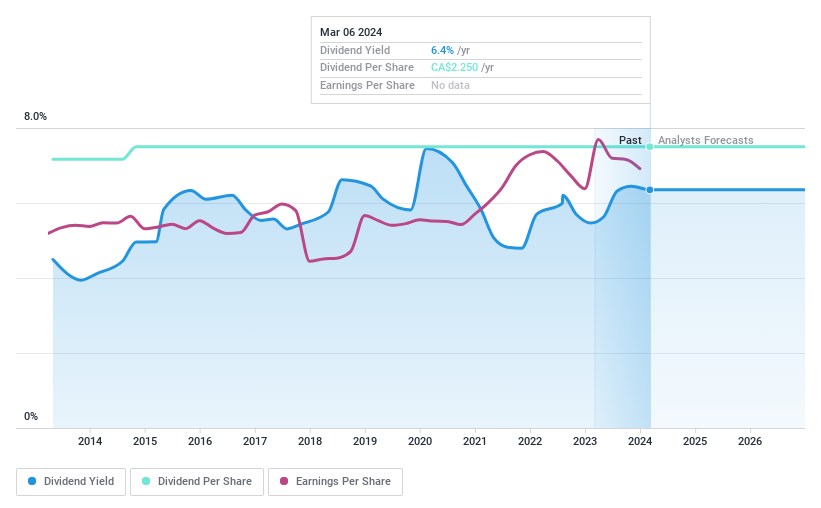

IGM Financial

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IGM Financial Inc. is a Canadian wealth and asset management company with a market capitalization of approximately CA$8.77 billion.

Operations: IGM Financial Inc. generates revenue primarily through two segments: Asset Management, which contributed CA$1.19 billion, and Wealth Management, contributing CA$2.26 billion.

Dividend Yield: 6.1%

IGM Financial's recent financial performance shows a decline, with Q1 2024 revenue at CA$811.67 million and net income at CA$223.39 million, both lower than the previous year. Despite this, the company maintains a stable dividend, declaring CA$0.5625 per share payable in July 2024. Over the past decade, IGM has consistently grown its dividend payments and maintained them with a reasonable payout ratio of 69.5% and cash payout ratio of 75.1%, suggesting sustainability despite current earnings challenges and its removal from the FTSE All-World Index in March 2024.

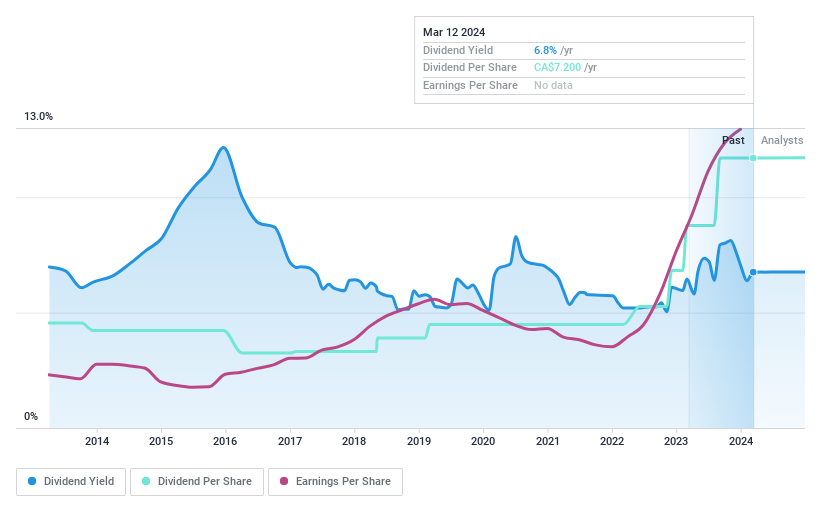

Olympia Financial Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Olympia Financial Group Inc., operating through its subsidiary Olympia Trust Company, serves as a non-deposit taking trust company in Canada with a market capitalization of approximately CA$262.29 million.

Operations: Olympia Financial Group Inc. generates its revenues through its subsidiary, Olympia Trust Company, which specializes in trust services across Canada.

Dividend Yield: 6.6%

Olympia Financial Group reported a revenue increase to CAD 25.84 million and net income of CAD 5.74 million in Q1 2024, showing financial growth from the previous year. Despite a history of volatile dividends, recent affirmations suggest stability with monthly distributions of CAD 0.60 per share maintained consistently into May 2024. The dividend is supported by a payout ratio of 57% and cash payout ratio of 76%, indicating coverage by both earnings and cash flow despite forecasts suggesting potential declines in future earnings.

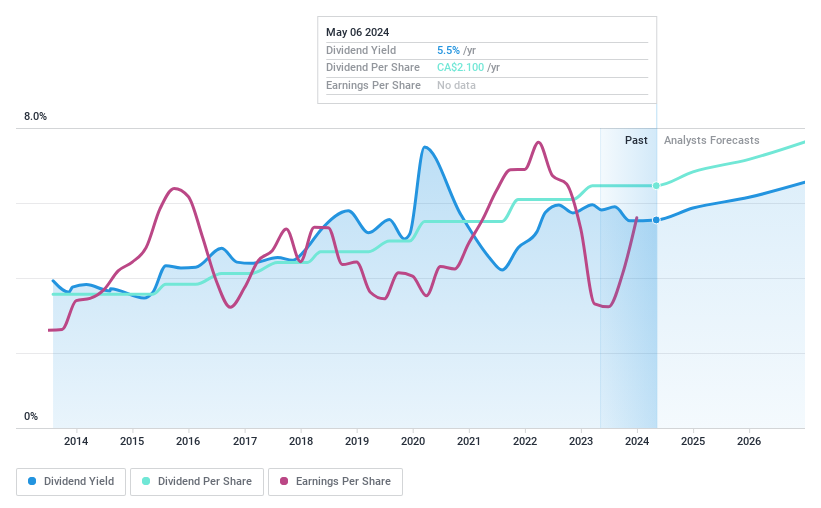

Power Corporation of Canada

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada, an international management and holding company, operates in financial services across North America, Europe, and Asia with a market capitalization of approximately CA$25.62 billion.

Operations: Power Corporation of Canada generates revenue primarily through its Lifeco segment with CA$23.51 billion, Power Financial - IGM contributing CA$3.67 billion, and Alternative Asset Investment Platforms adding CA$1.59 billion.

Dividend Yield: 5.7%

Power Corporation of Canada offers a stable and reliable dividend, with a history of consistent payments over the past decade. The dividends are well-supported, evidenced by a cash payout ratio of 28.4% and an earnings payout ratio of 49.9%. However, its dividend yield of 5.72% is below the top quartile in the Canadian market, which stands at 6.32%. Recent financial results show significant growth with net income doubling in Q1 2024 to CAD 722 million from CAD 326 million year-over-year, reinforcing its ability to maintain dividend payouts.

Taking Advantage

Click here to access our complete index of 32 Top TSX Dividend Stocks.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:IGMTSX:OLY and TSX:POW

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance