OPAL Fuels Inc. Surpasses Revenue Forecasts Despite Earnings Miss in Q1 2024

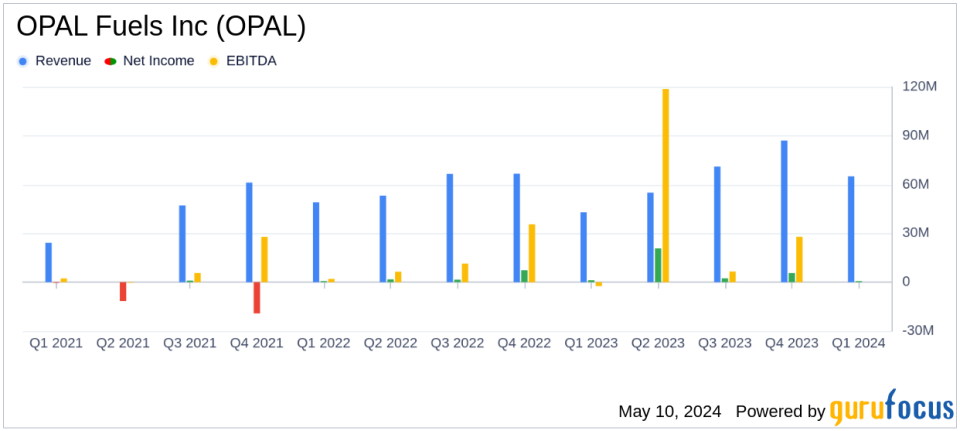

Revenue: Reported at $65.0 million for Q1 2024, marking a 51% increase year-over-year, but fell short of the estimated $79.27 million.

Net Income: Achieved $0.7 million, a significant improvement from a net loss of $7.3 million in the same period last year, yet below the estimated $3.55 million.

EPS: Recorded a net loss per share of $0.01 for Class A common shareholders, not aligning with the negative earnings per share estimate of $0.02.

Adjusted EBITDA: Increased substantially to $15.2 million from a negative $1.6 million in the prior year's quarter.

RNG Production: Volume produced rose by 33% to 0.8 million MMBtu compared to the previous year.

RNG Sales: Sold as transportation fuel surged by 98% to 16.4 million GGEs.

Operational Expansion: Announced the commencement of the Prince William RNG facility and ongoing construction of additional projects, aiming to expand total design capacity to 10.3 million annual MMBtu.

On May 9, 2024, OPAL Fuels Inc (NASDAQ:OPAL), a leading producer and distributor of renewable natural gas (RNG), released its 8-K filing detailing financial results for the first quarter ended March 31, 2024. The company reported a substantial 51% increase in revenue, reaching $65.0 million, significantly surpassing the estimated $79.27 million. Despite this, earnings per share fell short, with a reported loss of $0.01 per share against an estimated gain of $0.02 per share.

About OPAL Fuels Inc.

OPAL Fuels Inc is a vertically integrated leader in the capture and conversion of biogas into low-carbon intensity RNG and renewable electricity. The company plays a crucial role in the marketing and distribution of RNG to heavy-duty trucking and other sectors that are challenging to decarbonize. OPAL Fuels designs, develops, constructs, operates, and services fueling stations for trucking fleets across the nation, promoting the use of natural gas over diesel.

Operational and Financial Highlights

The first quarter of 2024 was marked by robust operational performance and significant strategic progress, including the commencement of operations at the Prince William RNG facility. This addition enhances OPAL's operating portfolio to 7.0 million annual MMBtu design capacity. Co-CEO Adam Comora highlighted the strength of the integrated business model and the foundational setup for progressive growth in production and earnings throughout the year.

Financially, OPAL Fuels made a commendable recovery from a net loss of $7.3 million in the same quarter last year to a net income of $0.7 million. This turnaround is attributed to increased RNG production and sales, which saw a 33% and 98% increase respectively. Adjusted EBITDA also reflected positive momentum, with a significant rise to $15.2 million from a negative $1.6 million in the prior year.

Strategic Developments and Future Outlook

Jonathan Maurer, co-CEO, expressed optimism about the company's strategic initiatives, including ongoing construction projects like the Sapphire and Polk RNG projects slated for operation later this year. These projects are expected to increase the annual MMBtu design capacity to 8.8 million by year-end. The company also initiated construction on the Cottonwood project, further expanding its portfolio.

Looking ahead, OPAL Fuels is well-positioned to leverage industry tailwinds and its strategic expansions to meet its financial and operational targets for 2024. The company's focus on increasing RNG production capacity and enhancing operational efficiencies is expected to drive continued growth and profitability.

Liquidity and Capital Expenditures

As of March 31, 2024, OPAL Fuels reported a solid liquidity position with $334.0 million available, comprising cash, cash equivalents, and available credit facilities. The company invested $26.8 million in capital expenditures during the quarter, focusing on the construction of RNG projects and proprietary fueling stations.

Conclusion

Despite missing earnings estimates, OPAL Fuels Inc's first quarter of 2024 demonstrates a strong trajectory in revenue growth and strategic project development. With new facilities coming online and an enhanced operational capacity, OPAL is steering towards a promising year of financial and environmental contributions to the renewable energy sector.

For further details, please refer to the full earnings release.

Explore the complete 8-K earnings release (here) from OPAL Fuels Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance