3 High-Yield Dividend Stocks On Euronext Amsterdam Offering Up To 6.5%

Amid a backdrop of fluctuating global markets, the Netherlands' Euronext Amsterdam has shown resilience, offering opportunities for investors seeking stable returns through high-yield dividend stocks. In light of current market conditions where cautious optimism prevails due to potential policy shifts in major economies, selecting stocks with robust dividends can be a prudent strategy for those looking to enhance their portfolio's income stream.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Acomo (ENXTAM:ACOMO) | 6.53% | ★★★★★☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.05% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 4.49% | ★★★★☆☆ |

Koninklijke Heijmans (ENXTAM:HEIJM) | 4.99% | ★★★★☆☆ |

Koninklijke KPN (ENXTAM:KPN) | 4.36% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

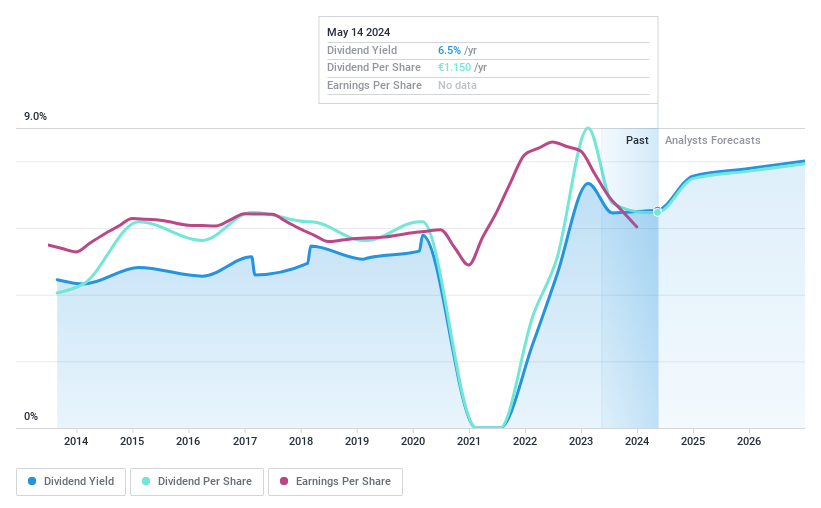

Acomo

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Acomo N.V. operates in sourcing, trading, processing, packaging, and distributing food ingredients for the food and beverage industry across Europe, North America, and globally with a market capitalization of approximately €521.27 million.

Operations: Acomo N.V. generates its revenue primarily from five segments: Tea (€120.62 million), Edible Seeds (€257.29 million), Food Solutions (€24.07 million), Spices and Nuts (€429.96 million), and Organic Ingredients (€436.38 million).

Dividend Yield: 6.5%

ACOMO's dividend profile shows a blend of strengths and concerns. While the dividends are supported by earnings with a payout ratio of 85.7% and strongly covered by cash flows at 26.1%, their history over the past decade has been marked by volatility and unreliability, including significant annual drops. Trading at 52.7% below its estimated fair value, ACOMO offers an attractive entry point despite its high level of debt and recent declines in sales from €1.42 billion to €1.27 billion year-over-year, alongside a drop in net income from €54.68 million to €39.73 million.

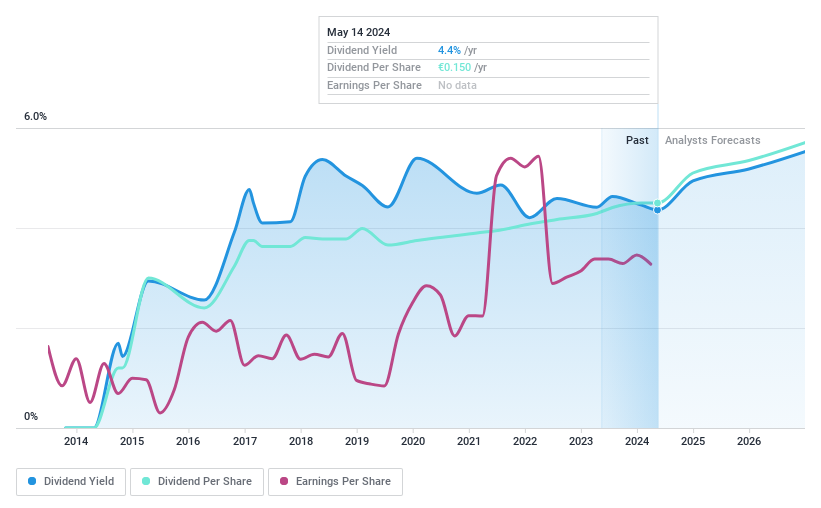

Koninklijke KPN

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke KPN N.V. is a telecommunications and IT service provider in the Netherlands, with a market capitalization of approximately €13.55 billion.

Operations: Koninklijke KPN N.V. generates revenue through three primary segments: Business (€1.84 billion), Consumer (€2.93 billion), and Wholesale (€0.70 billion).

Dividend Yield: 4.4%

Koninklijke KPN's dividend yield at 4.36% trails behind the top Dutch dividend payers. Despite a volatile decade for dividends, recent financials show stability with a payout ratio of 78.4% supported by earnings and a cash payout ratio of 59.6%. However, its recent quarterly report indicates a slight decline in net income and EPS compared to the previous year, alongside modest sales growth from €1.34 billion to €1.38 billion, reflecting potential challenges in sustaining dividend growth amidst fluctuating earnings.

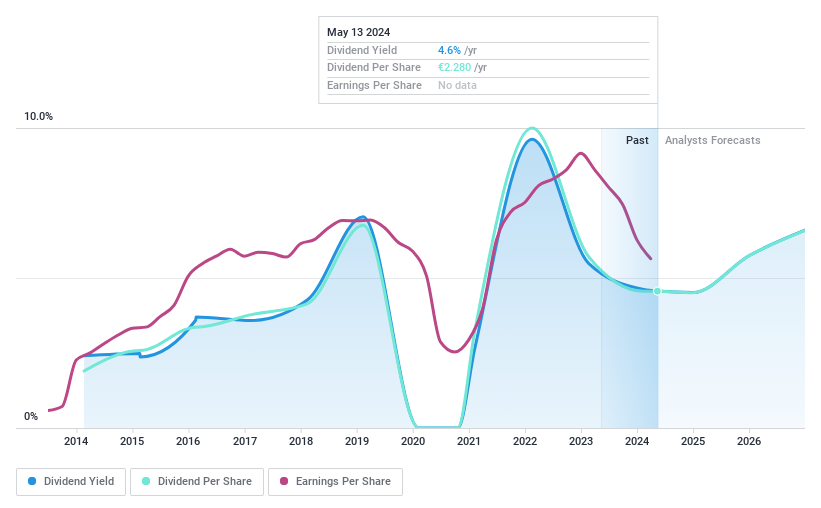

Randstad

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Randstad N.V. specializes in offering a wide range of work and human resources (HR) services, with a market capitalization of approximately €8.99 billion.

Operations: Randstad N.V. does not provide specific revenue segment details in the provided text.

Dividend Yield: 4.5%

Randstad N.V. reported a decrease in Q1 2024 sales to €5.94 billion and net income to €88 million, impacting its EPS, which fell to €0.48 from €0.83 year-over-year. Despite this downturn, the company maintains a dividend supported by a 73.4% earnings payout ratio and a cash payout ratio of 45.9%. However, Randstad's dividend history is marked by instability over the past decade, with recent share buybacks totaling €316.66 million underlining efforts to return value to shareholders amidst fluctuating financial performance.

Delve into the full analysis dividend report here for a deeper understanding of Randstad.

The valuation report we've compiled suggests that Randstad's current price could be quite moderate.

Turning Ideas Into Actions

Access the full spectrum of 5 Top Euronext Amsterdam Dividend Stocks by clicking on this link.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ACOMO ENXTAM:KPN and ENXTAM:RAND.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance