Sterling ended the week a touch lower versus the US dollar, down -0.2% and snapping a two-week bullish phase. As we enter the second full week of May, the GBP/USD currency pair will be monitored closely ahead of Tuesday’s employment and wage data out of the UK, with technical studies indicating a bearish move could be on the table.

Long-term picture

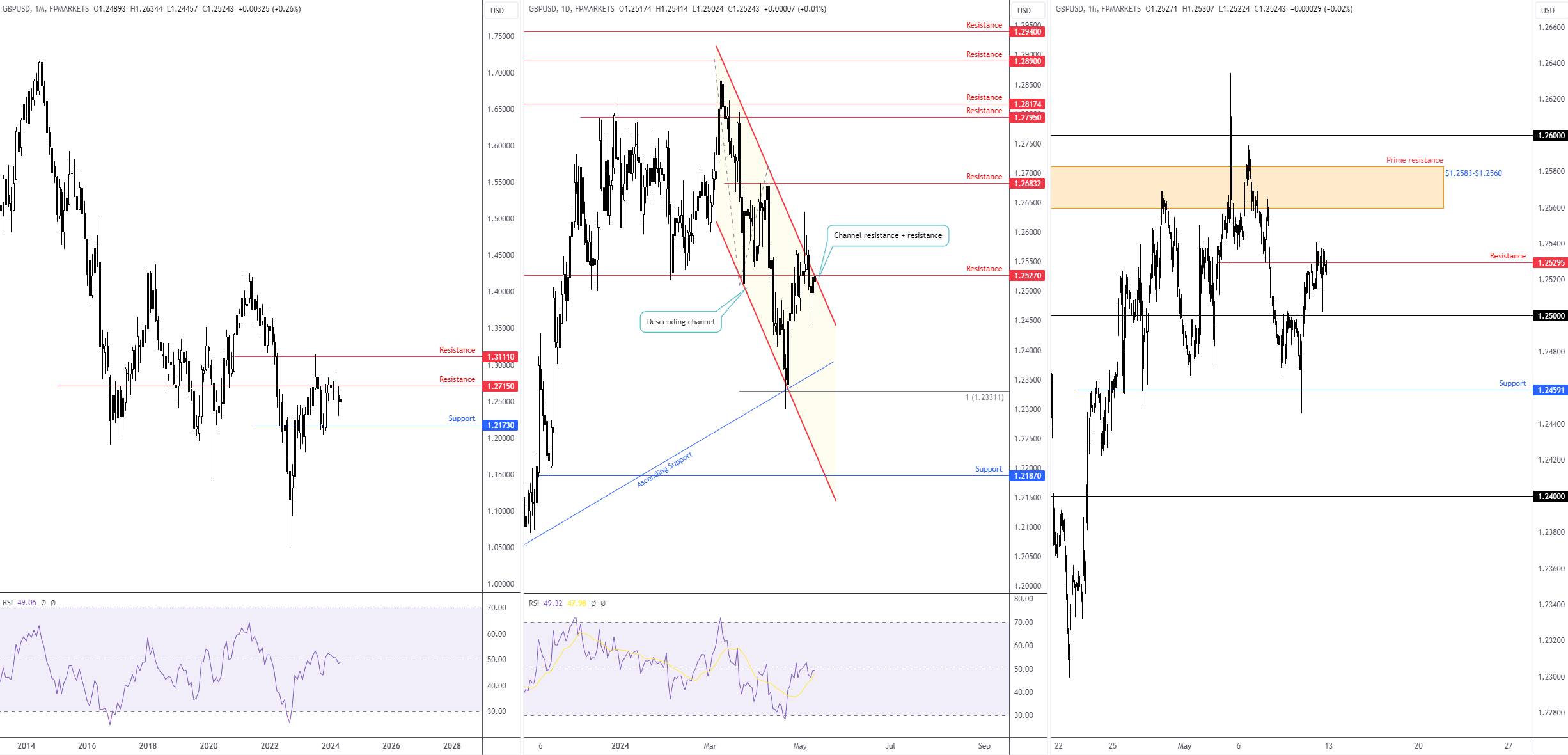

Price action on the monthly chart continues to hold under resistance at $1.2715, which has been the case since late 2023. This is currently reinforced by the daily chart wrapping up the week testing channel resistance, drawn from the high of $1.2894, a descending line complemented by a horizontal resistance level at $1.2527.

While one may argue that the monthly chart is in the early stages of an uptrend, the high at $1.3142, located near the next layer of resistance at $1.3111, would likely need to be breached before a long-term uptrend can be confirmed with any conviction.

As things stand, the monthly support level at $1.2173 is viewed as the next logical longer-term downside target for GBP bears and the trend currently supports sellers (this would be strengthened were a break of $1.2173 to be seen). This aligns with the daily chart’s downtrend, printing clear lower lows and lower highs since pencilling in a top at $1.2894. Further supporting bears, both monthly and daily charts reveal that the Relative Strength Index (RSI) is testing the underside of the 50.00 centreline, indicating possible resistance.

Short-term picture

From the H1 timeframe, price action concluded the week at the underside of resistance from $1.2530, set just ahead of the $1.25 handle. Space north of current resistance draws attention to prime resistance coming in from $1.2583-$1.2560. Knowing that the longer-term trend is facing southbound and daily price is testing resistance from $1.2527, H1 resistance from $1.2530 or the prime resistance at $1.2583-$1.2560 could be areas that sellers welcome this week, taking aim at $1.25, followed by H1 support from $1.2459 and perhaps $1.24.

This material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A Product Disclosure Statement for each of the financial products is available from FP Markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFS Licence No. 286354).

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0850 after upbeat US PMI data

EUR/USD lost its traction and declined below 1.0850 in the American session on Thursday. Upbeat PMI data from the US, combined with the mixed action seen in Wall Street's main indexes, helps the US Dollar gather strength and weighs on the pair.

GBP/USD falls toward 1.2700 as USD benefits from PMI data

GBP/USD came under modest bearish pressure and declined toward 1.2700 in the second half of the day on Thursday. The US Dollar (USD) benefits from the PMI data, which showed an ongoing expansion in the private sector at an accelerating pace, and weighs on the pair.

Gold extends slide below $2,350.00

Gold stays on the back foot and trades at its lowest level in over a week below $2,350. The benchmark 10-year US Treasury bond yield rises more than 1% following the stronger-than-forecast PMI data from the US, forcing XAU/USD to stretch lower.

As Ethereum spot ETF approval nears, these altcoins could explode

It is not surprising that altcoins related to Bitcoin saw a major rally post-Bitcoin spot ETF approval. Likewise, tokens closely related to Ether could ride the ETF approval wave. Ethereum Classic, Pepe, Floki and other DeFi tokens could gain momentum as the ETH ETF approval deadline nears.

US S&P Global PMIs Preview: Economic expansion set to persist in May

On Thursday, S&P Global will issue its flash estimates of the United States (US) Purchasing Managers Indexes (PMIs), a monthly survey of business activity. The survey is separated into services and manufacturing output and aggregated into a single statistic, the Composite PMI.