Top UK Dividend Stocks To Consider In May 2024

As the United Kingdom's financial markets exhibit resilience, with the FTSE 100 poised for an upbeat opening in response to stable wage figures, investors are closely monitoring various economic indicators. Amid these developments, dividend stocks continue to attract attention for their potential to offer steady income in a fluctuating market environment.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 7.94% | ★★★★★★ |

Dunelm Group (LSE:DNLM) | 7.68% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.96% | ★★★★★☆ |

DCC (LSE:DCC) | 3.22% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.00% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.75% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.04% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.58% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.29% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 4.03% | ★★★★★☆ |

Click here to see the full list of 55 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

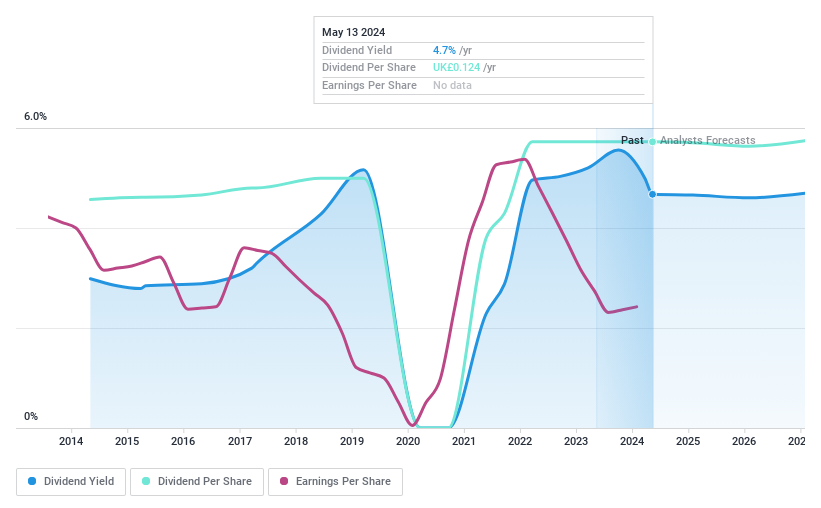

Kingfisher

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kingfisher plc operates as a retailer of home improvement products and services across the United Kingdom, Ireland, France, and other international markets, with a market capitalization of approximately £4.93 billion.

Operations: Kingfisher plc generates £12.98 billion from the sale of home improvement products and services.

Dividend Yield: 4.7%

Kingfisher plc, trading at a significant discount to its fair value, offers a dividend yield of 4.67%, which is lower than the top UK dividend payers. Despite this, the company has shown an ability to grow earnings by an estimated 11.49% annually. Dividends have increased over the past decade but have been marked by volatility and inconsistency in growth. Financially, dividends are supported by a reasonable payout ratio of 68.2% and a low cash payout ratio of 24.1%, indicating good coverage by both earnings and cash flows.

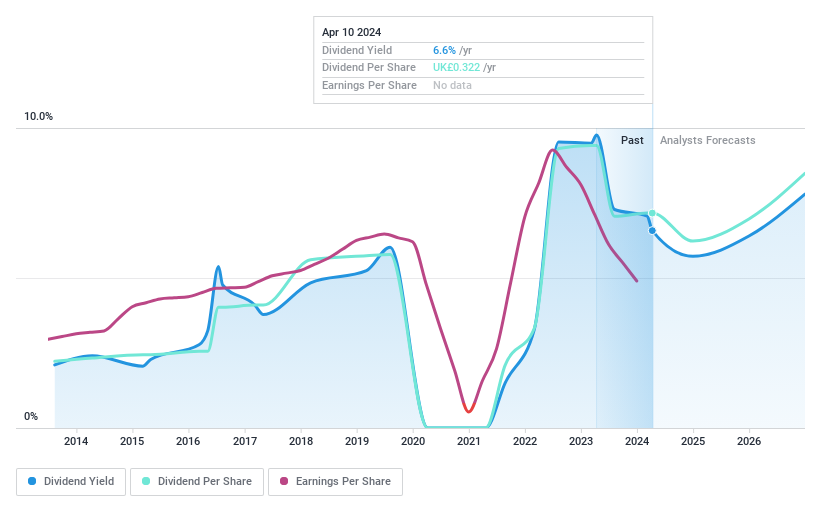

PageGroup

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PageGroup plc operates as a recruitment consultancy offering services across the UK, Europe, the Middle East, Africa, Asia Pacific, and the Americas with a market capitalization of approximately £1.48 billion.

Operations: PageGroup plc generates its revenue primarily through recruitment services, totaling £2.01 billion.

Dividend Yield: 6.8%

PageGroup's dividend yield of 6.84% ranks well among UK's top dividend payers. Despite a challenging year with net profit margins falling to 3.8% from 7%, and net income decreasing to £77.07 million from £139.01 million, dividends increased by 4.5%. The company maintains a high payout ratio at 67.1%, supported adequately by earnings and cash flows, with an expected earnings growth of 16.56%. However, its decade-long dividend history shows instability, reflecting periodic significant drops over 20%.

Get an in-depth perspective on PageGroup's performance by reading our dividend report here.

Our valuation report here indicates PageGroup may be undervalued.

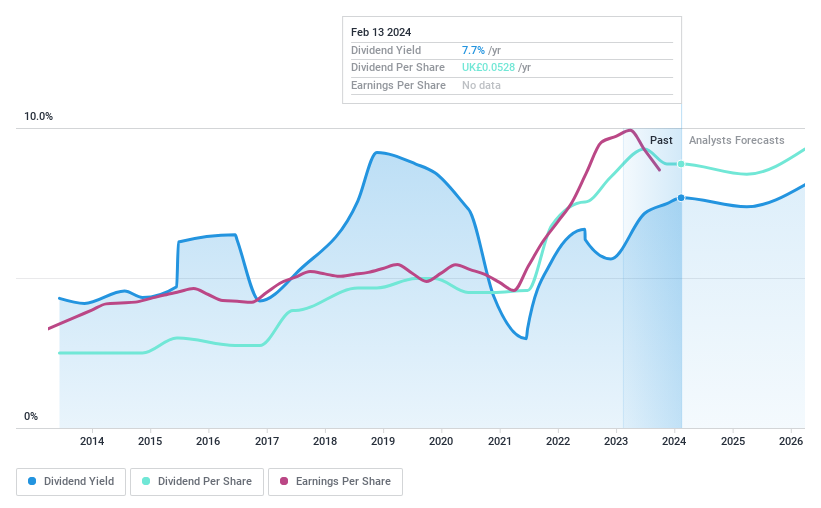

Record

Simply Wall St Dividend Rating: ★★★★★★

Overview: Record plc operates globally, offering currency and derivative management services across the UK, North America, Continental Europe, and Australia, with a market capitalization of approximately £127.61 million.

Operations: Record plc generates its revenue primarily from the provision of currency and derivatives management services, totaling £44.10 million.

Dividend Yield: 7.9%

Record plc has demonstrated a consistent ability to grow and sustain its dividends, with a notable yield of 7.94%, placing it in the top 25% of UK dividend payers. The dividends are well-supported by both earnings and cash flows, with payout ratios at 89.1% and 88.2% respectively, ensuring reliability over the past decade. Recent leadership transitions, including Dr. Jan Witte as CEO and Richard Heading as CFO by July 2024, could influence future financial strategies but have maintained stability thus far.

Summing It All Up

Unlock our comprehensive list of 55 Top Dividend Stocks by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:KGF LSE:PAGE and LSE:REC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance