Significant Shifts in Louis Moore Bacon's Portfolio Highlighted by Invesco S&P 500 Equal ...

Insights from the First Quarter 2024 13F Filing

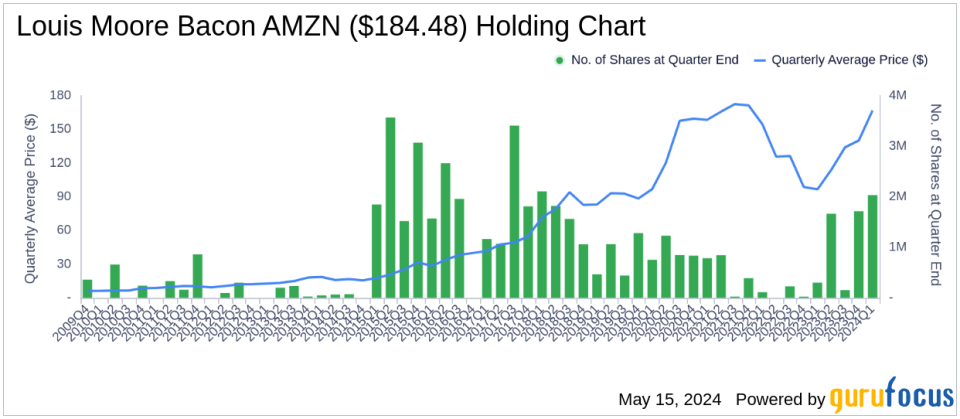

Louis Moore Bacon (Trades, Portfolio), a prominent figure in the investment world, recently disclosed his first quarter 2024 portfolio adjustments through a 13F filing. Bacon, born in 1956, is a renowned American hedge fund manager known for his global macro investment strategy. He founded Moore Capital Management in 1989, which after three decades, transitioned to a private investment firm focusing on his personal and proprietary investments. This shift allows Bacon to concentrate on a broad multi-asset alternatives platform, reflecting his deep expertise and strategic investment approach.

Summary of New Buys

Louis Moore Bacon (Trades, Portfolio)'s portfolio saw the addition of 129 stocks in the first quarter of 2024. Notable new acquisitions include:

VanEck Vectors Semiconductor ETF (NASDAQ:SMH), purchasing 472,200 shares, making up 1.74% of the portfolio valued at $106.24 million.

SPDR Oil & Gas Exploration and Production ETF (XOP), with 560,000 shares, accounting for 1.42% of the portfolio, valued at $86.76 million.

The Energy Select Sector SPDR Fund (XLE), adding 885,000 shares, which comprise 1.37% of the portfolio, totaling $83.55 million.

Key Position Increases

During the same period, Bacon increased his stakes in 64 stocks, with significant boosts in:

Digital Realty Trust Inc (NYSE:DLR), where he added 658,958 shares, bringing his total to 1,009,039 shares. This increase of 188.23% in share count impacts the portfolio by 1.55%, with a total value of $145.34 million.

Microsoft Corp (NASDAQ:MSFT), increasing by 219,810 shares to a total of 369,869 shares, marking a 146.48% rise in share count, valued at $155.61 million.

Summary of Sold Out Positions

The first quarter also saw Bacon exiting 133 positions, including significant holdings such as:

Invesco S&P 500 Equal Weight ETF (RSP), where all 1,563,222 shares were sold, impacting the portfolio by -4.49%.

SPDR S&P Regional Banking ETF (KRE), with all 2,064,974 shares liquidated, resulting in a -1.97% portfolio impact.

Key Position Reductions

Reductions were made in 54 stocks, with the most substantial cuts in:

Meta Platforms Inc (NASDAQ:META), reducing by 663,165 shares, a -62.42% decrease, impacting the portfolio by -4.27%. The stock traded at an average price of $446.07 during the quarter.

SPDR Biotech ETF (XBI), cutting 1,570,000 shares, an -87.71% reduction, affecting the portfolio by -2.55%. The stock's average trading price was $92.79 during the quarter.

Portfolio Overview

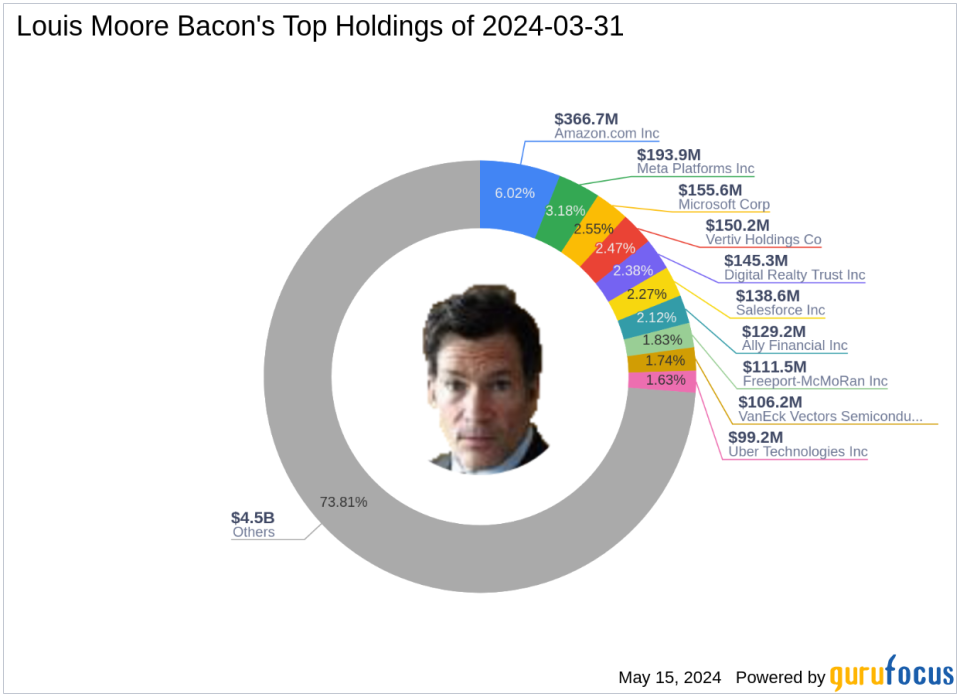

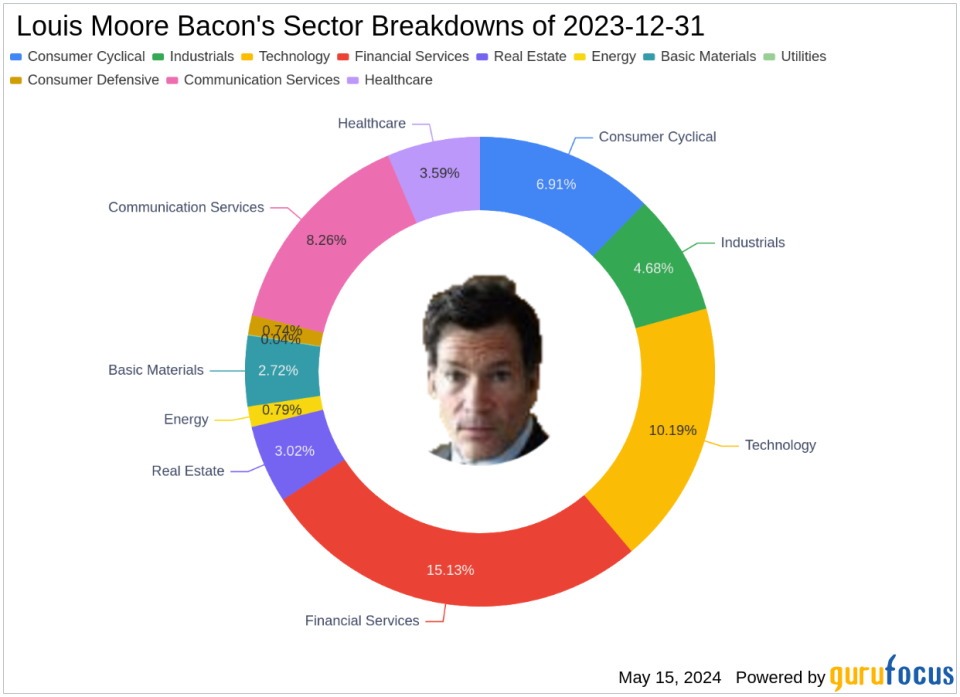

As of the first quarter of 2024, Louis Moore Bacon (Trades, Portfolio)'s portfolio included 427 stocks. Top holdings were 6.02% in Amazon.com Inc (NASDAQ:AMZN), 3.18% in Meta Platforms Inc (NASDAQ:META), 2.55% in Microsoft Corp (NASDAQ:MSFT), 2.47% in Vertiv Holdings Co (NYSE:VRT), and 2.38% in Digital Realty Trust Inc (NYSE:DLR). The portfolio is diversified across all 11 industries, with significant concentrations in Technology, Financial Services, and Consumer Cyclical sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance