Why You Should Add Encompass Health (EHC) to Your Portfolio Now

Encompass Health Corporation EHC is aided by growing patient volumes, a sound business outlook for 2024, an expanding healthcare portfolio and a notable financial position.

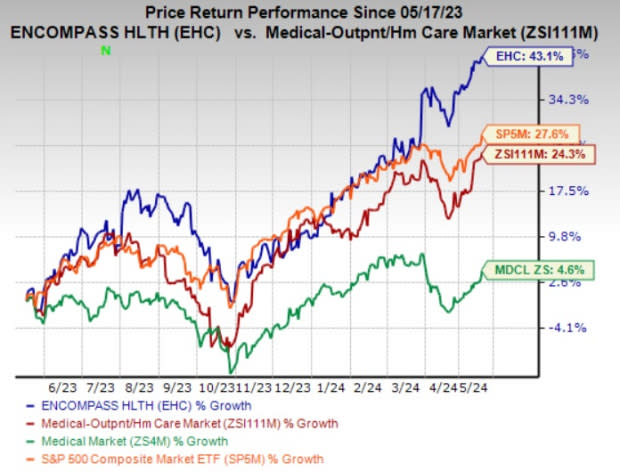

Top Zacks Rank & Upbeat Price Performance

Encompass Health currently carries a Zacks Rank #2 (Buy).

The EHC stock has gained 43.1% in the past year compared with the industry’s 24.3% growth. The Zacks Medical sector has rallied 4.6% and the S&P 500 composite has risen 27.6% in the same time frame.

Image Source: Zacks Investment Research

Favorable Style Score

EHC carries an impressive Value Score of A. Value Score helps find stocks that are undervalued. Back-tested results have shown so far that stocks with a favorable Value Score in combination with a solid Zacks Rank are the best investment bets.

Robust Growth Prospects

The Zacks Consensus Estimate for Encompass Health’s 2024 earnings is pegged at $4.09 per share, suggesting growth of 12.4% from the prior-year reported figure. The consensus mark for 2025 earnings is pegged at $4.56 per share, indicating an improvement of 11.5% from the 2024 estimate.

The expected long-term earnings growth rate is pegged at 15.6%, better than the industry’s average of 12%.

Northbound Estimate Revision

The Zacks Consensus Estimate for 2024 earnings has been revised upward 3.3% in the past 30 days.

Impressive Earnings Surprise History

EHC’s bottom line outpaced estimates in each of the trailing four quarters, the average surprise being 18.74%.

Valuation: Cheaply Priced

Price-to-earnings (P/E) is one of the multiples used for valuing healthcare stocks. Encompass Health has a reading of 20.43 compared with the industry’s forward 12-month P/E ratio of 21.39. It is quite evident that the stock is currently undervalued.

A Strong View for 2024

EHC forecasts revenues within the range of $5.25-$5.325 billion for 2024, the midpoint of which indicates an improvement of 10.1% from the 2023 reported figure.

Adjusted earnings per share from continuing operations are anticipated between $3.86 and $4.11, the midpoint of which suggests 9.5% growth from the 2023 level.

Key Business Tailwinds

The top line of Encompass Health is aided by a growing patient base at its inpatient rehabilitation hospitals. Its revenues rose 13.4% year over year in the first quarter. The dire need for specialized rehabilitative treatment that helps people recovering from chronic illnesses and injuries return to normal daily activities is likely to sustain the solid demand for services provided by its Inpatient Rehabilitation segment.

The Inpatient Rehabilitation unit holds growth potential owing to the active expansion endeavor that it usually resorts to throughout the year. Encompass Health either takes sole responsibility or forms joint ventures with renowned healthcare organizations to build inpatient rehabilitation hospitals across different U.S. communities and make the same operable within a reasonable time frame. Each hospital inauguration advances the capabilities and expands the nationwide foothold of Encompass Health.

Currently, it operates 161 hospitals across 37 states and Puerto Rico. The company expects to open six de novo hospitals in 2024. It also expects to add around 150 beds to existing hospitals this year. Over the 2023-2027 period, management aims to inaugurate six to ten de novos and make bed additions in the range of 80-120 each year.

A strong financial position provides a cushion for Encompass Health to pursue such uninterrupted growth-related initiatives. A growing cash reserve and solid cash-generating abilities bear testament to the same. As of Mar 31, 2024, cash and cash equivalents surged 94.5% from the 2023-end level. It also generated operating cash flows of $238.8 million in the first quarter, which improved 4.8% year over year. Adjusted free cash flow is anticipated to lie between $475 million and $570 million for 2024.

Other Stocks to Consider

Some other top-ranked stocks in the Medical space are Ligand Pharmaceuticals Incorporated LGND, Organon & Co. OGN and LeMaitre Vascular, Inc. LMAT, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ligand Pharmaceuticals’ earnings surpassed estimates in each of the last four quarters, the average surprise being 56.02%. The Zacks Consensus Estimate for LGND’s 2024 earnings indicates a rise of 12.3% while the consensus mark for revenues suggests an improvement of 6% from the respective year-ago actuals. The consensus mark for LGND’s 2024 earnings has moved 3.2% north in the past 60 days.

Organon’s earnings beat estimates in three of the trailing four quarters and missed the mark once, the average surprise being 13.62%. The Zacks Consensus Estimate for OGN’s 2024 earnings indicates a rise of 6.8% while the consensus mark for revenues suggests an improvement of 1.7% from the respective year-ago actuals. The consensus mark for OGN’s 2024 earnings has moved 4.7% north in the past 30 days.

The bottom line of LeMaitre Vascular outpaced estimates in each of the trailing four quarters, the average surprise being 10.12%. The Zacks Consensus Estimate for LMAT’s 2024 earnings indicates a rise of 28.2% while the consensus mark for revenues suggests an improvement of 11.3% from the respective year-ago actuals. The consensus mark for LMAT’s 2024 earnings has moved 5.5% north in the past 30 days.

Shares of Ligand Pharmaceuticals, Organon and LeMaitre Vascular have gained 9.1%, 3.8% and 21.9%, respectively, in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

LeMaitre Vascular, Inc. (LMAT) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

Organon & Co. (OGN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance