Private Capital's Strategic Moves in Q1 2024: Spotlight on KKR & Co Inc

Insight into Private Capital (Trades, Portfolio)'s Latest 13F Filing and Its Impact on Portfolio Dynamics

Private Capital (Trades, Portfolio), under the leadership of Gregg J. Powers, continues to navigate the complex market landscape with its value investing approach, focusing on stocks significantly below their intrinsic value. Founded in 1986 by Bruce Sherman, Private Capital (Trades, Portfolio) Management emphasizes thorough research, risk management, and patience, aiming to secure long-term capital gains. The firm's recent 13F filing for the first quarter of 2024 reveals several strategic adjustments, including new acquisitions, increased stakes, complete sell-offs, and reductions in existing positions.

Summary of New Buys

During the first quarter of 2024, Private Capital (Trades, Portfolio) expanded its portfolio by adding seven new stocks. Noteworthy new positions include:

3M Co (NYSE:MMM), purchasing 9,513 shares valued at approximately $843.67 million, making up 0.09% of the portfolio.

Newmont Corp (NYSE:NEM), with 15,000 shares valued at $537,600, representing about 0.06% of the portfolio.

Nutrien Ltd (NYSE:NTR), acquiring 10,287 shares valued at $558,660, also accounting for 0.06% of the portfolio.

Key Position Increases

Private Capital (Trades, Portfolio) also raised its stakes in 42 stocks. Significant increases include:

Everi Holdings Inc (NYSE:EVRI), with an additional 461,939 shares, bringing the total to 2,791,180 shares. This adjustment increased the share count by 19.83% and had a 0.52% impact on the portfolio, with a total value of $28,051,360.

AerSale Corp (NASDAQ:ASLE), adding 398,200 shares for a new total of 1,849,539 shares. This represents a 27.44% increase in share count, with a total value of $13,279,690.

Summary of Sold Out Positions

Private Capital (Trades, Portfolio) completely exited 10 holdings in the first quarter of 2024, including:

CRA International Inc (NASDAQ:CRAI), selling all 49,841 shares, impacting the portfolio by -0.55%.

EverQuote Inc (NASDAQ:EVER), liquidating all 202,666 shares, which had a -0.28% impact on the portfolio.

Key Position Reductions

Reductions were made in 53 stocks, with significant cuts in:

KKR & Co Inc (NYSE:KKR), reducing holdings by 116,885 shares, a -19.27% decrease, impacting the portfolio by -1.08%. The stock traded at an average price of $91.97 during the quarter and has seen a 12.36% return over the past three months and 30.72% year-to-date.

Jefferies Financial Group Inc (NYSE:JEF), cutting 132,500 shares, a -14.02% reduction, impacting the portfolio by -0.6%. The stock's average trading price was $41.65 during the quarter, with a 14.86% three-month return and 17.95% year-to-date gain.

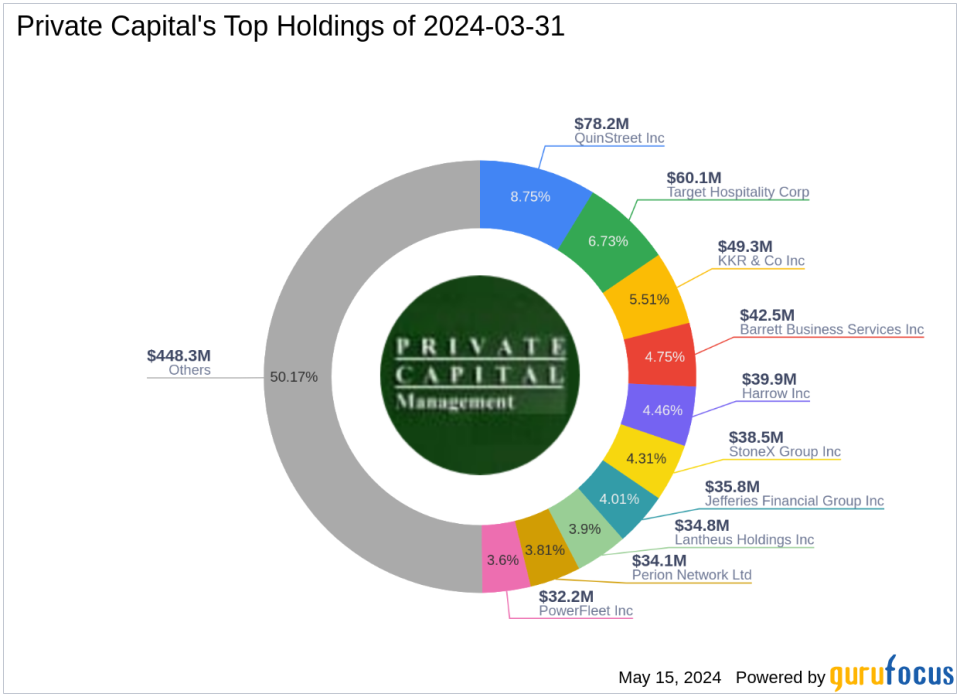

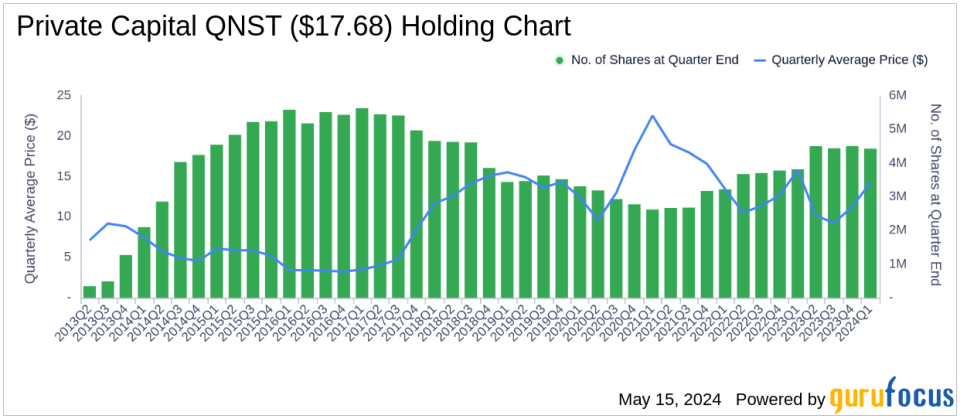

Portfolio Overview

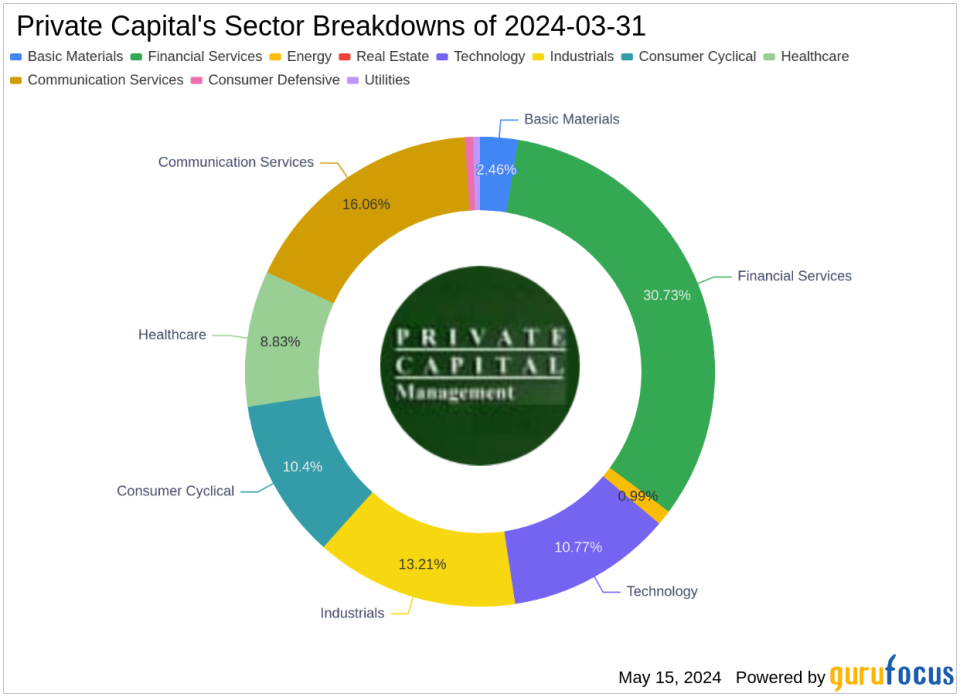

As of the first quarter of 2024, Private Capital (Trades, Portfolio)'s portfolio comprised 138 stocks. Top holdings included 8.75% in QuinStreet Inc (NASDAQ:QNST), 6.73% in Target Hospitality Corp (NASDAQ:TH), 5.51% in KKR & Co Inc (NYSE:KKR), 4.75% in Barrett Business Services Inc (NASDAQ:BBSI), and 4.46% in Harrow Inc (NASDAQ:HROW). The investments span across 10 of the 11 industries, with significant concentrations in Financial Services, Communication Services, Industrials, Technology, Consumer Cyclical, Healthcare, Basic Materials, Energy, Consumer Defensive, and Utilities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance