Eastman Kodak Co (KODK) Reports Modest Dip in Q1 2024 Earnings Amid Strategic Investments

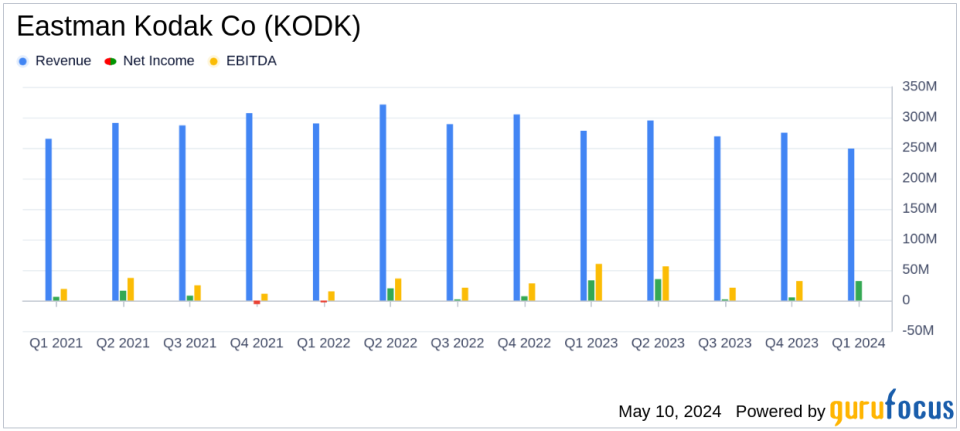

Revenue: $249M, down by 10% year-over-year from $278M in Q1 2023.

Net Income: $32M, a decrease of 3% from $33M in the same quarter last year.

Operational EBITDA: $4M, a significant decline of 56% from $9M in Q1 2023.

Cash Balance: Increased to $262M, up by $7M from the end of the previous year.

Gross Profit Percentage: Maintained at 20%, reflecting ongoing operational efficiency improvements.

Print Segment Revenue: Decreased to $182M from $209M in Q1 2023.

Advanced Materials & Chemicals Revenue: Slightly down to $59M from $61M in the previous year.

On May 9, 2024, Eastman Kodak Co (NYSE:KODK) released its 8-K filing, detailing the financial outcomes for the first quarter of 2024. The company, a stalwart in the print and advanced materials and chemicals sectors, reported a revenue of $249 million, marking a 10% decrease from the previous year. This decline was attributed to lower volumes and escalated costs due to strategic investments, despite no impact from foreign currency fluctuations.

Company Overview

Eastman Kodak Co operates through diverse segments including Print, Brand, and Advanced Materials and Chemicals, primarily in North America, Europe, and APAC regions. The company is renowned for its broad range of print solutions and has a significant footprint in the materials science sector, leveraging its extensive patent portfolio and manufacturing capabilities.

Financial Performance Insights

The quarter witnessed a slight decrease in GAAP net income to $32 million, down from $33 million in the same quarter the previous year, a modest decline of 3%. Operational EBITDA significantly dropped by 56%, standing at $4 million, compared to $9 million in Q1 2023. This substantial decrease was primarily due to lower sales volumes and higher costs associated with IT investments and organizational restructuring aimed at enhancing operational efficiency.

Despite these challenges, Kodak reported an increase in its cash balance to $262 million, up by $7 million, driven by effective working capital management and $40 million in cash proceeds from brand licensing. The company's gross profit percentage also improved, reflecting a strategic focus on operational streamlining and revenue efficiency.

Segment Performance

Revenue from the Print segment fell to $182 million from $209 million, while the Advanced Materials & Chemicals segment saw a slight decrease in revenue to $59 million. The Brand segment maintained a steady performance. Operational EBITDA reflected these trends, with the Print segment experiencing a notable decline.

Management's Outlook

Kodak continued to deliver strong cash performance in the first quarter, increasing our cash balance from $255 million to $262 million, stated David Bullwinkle, Kodaks CFO. We also improved our gross profit percentage year over year for the quarter, which reflects our ongoing focus on streamlining our operations and generating smart revenue. Operational EBITDA for the quarter was impacted by significant investments in automation and simplification of back-office functions. For the balance of the year, we plan to concentrate on the fundamentals from our strategic plan: investing for growth, increasing operational efficiency and helping our customers succeed.

Strategic Initiatives and Future Focus

Kodak is positioning itself as a growth-oriented company by continuing to invest in its core areas of print and advanced materials and chemicals. The company highlighted its commitment to innovation, particularly in integrating digital and offset print technologies, and expanding its film production capacity to meet the rising demand in both still and motion picture markets.

As Kodak navigates through operational restructuring and strategic investments, its focus remains on long-term growth and operational efficiency, aiming to deliver enhanced value to its customers and stakeholders.

Conclusion

While facing short-term financial headwinds, Eastman Kodak's strategic investments in technology and operational efficiency set the stage for potential growth. Investors and stakeholders may look forward to the company's continued progress in aligning its operations with future market demands and its historical strength in innovation.

Explore the complete 8-K earnings release (here) from Eastman Kodak Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance