Primo Water Corp (PRMW) Surpasses Q1 Revenue Expectations and Declares Quarterly Dividend

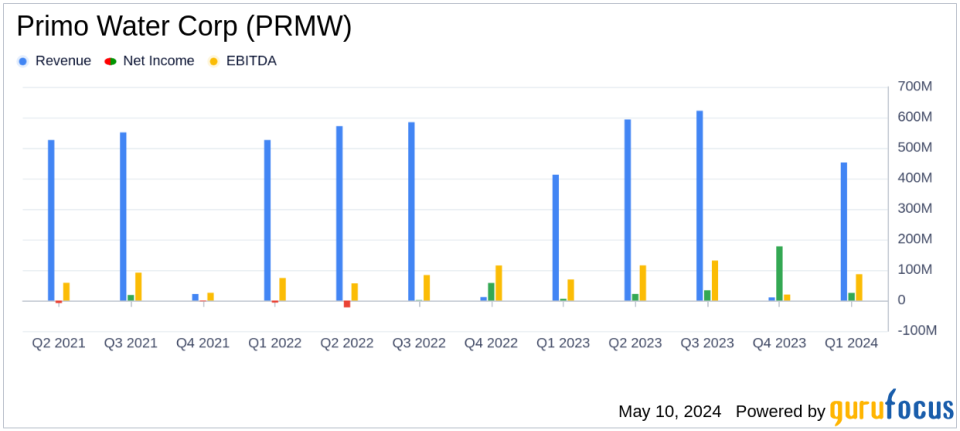

Revenue: Reported at $452.0 million, up 9.6% year-over-year, below the estimated $476.10 million.

Net Income: From continuing operations reached $18.7 million, significantly up from $3.2 million last year, below the estimated $35.04 million.

Earnings Per Share (EPS): From continuing operations was $0.12, below the estimated $0.23 per share.

Adjusted EBITDA: Increased by 24.2% to $93.9 million, with the margin expanding by 250 basis points to 20.8%.

Dividend: Declared a quarterly dividend of $0.09 per share, payable on June 18, 2024, to shareholders of record as of June 7, 2024.

Share Repurchase: Repurchased approximately $9 million of its shares under the ongoing share repurchase program.

Outlook: Raised full-year guidance for revenue, Adjusted EBITDA, and Adjusted free cash flow based on strong Q1 performance.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On May 9, 2024, Primo Water Corp (NYSE:PRMW), a leader in sustainable drinking water solutions in North America, announced its first-quarter results, which exceeded the upper end of its guidance for revenue and Adjusted EBITDA. The company also declared a quarterly dividend, reflecting confidence in its financial health and ongoing commitment to shareholder returns. The details were released in their recent 8-K filing.

Company Overview

Primo Water, headquartered in Tampa, Florida, operates primarily under a recurring revenue model, often described as "razor-razorblade," where the initial sale of water dispensers drives continuous revenue through subsequent water solution sales. The company's offerings include Water Direct, Water Exchange, and Water Refill services, catering to both residential and commercial customers across North America.

Financial Performance

For the quarter ended March 30, 2024, Primo Water reported a significant increase in revenue, reaching $452.0 million, up 9.6% from $412.5 million in the same period last year. This performance surpasses the current quarterly revenue estimate of $476.10 million. Net income from continuing operations saw a substantial rise to $18.7 million, compared to $3.2 million in the first quarter of 2023. Adjusted EBITDA also grew impressively by 24.2% to $93.9 million, with the margin expanding by 250 basis points to 20.8%.

Robbert Rietbroek, CEO of Primo Water, commented on the results,

This quarter we exceeded the high end of our guidance for revenue and Adjusted EBITDA. Our balanced and broad-based channel performance in the first quarter enables us to raise our revenue, Adjusted EBITDA and Adjusted free cash flow outlook for the 2024 fiscal year."

Operational Highlights

The company's operational success was driven by growth across all major channels. The Water Direct and Water Exchange segments posted an 8.6% increase in revenue, while the Water Refill and Water Filtration segments grew by 11.1%. The Other Water segment, which includes diverse water-related products and services, saw a remarkable revenue increase of 56.6%.

Dividend and Share Repurchase

Reflecting its strong cash flow and financial stability, Primo Water declared a quarterly dividend of $0.09 per share, payable on June 18, 2024, to shareholders of record as of June 7, 2024. Additionally, the company repurchased approximately $9 million worth of shares under its share repurchase program, underscoring its commitment to enhancing shareholder value.

Looking Ahead

With the robust first-quarter performance, Primo Water has raised its financial outlook for 2024, now expecting revenue to range between $1,855 million and $1,885 million. The company also anticipates Adjusted EBITDA to be between $410 million and $430 million for the full year. These projections reflect the company's confidence in its operational strategies and market position.

As Primo Water continues to expand its market presence and enhance its product offerings, the company remains a significant player in the North American water solutions market, poised for continued growth and profitability.

Conclusion

Primo Water's first-quarter results demonstrate a solid start to the year, with performance metrics that not only highlight the company's operational efficiency but also its strategic positioning in the sustainable water industry. Investors and stakeholders may look forward to continued growth and shareholder value enhancement in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Primo Water Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance