Energy Vault Holdings Inc (NRGV) Q1 2024 Earnings: Misses Revenue Expectations, Narrows Losses

Revenue: Reported at $7.8 million, falling short of the estimated $12.57 million.

Net Loss: Improved to $(21.1) million, failing to meet the estimated net loss of $(18.00) million.

GAAP Gross Margin: Achieved 26.7%, indicating strong project management and execution efficiency.

Cash and Cash Equivalents: Ended the quarter at $136.8 million, aligning with the guidance range of $125 150 million.

Operating Expenses: Cash operating expenses reduced by 22% year-over-year and 14% quarter-over-quarter to $16.7 million, reflecting effective cost control measures.

Adjusted EBITDA: Showed improvement, reducing losses by $4.6 million year-over-year to $(14.4) million.

Future Outlook: Detailed 2024-2025 financial guidance to be provided at the upcoming Investor & Analyst Day.

Energy Vault Holdings Inc (NYSE:NRGV), a pioneer in grid-scale energy storage solutions, released its 8-K filing on May 8, 2024, detailing the financial outcomes for the first quarter of the year. The company, known for addressing the intermittency challenges of renewable energy sources like solar and wind, operates primarily in the United States, with expanding footprints in China and other regions.

Financial Performance

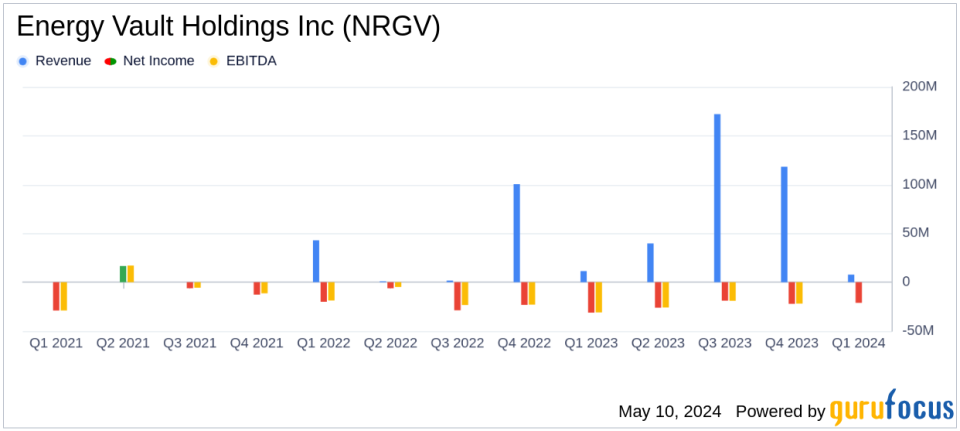

For Q1 2024, Energy Vault reported revenue of $7.8 million, primarily from utility and independent power producer (IPP) storage projects. This figure falls short of the analyst expectations of $12.57 million, reflecting a significant year-over-year decline from the previous year's revenue of $11.42 million. Despite the revenue shortfall, the company achieved a GAAP gross margin of 26.7%, amounting to a gross profit of $2.1 million, driven by effective project management and a favorable mix of higher-margin services.

The net loss for the quarter was $21.1 million, a 32% improvement from the $31.2 million loss recorded in the same period last year. This reduction in net loss is attributed to decreased operating expenses and increased other income. The cash operating expenses of $16.7 million marked a 22% year-over-year improvement, reflecting the company's successful cost containment efforts initiated in the previous quarter.

Balance Sheet and Cash Flow Insights

Energy Vault ended the quarter with $136.8 million in cash and cash equivalents, aligning with the guidance range of $125 150 million and showing a strong liquidity position with no debt on the balance sheet. The company's cash management reflects strategic financial stewardship amid its expansive project executions.

Operational Highlights and Future Outlook

Operationally, the quarter was marked by the commissioning and initial operation of significant projects, including the 25MW, 100MWh Gravity Energy Storage System (GESS) in Rudong, China, and a 440 MWh Battery Energy Storage System (BESS) in Nevada. These projects underscore Energy Vault's commitment to enhancing renewable energy storage solutions.

Looking ahead, Energy Vault anticipates licensing revenue recognition from its Southern Africa operations later in 2024 and plans to provide detailed financial guidance for 2024-2025 at its upcoming Investor & Analyst Day. This event will also offer insights into the company's strategic initiatives, new product updates, and customer testimonials, providing a comprehensive view of its forward-looking strategies.

Analysis and Investor Implications

The Q1 results reflect a mixed financial performance with significant improvements in cost management and operational efficiencies, albeit with revenues not meeting expectations. For investors, the key takeaway would be the company's robust gross margin performance and reduced losses, indicating potential for future profitability as it scales operations and enters new markets. However, the revenue miss might raise concerns about near-term growth trajectories, especially in the competitive energy storage sector.

Energy Vault's strategic focus on expanding its technological and geographical footprint, coupled with a strong balance sheet, positions it well for sustainable growth. Investors and stakeholders will likely watch closely how the company executes its upcoming projects and capitalizes on emerging opportunities in green energy storage.

Conclusion

As Energy Vault Holdings Inc (NYSE:NRGV) continues to navigate the complexities of the renewable energy market, its ability to manage costs and streamline operations will be critical in leveraging its innovative storage solutions for long-term success. The upcoming Investor & Analyst Day will be pivotal in shaping investor perceptions and confidence in the company's strategic direction.

Explore the complete 8-K earnings release (here) from Energy Vault Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance