Innovative Industrial Properties Inc (IIPR) Q1 2024 Earnings: Misses EPS Estimates, Revenue ...

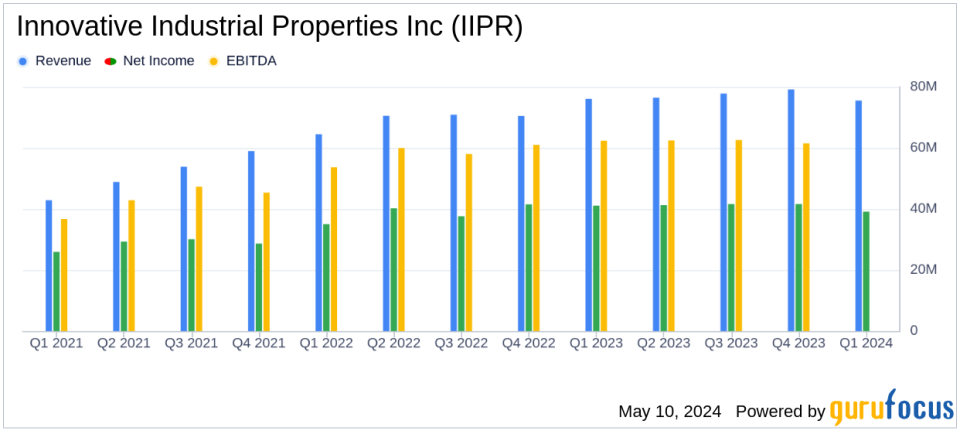

Revenue: Reported at $75.5 million for Q1 2024, showing a slight decrease of 1% from $76.1 million in Q1 2023, falling short of the estimated $78.58 million.

Net Income: Recorded at $39.1 million, below the estimate of $40.69 million and a decrease from $40.75 million in the prior year.

Earnings Per Share (EPS): Achieved $1.36, below the estimated $1.43 and down from $1.43 in Q1 2023.

Dividend: Paid a quarterly dividend of $1.82 per common share, with an AFFO payout ratio of 82%.

Adjusted Funds From Operations (AFFO): Posted $63.0 million or $2.21 per share, reflecting a slight decrease from $63.37 million or $2.25 per share in Q1 2023.

Financing Activity: Upsized the revolving credit facility to $45.0 million in aggregate commitments and issued 123,224 shares under the ATM Program for net proceeds of $11.8 million.

Portfolio Expansion: Executed new leases at four existing properties, totaling $69.4 million in invested/committed capital year-to-date.

Innovative Industrial Properties Inc (NYSE:IIPR) disclosed its first-quarter earnings for 2024 on May 8, as detailed in its 8-K filing. The company, a real estate investment trust (REIT) specializing in properties leased to operators in the regulated U.S. cannabis industry, reported a mixed financial performance with a slight decline in revenue and earnings per share (EPS) falling short of analyst expectations.

Financial Highlights and Operational Activities

For the quarter ended March 31, 2024, IIPR generated revenue of $75.5 million, a slight decrease from $76.1 million in the same period last year. This 1% decline was primarily due to a $5.6 million drop in contractual rent and property management fees from properties that IIP took back possession of since March 2023. However, this was partially offset by a $6.0 million increase in contractual rent from rent escalations and amendments to existing leases.

The company recorded net income attributable to common stockholders of $39.1 million, or $1.36 per share, which is below the analyst estimate of $1.43 per share. Additionally, funds from operations (FFO), normalized FFO, and adjusted funds from operations (AFFO) per share were reported at $1.98 and $2.21 respectively, both showing a decrease from the previous year.

Strategic Developments and Portfolio Expansion

Innovative Industrial Properties has been actively managing its property portfolio, highlighted by the execution of new leases at four existing properties and the investment of $69.4 million year-to-date. The company also obtained temporary certificates of occupancy for properties previously under development and continued to re-lease properties that were taken back in possession.

Despite these efforts, rent commencement on some re-leased properties is contingent upon tenants obtaining necessary operational approvals, with temporary rent abatements affecting immediate revenue recognition.

Balance Sheet and Liquidity

As of March 31, 2024, IIPR's balance sheet remains robust with $153.5 million in cash and cash equivalents. The total assets were reported at $2.4 billion. The company has also upsized its revolving credit facility, securing $45.0 million in aggregate commitments, enhancing its financial flexibility.

In the first quarter, IIPR paid a quarterly dividend of $1.82 per common share, maintaining a strong AFFO payout ratio of 82%.

Market and Future Outlook

The slight downturn in IIPR's quarterly performance reflects the challenges in the cannabis real estate sector, particularly with the re-leasing of properties and the impact of temporary rent abatements. However, the company's continued investment in property improvements and strategic lease amendments demonstrate a proactive approach to managing its portfolio and supporting tenant operations.

The real estate investment trust sector, particularly those like IIPR focusing on the cannabis industry, continues to navigate regulatory and market dynamics. Investors and stakeholders will be watching closely how IIPR's strategic initiatives unfold in the coming quarters to mitigate the current challenges and leverage opportunities for growth.

For more detailed information, investors are encouraged to review the full earnings report and listen to the earnings call scheduled for May 9, 2024.

Explore the complete 8-K earnings release (here) from Innovative Industrial Properties Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance