Toyota (TM) Falls 5% Since Q4 Earnings Beat on Soft Profit View

Shares of Toyota TM have declined roughly 5% since it released its fiscal fourth-quarter 2024 results on May 8. This Japan-based auto giant posted earnings of $4.99 per share, which surpassed the Zacks Consensus Estimate of $2.91 and rose from the year-ago earnings of $3.07 a share. Consolidated revenues came in at $74.5 billion, beating the consensus mark of $67.2 billion and rising from $73.2 billion in the year-ago quarter. However, an expected year-over-year decline in fiscal 2025 profits is likely to have upset investors.

Toyota — currently carrying a Zacks Rank #4 (Sell) — had cash and cash equivalents of ¥9.41 trillion ($60.83 billion) as of Mar 31, 2024. Long-term debt was ¥21.15 trillion ($136.7 billion), up from ¥17.1 trillion as of Mar 31, 2023.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

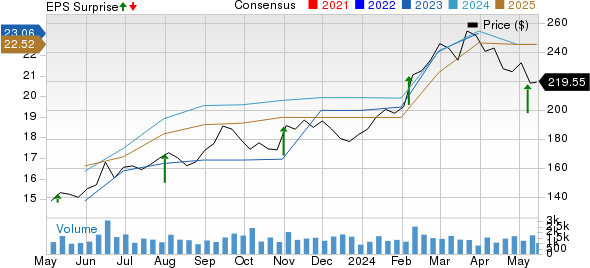

Toyota Motor Corporation Price, Consensus and EPS Surprise

Toyota Motor Corporation price-consensus-eps-surprise-chart | Toyota Motor Corporation Quote

Segmental Results

The Automotive segment’s net revenues for the fiscal fourth quarter increased 13.7% year over year to ¥10.03 trillion ($67.62 billion), outperforming our projection of ¥8.58 trillion. Operating profit came in at ¥901.5 billion ($6.07 billion), rocketing from ¥458.8 billion generated in the year-ago quarter and breezing past our estimate of ¥487.2 billion.

The Financial Services segment’s net revenues rose 32% from the prior-year quarter to ¥940.4 billion ($6.33 billion). The metric outpaced our forecast of ¥897 billion. The segment registered an operating income of ¥153 billion ($1.03 billion), up from ¥113.5 billion in fourth-quarter fiscal 2023 and surpassed our estimate of ¥114 billion.

All Other businesses’ net revenues totaled ¥385 billion ($2.59 billion) in the reported quarter, rising from ¥379.2 billion from the comparable year-ago period and surpassing our projection of ¥381 billion. The unit generated an operating profit of ¥51.2 billion ($345 million), marking an improvement from ¥46.2 billion generated in the year-ago period and topping our estimate of ¥47.7 billion.

FY25 Guidance

For fiscal 2025, Toyota projects total retail vehicle sales of 10.95 million units, indicating a decrease from 11.09 million units sold in fiscal 2024. Fiscal 2025 sales are expected to total ¥46 trillion, up from ¥45 trillion recorded in fiscal 2023. Operating income is projected to be ¥4.3 trillion, indicating a contraction of 19.6% year over year.

Pretax profit is estimated to be ¥5.07 trillion, implying a decline from ¥6.96 trillion generated in fiscal 2024. R&D expenses are envisioned to be ¥1.3 trillion, up from ¥1.2 trillion spent in fiscal 2024. Capex is forecast to be ¥2.15 trillion, signaling an uptick from ¥2.01 trillion spent in fiscal 2024.

Quarterly Releases of Other Legacy Automakers

General Motors GM reported first-quarter 2024 results on Apr 23. It posted adjusted earnings of $2.62 per share, which surpassed the Zacks Consensus Estimate of $2.08. The bottom line also increased from the year-ago quarter’s level of $2.21. Solid results from the GMNA segment led to the outperformance. Revenues of $43.01 billion beat the Zacks Consensus Estimate of $41.28 billion and increased from $39.9 billion recorded in the year-ago period. General Motors had cash and cash equivalents of $17.64 billion as of Mar 31, 2024. The long-term automotive debt at the end of the quarter was $15.9 billion

Ford F reported first-quarter 2024 results on Apr 24. It posted adjusted EPS of 49 cents, which beat the Zacks Consensus Estimate of 42 cents but declined from 63 cents recorded in the year-ago quarter. The company’s consolidated first-quarter revenues came in at $42.8 billion, up 3.1% year over year. Ford reported a negative adjusted free cash flow of $479 million for the quarter. It had cash and cash equivalents of $19.72 billion as of Mar 31, 2024. Long-term debt, excluding Ford Credit, totaled $19.4 billion at the end of the first quarter of 2024.

Honda HMC reported fourth-quarter fiscal 2024 results on May 10. It reported earnings of 99 cents per share, surpassing the Zacks Consensus Estimate of 44 cents and increasing from the year-ago profit of 51 cents per share. Quarterly revenues totaled $36.5 billion, missing the Zacks Consensus Estimate of $37.9 billion but rising from $33.1 billion recorded in the year-ago period. Consolidated cash and cash equivalents were ¥4.95 trillion ($32.73 billion) as of Mar 31, 2024. Long-term debt was around ¥6 trillion ($40.2 billion) as of Mar 31, up from ¥4.37 trillion as of Mar 31, 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance