Arch Resources Inc Faces Significant Reduction in Mohnish Pabrai's Latest 13F Filings

Insights into Pabrai's Q1 2024 Investment Moves and Portfolio Adjustments

Mohnish Pabrai (Trades, Portfolio), the Managing Partner of Pabrai Investment Funds, is renowned for his focused value investing approach. In a strategic shift highlighted in his latest 13F filing for the first quarter of 2024, Pabrai has continued to adjust his U.S.-based portfolio, which represents a smaller portion of his overall assets under management. His investment philosophy often targets smaller, undervalued companies, primarily in international markets such as India, Turkey, and South Korea, reflecting his pursuit of superior opportunities outside the U.S.

Portfolio Overview

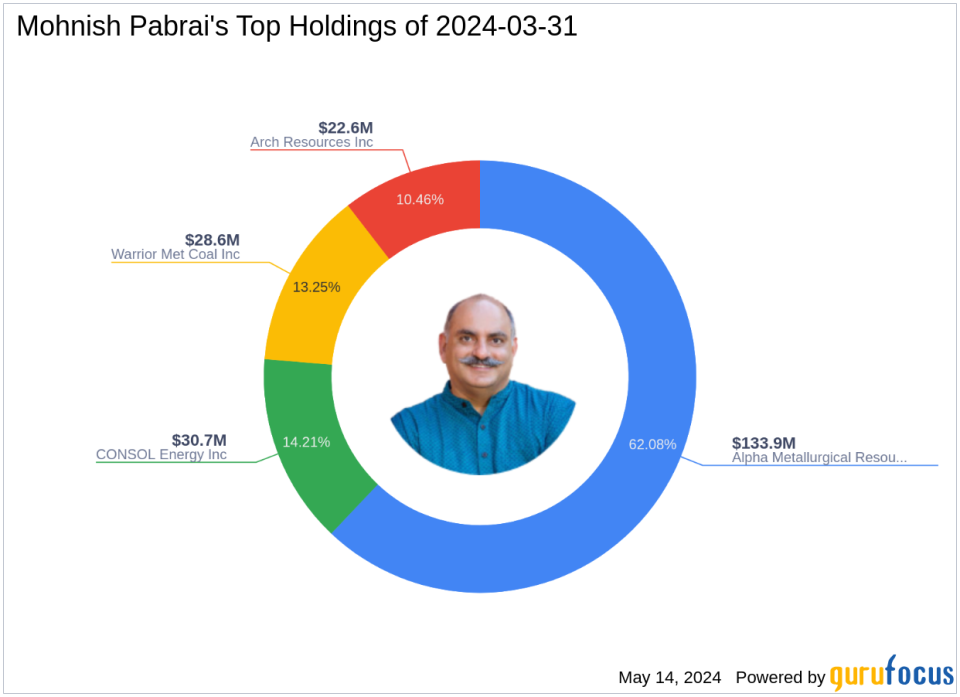

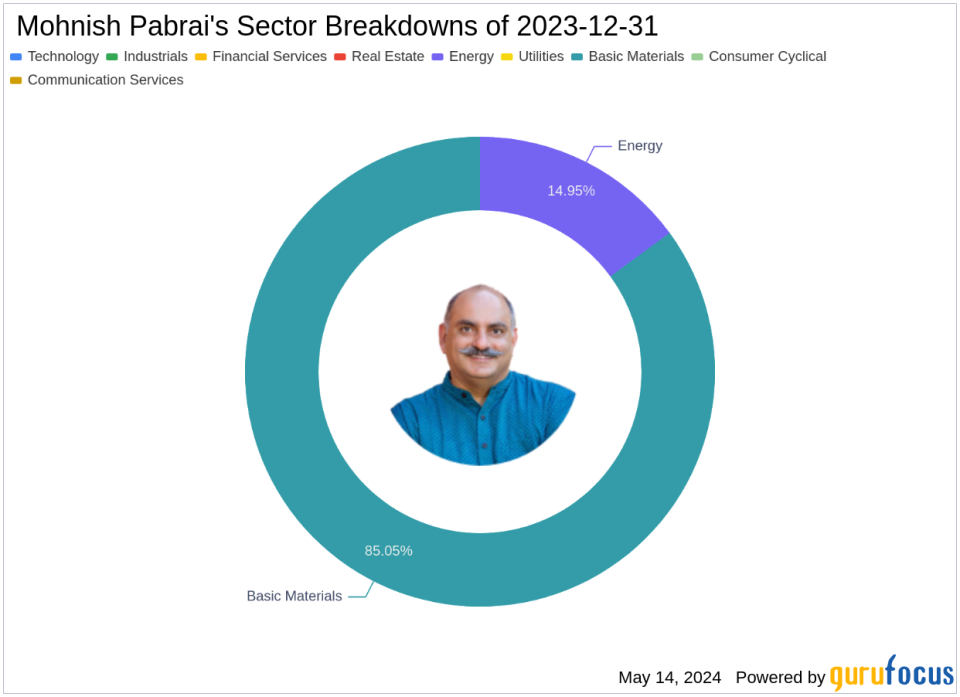

As of the first quarter of 2024, Mohnish Pabrai (Trades, Portfolio)'s investment portfolio included 4 stocks with significant holdings in sectors like Basic Materials and Energy. The top holdings were 62.08% in Alpha Metallurgical Resources Inc (NYSE:AMR), 14.21% in CONSOL Energy Inc (NYSE:CEIX), 13.25% in Warrior Met Coal Inc (NYSE:HCC), and 10.46% in Arch Resources Inc (NYSE:ARCH). This composition underscores a concentrated investment strategy, focusing heavily on a select few industries.

Key Position Increases

Mohnish Pabrai (Trades, Portfolio) expanded his holdings in the following stock during the first quarter:

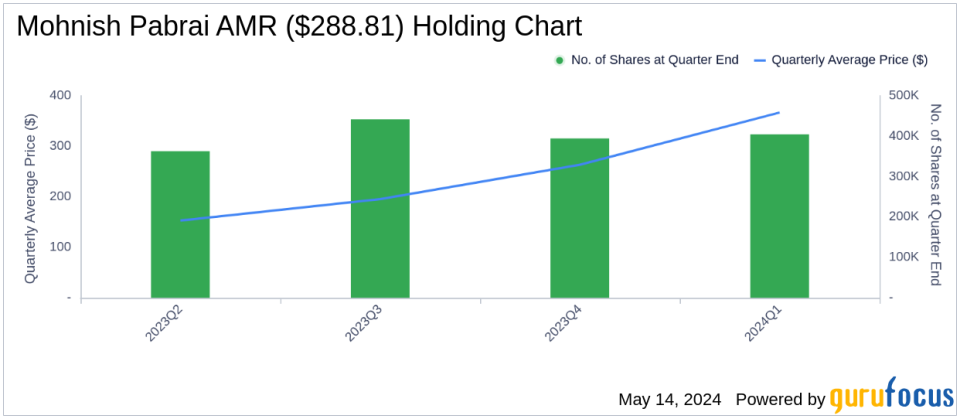

Alpha Metallurgical Resources Inc (NYSE:AMR) saw an addition of 10,044 shares, bringing the total to 404,357 shares. This increase of 2.55% in share count had a 1.54% impact on the current portfolio, valuing it at approximately $133,910,970.

Key Position Reduces

Reductions were made in several stocks, with significant changes in the following:

Arch Resources Inc (NYSE:ARCH) was reduced by 94,686 shares, resulting in a -40.29% decrease in shares and a -6.33% impact on the portfolio. The stock traded at an average price of $170.82 during the quarter and has seen a return of -7.29% over the past 3 months and -3.03% year-to-date.

Warrior Met Coal Inc (NYSE:HCC) was reduced by 158,949 shares, marking a -25.24% reduction in shares and a -3.9% impact on the portfolio. The stock traded at an average price of $60.58 during the quarter and has returned 6.00% over the past 3 months and 5.67% year-to-date.

The strategic adjustments in Mohnish Pabrai (Trades, Portfolio)'s portfolio reflect his ongoing commitment to value investing, albeit with a keen eye on global opportunities that promise higher returns. His recent moves, particularly the significant reduction in Arch Resources Inc, indicate a tactical shift that aligns with broader market trends and individual stock performances.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance