Could ARM Holdings Dethrone Nvidia?

Nvidia (NASDAQ: NVDA) has been one of the best companies to be invested in over the past year. It has shot up like a rocket on the back of massive graphics processing unit (GPU) demand driven by the artificial intelligence (AI) arms race. GPUs are great for AI workloads because they allow parallel processing, making them far more powerful when crunching massive problems like AI model training.

While these GPUs are incredibly powerful, they aren't very energy-efficient. As AI workloads begin to take shape, GPUs may no longer be the best choice to run these models, and more energy-efficient designs from Arm Holdings (NASDAQ: ARM) may take their place.

So, could Arm dethrone Nvidia from atop the AI world? Let's find out.

Arm's clients are starting to make products that challenge Nvidia

As mentioned before, GPUs are fantastic because of their versatility. When a model is just starting to take shape, it is wise to use a GPU to quickly check its validity. However, now that AI model creation is becoming a more standardized workload, companies like Alphabet (Google) are designing their own products. Recently, Google announced its Google Axion CPU, which will be solely available to Google Cloud customers. This product is based on Arm's ultra-efficient CPU (central processing unit) technology and could decrease the amount of GPUs Alphabet buys from Nvidia if the product becomes a hit.

Google Cloud isn't the only cloud provider doing this, either.

Microsoft Azure announced a similar product back in November. Its Cobalt CPU is another Arm-based processor, but it is used for general-purpose workloads rather than AI ones. While this isn't an issue for Nvidia yet, if Microsoft sees success with its in-house design, it may consider creating a similar product to the Google Axion to bring down some of its costs associated with AI.

While Arm isn't quite ready to dethrone Nvidia yet, there is some writing on the wall that signals it could challenge some of Nvidia's business in the future. But does that make it a stock worth buying?

Arm is growing rapidly, but that comes at a price

In the fourth quarter of fiscal year 2024 (ended March 31), Arm's revenue rose 47% year over year to $928 million, a significant acceleration to its 21% full-year revenue increase. Because Arm is a design firm, it has fantastic margins and converted an incredible 69% of that to $637 million in free cash flow.

It also gave solid guidance, with revenue expected to be around $900 million in the first quarter and $3.95 billion in fiscal year 2025, indicating 33% and 22% growth, respectively.

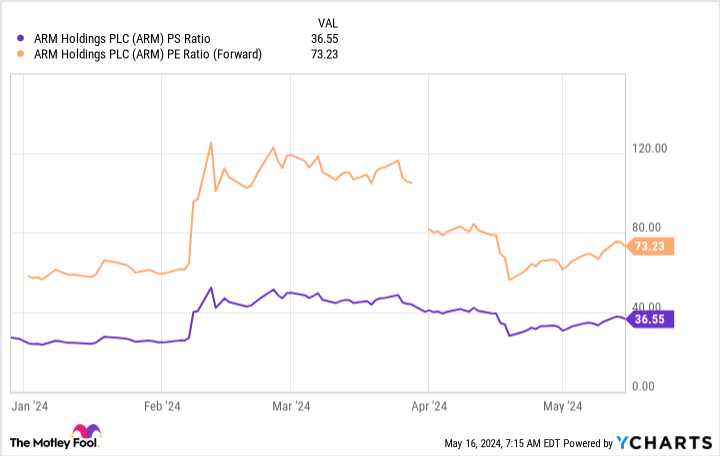

However, this success comes with a hefty price tag, and Arm's stock isn't cheap. At 73 times forward earnings and 37 times sales, it's an incredibly expensive stock.

For comparison, Nvidia trades at 38 times forward earnings and 37 times sales. That shows how much Nvidia is expected to grow in 2024, so it's clear that the market doesn't think the threat from Arm-based designs tailored specifically for certain workloads is a threat to Nvidia's core business.

There's no doubt that Arm's designs could challenge some Nvidia products in the future, but right now, the two are vital partners. Nvidia owns around $147 million in Arm's stock because the two collaborate to create products. The Nvidia Grace CPU utilizes Arm technology and can be paired with Nvidia's GPUs to create a powerful system that processes large language models quickly.

So, while Arm may be working with Nvidia's competitors, it's also a vital partner to Nvidia itself. Arm, or more specifically, Arm's customers, won't dethrone Nvidia anytime soon. However, with how expensive Arm stock is, I think it's one that investors should avoid due to its hefty price tag, even with its top-tier technology.

Should you invest $1,000 in Arm Holdings right now?

Before you buy stock in Arm Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Arm Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Keithen Drury has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Could ARM Holdings Dethrone Nvidia? was originally published by The Motley Fool