Insider Sale at Cutera Inc (CUTR): EVP, Chief Technology Officer Michael Karavitis Sells 63,603 ...

On May 16, 2024, Michael Karavitis, the Executive Vice President and Chief Technology Officer of Cutera Inc (NASDAQ:CUTR), sold 63,603 shares of the company. The transaction was documented in an SEC Filing. Over the past year, the insider has sold a total of 63,603 shares and has not purchased any shares.

Cutera Inc specializes in designing, developing, manufacturing, and marketing laser and other energy-based aesthetics systems for practitioners worldwide. These systems are used in a variety of cosmetic procedures, including skin rejuvenation and hair removal.

On the date of the sale, shares of Cutera Inc were priced at $2.6, resulting in a market cap of approximately $48.377 million. This valuation places the company in a lower market cap category, reflecting its niche position in the medical aesthetics technology market.

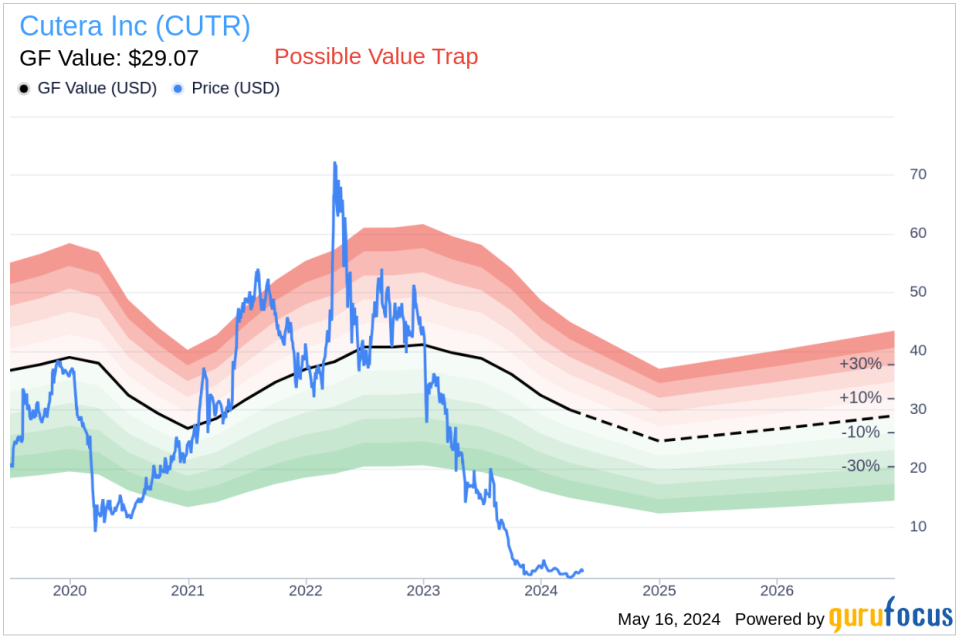

The GF Value of Cutera Inc is estimated at $29.07, suggesting a significant discrepancy with its current trading price. The price-to-GF-Value ratio stands at 0.09, indicating that the stock might be a Possible Value Trap, Think Twice before investing.

The valuation metrics such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow are calculated based on historical trading multiples, adjustments for past performance, and future business expectations provided by analysts.

Insider transaction trends for Cutera Inc over the past year show a limited number of transactions, with only 2 insider buys and 1 insider sell, including the recent transaction by the insider.

The GF Value assessment, which considers historical trading multiples and future performance estimates, suggests caution. The current stock price significantly undervalues the company according to the GF Value, which could indicate underlying challenges or market misperceptions.

Investors and stakeholders in Cutera Inc should consider these factors and monitor insider transactions and company performance closely to make informed decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance