ZimVie Inc. (ZIMV) Reports Mixed Q1 2024 Financial Results, Misses Earnings Predictions

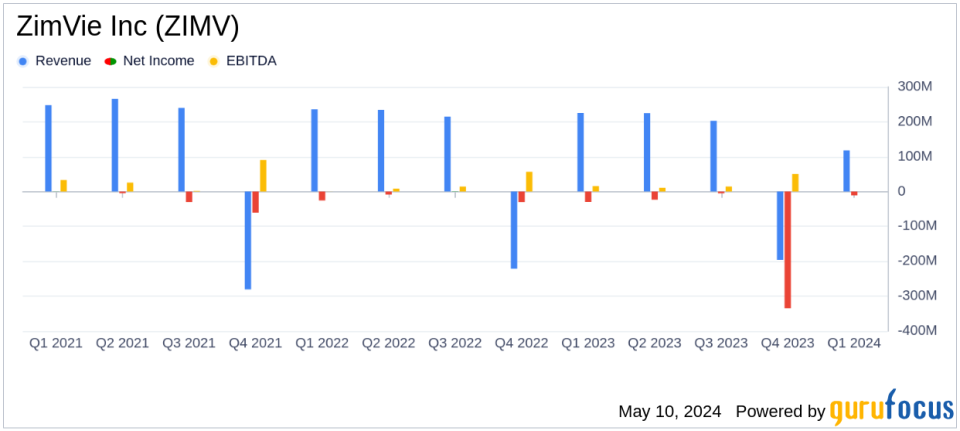

Revenue: Reported at $118.2 million for Q1 2024, showing a slight decrease of 1.6% year-over-year and exceeding estimates of $116.2 million.

Net Loss: Stood at $11.5 million in Q1 2024, an improvement from a loss of $16.4 million in the same quarter last year, but still above the estimated loss of $1.9 million.

Earnings Per Share (EPS): Basic and diluted EPS were recorded at -$0.42, underperforming against the estimated EPS of -$0.04.

Adjusted Net Income: Improved to $2.2 million, up from the previous year's $0.3 million, indicating better operational efficiency.

Adjusted EBITDA: Increased to $12.5 million or 10.5% of sales, up $1.8 million year-over-year, reflecting enhanced profitability.

Debt Reduction: Highlighted a significant reduction in debt with $275 million paid down, aiming for a stronger financial structure.

Full Year Guidance: Projected net sales for 2024 are forecasted between $450 million to $460 million with adjusted EPS ranging from $0.55 to $0.70.

ZimVie Inc. (NASDAQ:ZIMV), a prominent player in the dental and spine markets, disclosed its financial outcomes for the first quarter ended March 31, 2024. The company, known for its innovative solutions in dental implants and digital workflow technologies, reported a decrease in net sales and a significant net loss, underscoring challenges despite strategic advancements. The full details of the financial results can be viewed in their 8-K filing.

Financial Performance Overview

ZimVie reported third-party net sales of $118.2 million for Q1 2024, a slight decrease of 1.6% compared to the same period last year. The net loss was substantial at $11.5 million, although this was an improvement from a net loss of $16.4 million in Q1 2023. The net loss margin increased to 9.7% of third-party net sales. Despite these challenges, the company achieved an adjusted net income of $2.2 million, indicating some positive outcomes from its operational adjustments.

The reported earnings per share (EPS) stood at -$0.42, with an adjusted diluted EPS of $0.08. This performance reflects a miss on the estimated earnings per share of -$0.04 as forecasted by analysts, highlighting a tougher quarter than expected.

Strategic Focus and Adjustments

ZimVie's leadership emphasized their commitment to reshaping the company's financial profile and focusing exclusively on the dental sector. According to Vafa Jamali, President and CEO, the company has made significant strides in engaging with dental customers and enhancing its product offerings. A notable achievement in the quarter was the reduction of $275 million in debt, aligning with its strategic priorities.

Future Outlook and Guidance

Looking ahead, ZimVie provided guidance for the full year of 2024, projecting net sales to be between $450 million and $460 million. The company also anticipates adjusted EBITDA to range from $60 million to $65 million and adjusted EPS to be between $0.55 and $0.70. This guidance reflects management's confidence in the company's strategic direction and operational focus.

Challenges and Market Conditions

The financial results also underscore the broader challenges faced by ZimVie, including pricing pressures, regulatory changes, and competitive dynamics in the dental market. The company's ability to navigate these challenges while continuing to innovate and meet customer needs will be crucial for its long-term success.

Conclusion

While ZimVie's Q1 2024 results show some areas of concern, particularly with the missed earnings predictions and a decrease in net sales, the company's strategic adjustments and focus on the dental market are promising signs. Investors and stakeholders will likely watch closely how these strategies unfold in the coming quarters, impacting the company's financial health and market position.

For detailed financial figures and further information, interested parties can access the earnings call and additional documents through ZimVie's investor relations website.

Explore the complete 8-K earnings release (here) from ZimVie Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance