Ginkgo Bioworks Holdings Inc (DNA) Reports Q1 2024 Results: A Comprehensive Overview

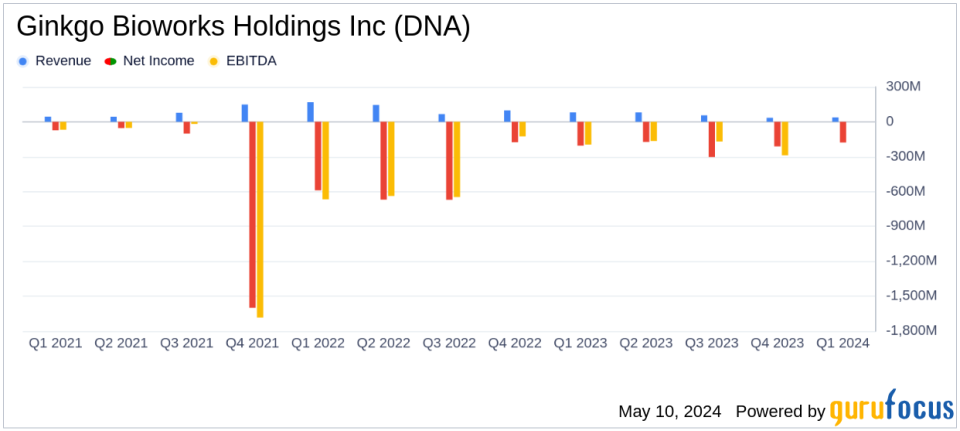

Revenue: Reported at $38 million for Q1 2024, a significant decrease of 53% from $81 million in the prior year, falling short of estimates of $46.04 million.

Net Loss: Increased to $(165.91) million in Q1 2024 compared to $(204.97) million in the same period last year, falling short of the estimated net loss of $(162.22) million.

Earnings Per Share (EPS): Recorded at -$0.08, meeting the estimated EPS of -$0.08.

Adjusted EBITDA: Remained stable at $(100) million year-over-year, despite a significant drop in revenue.

Cash Position: Ended the quarter with $840 million in cash and cash equivalents, down from $944 million at the end of Q1 2023.

Operational Efficiency: Announced initiatives targeting a $200 million reduction in annualized operating expenses by mid-2025, including a 25% cut in labor expenses and consolidation of operations.

Future Revenue Guidance: Adjusted 2024 total revenue expectations to $170-$190 million, with revised Cell Engineering services revenue projected between $120-$140 million.

Ginkgo Bioworks Holdings Inc (NYSE:DNA), a leader in cell programming and biosecurity, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its recent 8-K filing. The company reported a substantial decrease in revenue and continues to operate at a loss, although it has laid out a clear path toward achieving adjusted EBITDA breakeven by the end of 2026.

Financial Performance Overview

For Q1 2024, Ginkgo Bioworks posted total revenue of $38 million, a significant drop of 53% from $81 million in the same period last year. This decline was primarily due to the anticipated reduction in K-12 testing in the company's Biosecurity segment. The Cell Engineering segment also saw a decrease, with revenues falling 18% to $28 million, attributed to lower earnings from early-stage customers, partially offset by growth from large enterprise clients.

The company's loss from operations improved slightly to $(178) million in Q1 2024 from $(216) million in Q1 2023, helped by a reduction in stock-based compensation expense and overall operating expenses. Despite these reductions, Ginkgo's adjusted EBITDA remained flat at $(100) million year-over-year.

Strategic Adjustments and Future Outlook

In response to these challenges, Ginkgo Bioworks is implementing several strategic initiatives aimed at reducing costs and simplifying operations. These include a targeted $200 million reduction in annualized run-rate operating expenses by mid-2025 and a consolidation of its Foundry operations. The company plans to reduce its physical footprint by up to 60% and labor expenses by at least 25% across general and administrative and research and development functions.

Additionally, Ginkgo is revising its customer engagement model to streamline transactions and enhance the efficiency of its platform. This includes the introduction of Lab Data as a Service (LDaaS) and other modular offerings to reduce manual R&D support and leverage its high-throughput, flexible automation more effectively.

Financial Position and Liquidity

As of March 31, 2024, Ginkgo Bioworks reported a strong cash and cash equivalents balance of $840 million, indicating a robust liquidity position to support its strategic plans. The company has no bank debt, further underscoring its solid financial footing despite ongoing losses.

Market and Operational Challenges

The significant revenue decline in Ginkgo's Biosecurity segment, primarily due to reduced K-12 testing, highlights the challenges in maintaining stable revenue streams in rapidly evolving market conditions. The Cell Engineering segment's struggle with early-stage customer retention also underscores the need for Ginkgo to enhance its value proposition and customer engagement strategies in highly competitive markets.

Conclusion

While Ginkgo Bioworks faces considerable challenges in terms of revenue generation and profitability, its proactive strategic adjustments and strong cash reserves position it to potentially stabilize and grow in the coming years. Investors and stakeholders will likely watch closely to see if the company can streamline operations and achieve its financial targets as planned.

For detailed insights and continued updates on Ginkgo Bioworks Holdings Inc (NYSE:DNA), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Ginkgo Bioworks Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance