1 Reason to Buy Altria Stock Like There's No Tomorrow

Altria (NYSE: MO) is commonly regarded as a defensive stock. That is, when you want to play defense against a potential bear market, this is the type of stock you want to own.

No one knows exactly where markets will head from here. But if you want to protect your nest egg, keep reading.

Make sure you own Altria stock if this 1 thing happens

If a bear market hits, you'll want to own Altria stock. Of course, no one can predict when the next crash will come, but if you're concerned about a downturn, or simply want to make sure your money is protected, start to introduce stocks like this into your portfolio.

Let's look at a few examples of how Altria can insulate your money during a bear market.

For the first 60 days of the 2020 crash, Altria stock outpaced the market by a healthy margin. While Altria stock did lose value -- falling by around 7.2% -- the S&P 500 lost 14.8% of its value. If you had invested in Altria instead of the market, you would have cut your losses in half.

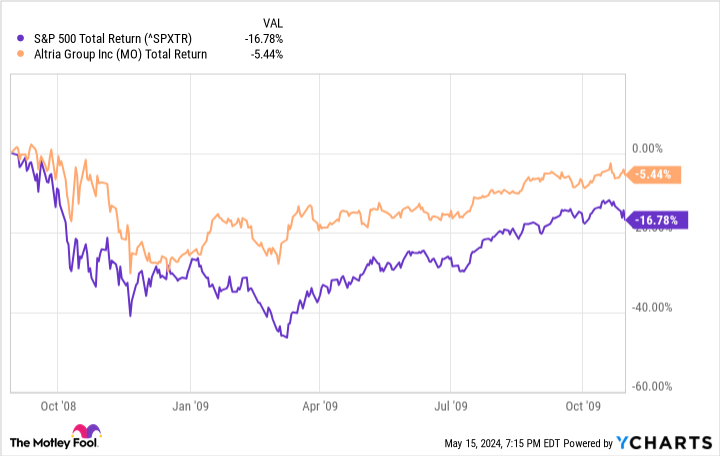

And what about during the first 60 days of the 2008 crash? From Sept. 1 to Nov. 1, Altria stock lost around 5.4% in value. The S&P 500, meanwhile, fell by 16.8%. Holding Altria stock, therefore, would have cut your losses by two-thirds.

Altria stock can also deliver during bull markets

Altria isn't just a reliable stock for bad times. Over the long run, it's also proven capable of beating the market, even during bull markets. Since 2000, for instance, Altria stock has delivered a total return of 12,370%. The S&P 500, meanwhile, posted total returns of just 472%. That time period included several sizable bull and bear markets, yet Altria stock still came out well ahead of the market.

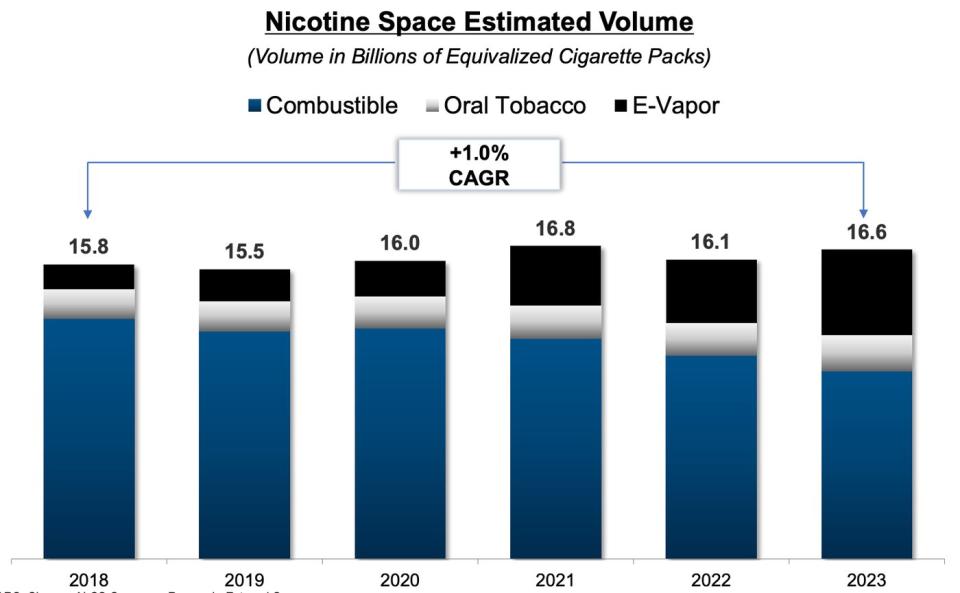

What makes Altria so good at generating above-average returns regardless of market conditions? Primarily, it has the benefit of selling recession-proof products. As the largest nicotine company in the U.S., Altria commands many well-known brands, including Marlboro and Black & Mild. But it's also invested heavily in e-vapor and non-combustible products. That's a wise move, for while combustible volumes have fallen in the U.S. over time, total nicotine usage continues to rise slowly.

With a dominant market share in a stable, steadily growing end market, Altria has been able to pay outsized dividends throughout nearly any market condition -- the 2008 financial crisis being the only time over the last 40 years that the dividend has been cut. The current yield, however, is now over 8%, its highest level in more than a decade.

This elevated dividend yield is the result of a couple of things. First, the dividend payout has continued to rise, buoyed by rising cash flows. Since 2018, cash from operations has roughly doubled. The second reason is a struggling stock price. This is where investors should get excited.

While Altria has proven its ability to perform well across both bull and bear markets, shares often struggle during dramatic market upturns, like the one we are experiencing right now. That's because the company can't grow faster at the flip of a switch. The company's main advantage -- a stable, slow-growth end market -- becomes a drag during markets like this. Over the last five years, for example, the S&P 500 has doubled in value, while Altria stock has only risen by 31%.

In many ways, now is a perfect time to buy. There are legitimate concerns regarding Altria's ability to transition its combustibles business to non-combustibles. And markets like this don't value businesses like this very highly. But if markets head lower, you'll be glad to have Altria as part of your portfolio. Its reliable cash flows, high dividend, and sizable share buyback program provide ample downside protection during a downturn. Shares also now trade at a 11% free cash flow yield, adding yet more downside protection. It's simply hard to see Altria stock trading for a much bigger discount than this.

Is Altria a perfect stock? Certainly not. But if you want to prepare parts of your portfolio for a potential bear market, start with stocks like this.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

1 Reason to Buy Altria Stock Like There's No Tomorrow was originally published by The Motley Fool