Robert Bruce's Strategic Moves in Q1 2024: Spotlight on Xcel Energy Inc

Insights into the Investment Shifts of Bruce & Co

Robert Bruce (Trades, Portfolio), the seasoned investor behind Bruce & Co, has made notable adjustments to his investment portfolio in the first quarter of 2024. As the principal advisor to the Bruce Fund, which he manages alongside his son, Robert Jeffrey Bruce, their strategy primarily targets common stocks, high-yield and distressed debts, with occasional investments in long-term U.S. government securities. The fund's focus is on undervalued small- to mid-cap stocks, including convertible and distressed bonds, aiming for long-term holdings in companies poised for a turnaround.

Summary of New Buys

During this quarter, Robert Bruce (Trades, Portfolio) expanded his portfolio with two new stocks:

Bunge Global SA (NYSE:BG) was the primary addition with 50,000 shares, making up 1.73% of the portfolio, valued at $5.13 million.

Archer-Daniels Midland Co (NYSE:ADM) also saw an addition of 50,000 shares, accounting for about 1.06% of the portfolio, with a total value of $3.14 million.

Key Position Increases

Robert Bruce (Trades, Portfolio) also increased his stakes in two companies:

Vicor Corp (NASDAQ:VICR) saw an addition of 15,000 shares, bringing the total to 45,000 shares. This 50% increase in share count had a 0.19% impact on the current portfolio, totaling $1.72 million in value.

Darling Ingredients Inc (NYSE:DAR) was boosted by 10,000 shares, reaching a total of 150,000 shares. This 7.14% increase in share count amounted to a value of $6.98 million.

Key Position Reductions

Significant reductions were made in three stocks, notably:

Xcel Energy Inc (NASDAQ:XEL) was reduced by 100,000 shares, a 34.13% decrease, impacting the portfolio by -2.23%. The stock had an average trading price of $57.1 during the quarter, with a -3.18% return over the past three months and -8.86% year-to-date.

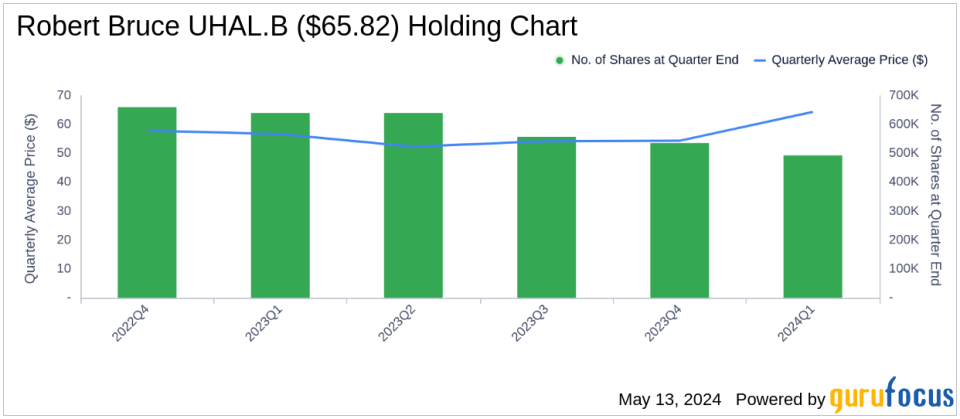

U-Haul Holding Co (NYSE:UHAL.B) saw a reduction of 43,000 shares, an 8.02% decrease, impacting the portfolio by -1.07%. The stock traded at an average price of $64.42 during the quarter, with a 6.99% return over the past three months and a -5.76% year-to-date return.

Portfolio Overview

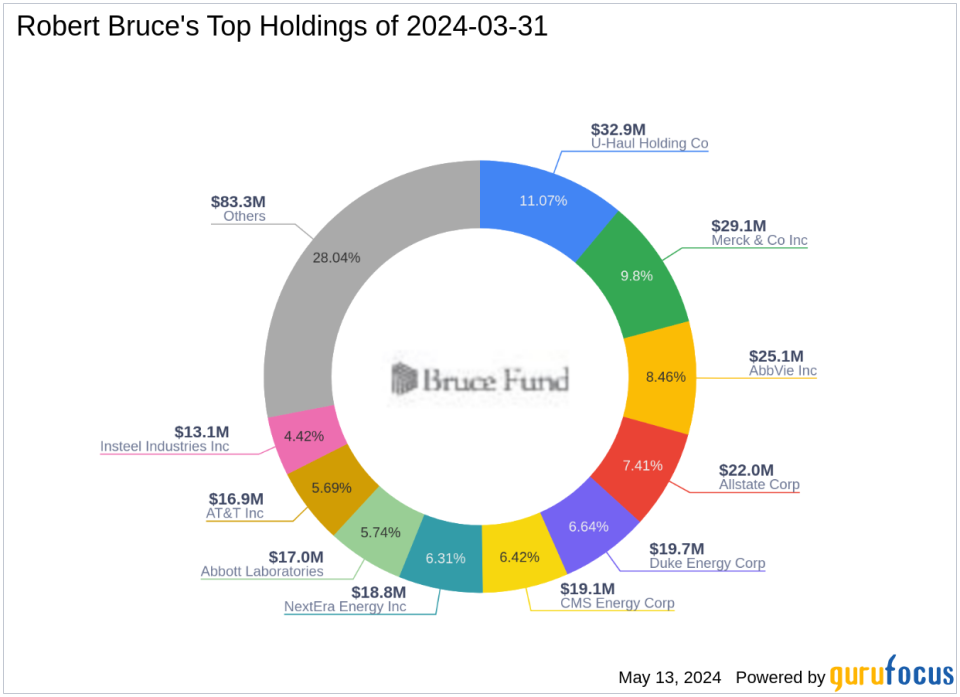

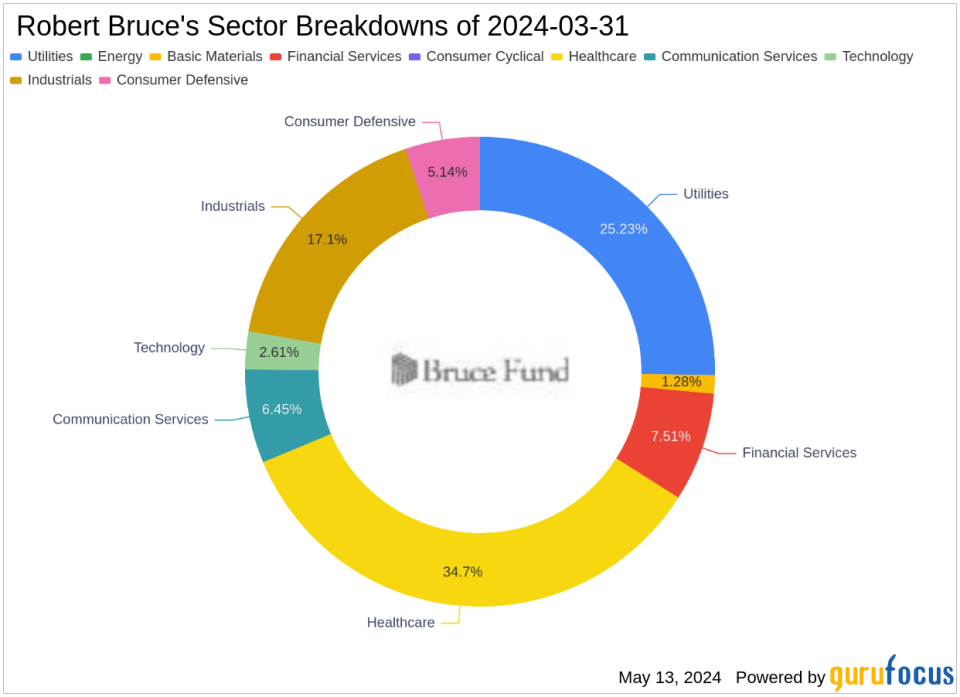

As of the first quarter of 2024, Robert Bruce (Trades, Portfolio)'s portfolio comprised 37 stocks. The top holdings included 11.07% in U-Haul Holding Co (NYSE:UHAL.B), 9.8% in Merck & Co Inc (NYSE:MRK), 8.46% in AbbVie Inc (NYSE:ABBV), 7.41% in Allstate Corp (NYSE:ALL), and 6.64% in Duke Energy Corp (NYSE:DUK). The investments are predominantly concentrated in eight industries: Healthcare, Utilities, Industrials, Financial Services, Communication Services, Consumer Defensive, Technology, and Basic Materials.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.