Arcus Biosciences Surpasses Analyst Revenue Forecasts in Q1 2024

Revenue: $145 million, significantly exceeded estimates of $28.74 million.

Net Loss: $4 million, substantially above estimates of -$87.54 million.

Earnings Per Share (EPS): -$0.05, outperforming the estimated -$0.62.

Cash Reserves: Ended the quarter with $1.1 billion, up from $866 million at the end of the previous quarter.

Research and Development Expenses: Increased to $109 million from $81 million year-over-year, reflecting higher investment in clinical and operational activities.

Impairment of Long-lived Assets: Recorded a $20 million non-cash charge due to plans to sublease part of the facilities.

Operational Milestones: Expects to complete enrollment for key Phase 3 studies in cancer treatment by the end of 2024.

Arcus Biosciences Inc (NYSE:RCUS) reported its first-quarter financial results on May 8, 2024, revealing significant revenue growth and strategic advancements in its oncology pipeline. The detailed earnings were disclosed in their 8-K filing.

Arcus Biosciences, a clinical-stage biopharmaceutical company, is at the forefront of developing innovative immunotherapies for cancer, focusing on mechanisms like the ATP-adenosine pathway to optimize small-molecule immuno-oncology candidates. Their product pipeline includes promising candidates such as Domvanalimab and Etrumadenant, targeting various cancers including lung, colorectal, and pancreatic cancers.

Financial Highlights and Performance

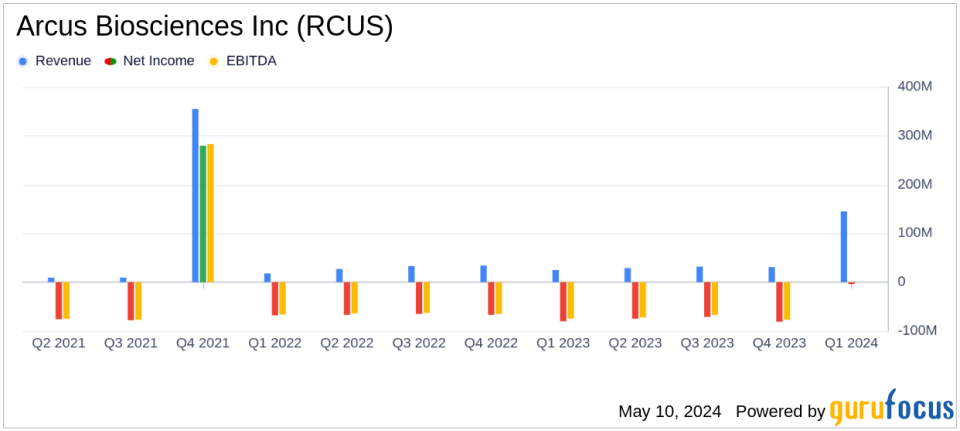

For Q1 2024, Arcus Biosciences reported an impressive revenue of $145 million, a substantial increase from $25 million in the same period last year. This surge was primarily driven by $135 million in license and development services revenue, largely from amendments to the Gilead collaboration. This performance significantly exceeded analyst expectations, which had estimated revenues at $28.74 million for the quarter.

Research and Development (R&D) expenses rose to $109 million from $81 million in Q1 2023, reflecting increased investment in clinical trials and development programs. General and Administrative (G&A) expenses also saw a modest rise to $32 million, up from $30 million in the prior year's first quarter.

The company reported a net loss of $4 million for the quarter, a notable improvement compared to a net loss of $80 million in Q1 2023. This reduction in net loss highlights the effective management of expenses and the beneficial impact of the increased revenues.

Strategic Developments and Pipeline Updates

Arcus Biosciences continues to advance its clinical pipeline with multiple studies across different cancer types. Noteworthy developments include the expected completion of enrollment in Phase 3 studies STAR-221 and STAR-121 for Domvanalimab in combination with Zimberelimab and chemotherapy, targeting upper GI and non-small cell lung cancers respectively.

Furthermore, the company anticipates presenting new data from its various clinical trials at upcoming medical conferences, which could provide significant catalysts for further validation of its pipeline. This includes updated data from the EDGE-Gastric trial and results from the ARC-9 study in metastatic colorectal cancer.

Financial Stability and Outlook

Arcus's financial position remains robust with $1.1 billion in cash, cash equivalents, and marketable securities as of March 31, 2024. This financial stability is expected to support operations well into 2027, allowing the company to continue its research and development efforts without financial hindrance.

Conclusion

The first quarter of 2024 has been pivotal for Arcus Biosciences, with financial results that not only surpassed analyst estimates but also positioned the company for sustained growth. The advancements in its clinical pipeline and the strategic collaborations, particularly with Gilead, underscore Arcus's potential to become a leader in the oncology sector. Investors and stakeholders may look forward to a promising future as the company progresses towards delivering innovative cancer treatments.

For detailed insights and further information, you can access the full earnings report and listen to the earnings call via the Arcus Biosciences website.

Explore the complete 8-K earnings release (here) from Arcus Biosciences Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance