Arq Inc (ARQ) Reports Q1 2024 Earnings: Revenue Growth Amid Lower Volumes

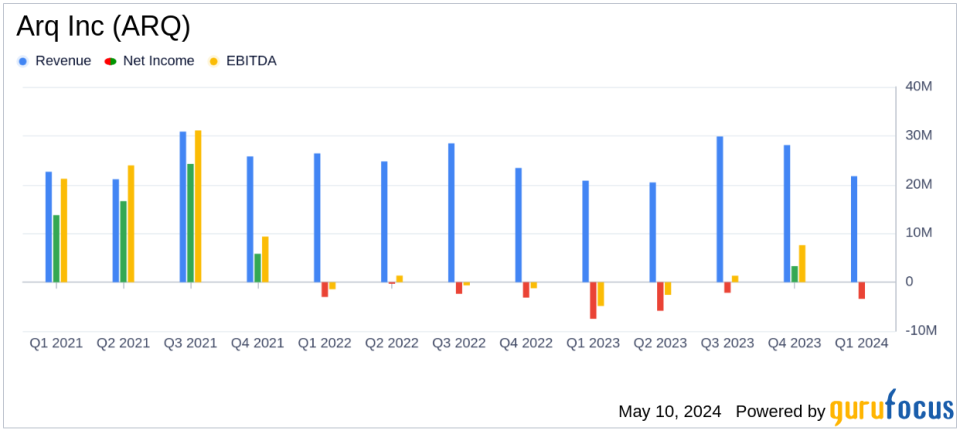

Revenue: $21.7M in Q1 2024, an increase of 4% year-over-year.

Gross Margin: Improved significantly to 37% in Q1 2024 from 17% in the previous year.

Net Loss: Reduced to $3.4M in Q1 2024 from $7.5M in Q1 2023.

Adjusted EBITDA: Loss decreased to $1.1M in Q1 2024 from a loss of $2.2M in the same period last year.

Capital Expenditure: Updated full-year forecast to $60-70M, an increase due to higher costs in the Red River expansion.

Cash Position: Ended Q1 2024 with $44.0M, down from $54.2M year-over-year.

Strategic Milestones: Secured first GAC supply contract, representing 20% of capacity at Red River facility with delivery expected in Q1 2025.

On May 8, 2024, Arq Inc (NASDAQ:ARQ), a leader in the environmental technology sector, disclosed its financial results for the first quarter of 2024. The company, known for its innovative activated carbon products, reported a revenue increase and significant improvements in gross margin despite a decrease in volumes. The full details of these results can be accessed through Arq Inc's 8-K filing.

Arq Inc specializes in producing activated carbon and other carbon products used in purification and sustainable materials, catering to a wide range of industries, including power generation and water treatment.

Financial Performance Highlights

For Q1 2024, Arq Inc posted revenues of $21.7 million, marking a 4% increase from the previous year, primarily driven by a 16% rise in average selling prices (ASP) and favorable changes in product mix. This revenue growth was achieved despite a 6% drop in volumes, attributed to a milder winter affecting power generation demand.

The company's gross margin saw a remarkable improvement, doubling from 17% in the prior year to 37% in Q1 2024. This increase was fueled by the higher ASP and stringent operational cost management. However, Arq Inc still reported a net loss of $3.4 million, which, while a significant reduction from the $7.5 million loss in the same period last year, highlights ongoing challenges.

Adjusted EBITDA also showed improvement, with a loss of $1.1 million compared to a $7.7 million loss in Q1 2023. This was primarily due to the reduction in net loss and adjustments in interest expenses.

Operational and Strategic Developments

Arq Inc achieved a critical milestone in Q1 2024 by securing its first supply contract for Granular Activated Carbon (GAC), which is expected to cover 20% of the capacity at its Red River facility. This contract is a significant step as it provides validation for Arq's strategic direction and de-risks the expansion project at Red River, which is on track for completion in Q4 2024.

The company also commenced the commissioning of its Corbin facility, which is anticipated to enhance its production capabilities significantly. Furthermore, the Environmental Protection Agency (EPA) has issued new, stricter regulations on water contaminants, which are expected to drive demand for Arq's specialized GAC products.

Financial Health and Future Outlook

Arq Inc closed Q1 2024 with $44.0 million in cash and restricted cash, a decrease from $54.2 million at the end of 2023, reflecting ongoing investments in its Red River and Corbin facilities. The company also adjusted its capital expenditure forecast for 2024 to $60-70 million, up from the previously estimated $55-60 million, due to increased costs associated with these strategic expansions.

Despite the current net losses, the strategic developments and operational improvements suggest a positive trajectory for Arq Inc. The company's focus on enhancing profitability through better pricing strategies and cost management, coupled with strategic capital investments, positions it well for future growth and operational efficiency.

Arq Inc's management remains optimistic about the company's direction and its role in supporting environmental sustainability through its advanced carbon technologies. As these initiatives progress, they are expected to substantially improve Arq's financial performance and market position.

Explore the complete 8-K earnings release (here) from Arq Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance