The US stock market has surged to new heights, with the S&P 500 index reaching a record high of 5,325 points and the DJIA index touching 40,000 points. Investors are experiencing euphoria, spurred by the unexpectedly low US inflation figures released earlier.

Inflation has recently been a critical driver of market volatility, thus its stabilisation is a cause for significant optimism. The April CPI increase, lower than expected at just 0.3% month-on-month, suggests a potential return to a downward inflation trajectory. Year-on-year, the CPI climbed by 3.4% in April, a slight dip from 3.5% in March. Inflation peaked in June 2022 at 9.1%, and while there was progress, the current deceleration is encouraging for investors.

The April inflation report marked the first decline in year-on-year inflation since January 2024. The CPI rose slower, raising market hopes that the Federal Reserve might soon ease monetary conditions.

Technical analysis of S&P 500

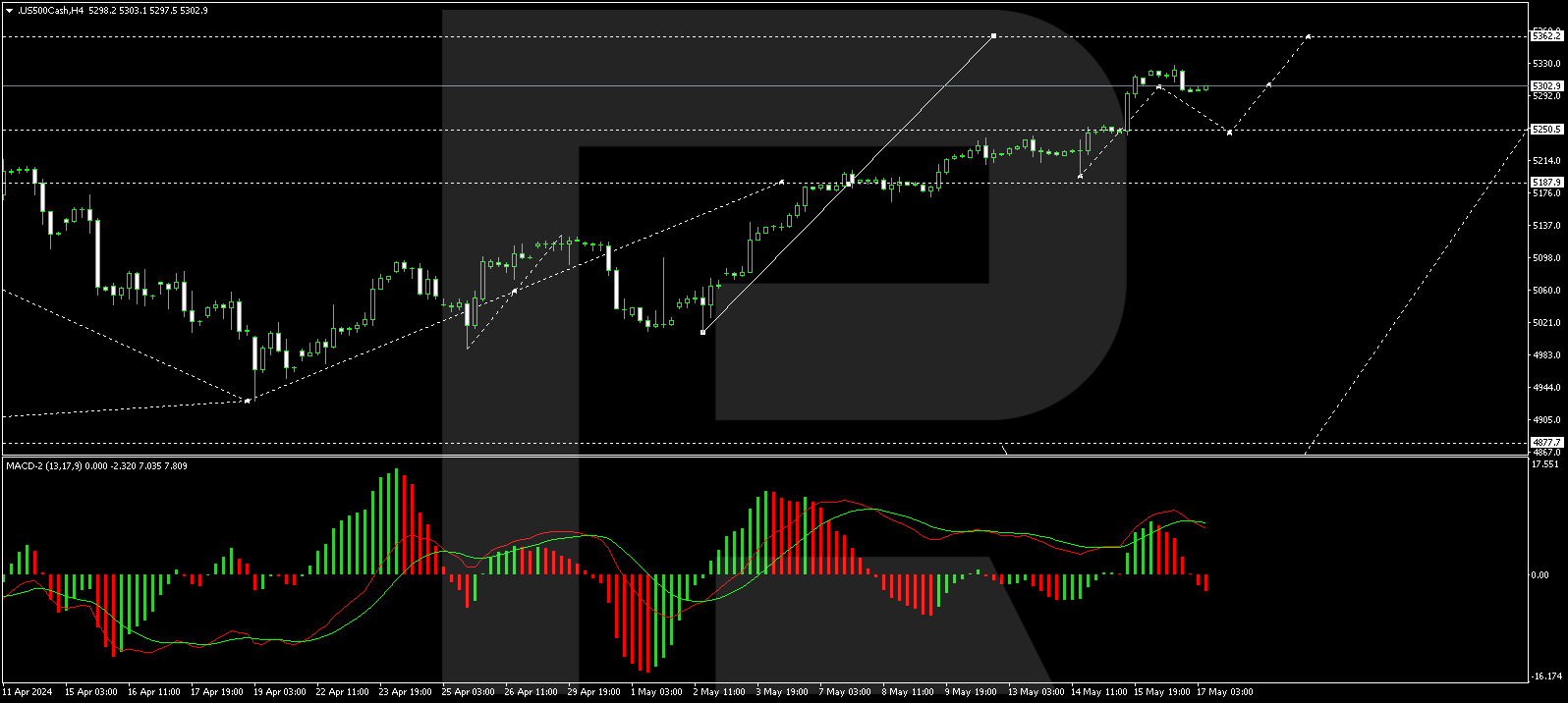

On the H4 chart of the S&P 500 index, a consolidation range has formed around the 5188.0 level. With an upward breakout, extending the fifth wave to 5363.0 is possible. The growth link to 5315.0 has been executed, and we now expect a consolidation range to form around this level. A downward breakout could lead to a range expansion to 5250.5, while an upward breakout could extend to 5363.0. The market is developing the fifth wave of growth without any significant correction, and a sharp decline along the trend to 4735.0 could begin at any moment. This scenario is technically supported by the MACD indicator, with its signal line at the maximums and pointing strictly downwards.

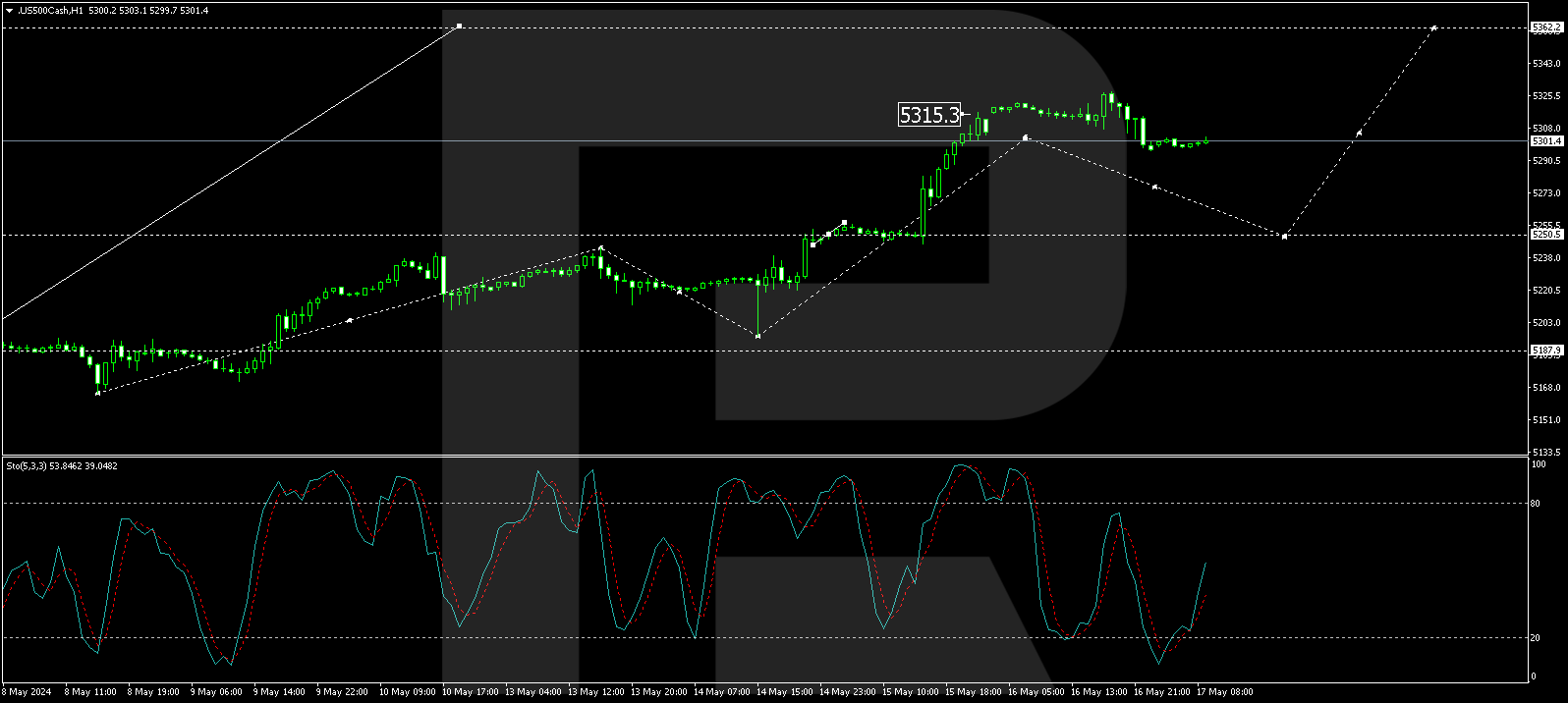

On the H1 chart, the upward move to 5315.5 has been completed. A consolidation range is forming around this level, and a downward impulse to 5296.0 has been fulfilled. We expect a growth link to 5315.5 (testing from below) today. A downward breakout from the range could lead to a continuation of the decrease wave to 5250.5. The Stochastic oscillator technically confirms this scenario, with its signal line above 20 and expected to rise to 80, indicating a potential for continued growth.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended content

Editors’ Picks

EUR/USD clings to gains above 1.0850 after US inflation data

EUR/USD trades in positive territory above 1.0850 in the American session on Friday. The US Dollar struggles to preserve its strength following the April PCE inflation data and helps the pair hold its ground heading into the weekend.

GBP/USD retreats from 1.2765, holds on to modest gains

GBP/USD posted a two-day high peat at 1.2765 in the American session, as US data showed that the core PCE inflation held steady at 2.8% on a yearly basis in April. The pair retreated afterwards as risk aversion triggered US Dollar demand.

Gold falls towards $2,330 as the mood sours

US inflation-related data took its toll on financial markets. Wall Street turned south after the opening and without signs of easing price pressures in the world’s largest economy. The US Dollar takes the lead in a risk-averse environment.

Here’s why Chainlink price could crash 15% despite spike in social volume Premium

Chainlink price has flashed multiple sell signals after its recent climb, hinting at a short-term correction. This signal comes despite a double-digit growth in its social volume. LINK bulls need to exercise caution as this forecast is backed by on-chain metrics.

Week ahead – ECB rate cut might get eclipsed by BoC surprise and NFP report

ECB set to slash rates on Thursday, focus on forward guidance. But will the BoC take the lead when it meets on Wednesday? US jobs report eyed on Friday as Fed unyielding on cuts. OPEC+ might extend some output reductions into 2025.