Americold Realty Trust Inc (COLD) Q1 2024 Earnings: Aligns with EPS Projections, Raises Annual ...

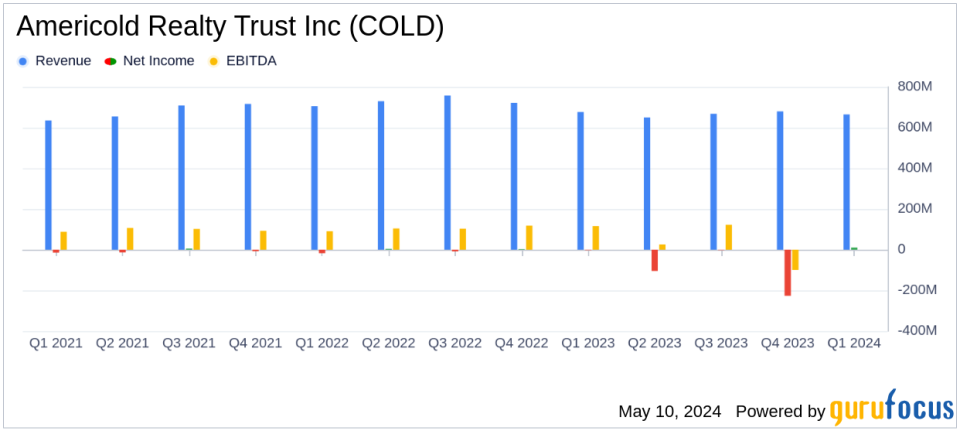

Revenue: Reported at $665.0 million, marking a decrease of 1.7% from $676.5 million in the same quarter the previous year, falling short of estimates of $679.63 million.

Net Income: Achieved $9.8 million, surpassing the estimated $7.45 million, and significantly improved from a net loss of $2.6 million in Q1 2023.

Earnings Per Share (EPS): Met the estimated earnings at $0.03 per diluted share.

Adjusted Funds From Operations (AFFO): Increased to $104.9 million, or $0.37 per diluted share, up from $79.9 million, or $0.29 per diluted share in Q1 2023.

Global Warehouse Segment: Same store NOI grew by 10.1% on a constant currency basis, despite a slight decrease in same store revenue by 0.7% on an actual basis.

Development and Expansion: Progressed with strategic developments including breaking ground on new facilities in Kansas City and Dubai, and announcing a new project in Sydney, Australia for $36 million.

Guidance Update: Raised AFFO per share guidance for 2024 to $1.38 - $1.46, reflecting positive adjustments from previous estimates of $1.32 - $1.42.

Americold Realty Trust Inc (NYSE:COLD) released its 8-K filing on May 9, 2024, unveiling its financial outcomes for the first quarter ended March 31, 2024. The Atlanta-based global leader in temperature-controlled warehousing reported a net income of $9.8 million, or $0.03 per diluted share, aligning with the estimated earnings per share of $0.03. The company also announced a notable annual guidance upgrade, reflecting confidence in sustained growth.

Company Overview

Americold Realty Trust Inc stands as the world's second-largest owner and operator of temperature-controlled warehouses. With approximately 245 facilities spanning 1.5 billion cubic feet, Americold plays a crucial role in the logistics and supply chain sectors, primarily in the U.S., but also internationally in Europe, Canada, Australia, and New Zealand. Operating as a real estate investment trust (REIT), the company also offers supply management and transportation services, enhancing its core warehousing operations.

Financial Performance Insights

The first quarter of 2024 saw Americold achieving a total revenue of $665.0 million, a slight decrease of 1.7% from the previous year's $676.5 million. This change was attributed to shifts in the Transportation and Third-party managed segments, slightly offset by growth in the Global Warehouse segment. Notably, the company's total Net Operating Income (NOI) surged by 12.4% to $210.8 million, driven by robust variable cost control and higher warehouse services margins.

Americold's Adjusted Funds From Operations (AFFO) per share saw a significant increase, reaching $0.37, up from $0.29 in the same quarter last year. This improvement underscores the company's effective management and operational efficiency, particularly within its core warehouse segment.

Strategic Developments and Future Outlook

During the quarter, Americold embarked on several strategic initiatives, including breaking ground on new development projects in Kansas City and Dubai, and announcing a $36 million expansion in Sydney, Australia. These projects are expected to fuel future growth and enhance the company's global footprint.

Looking ahead, Americold has raised its 2024 guidance, now anticipating AFFO per share to be between $1.38 and $1.46. This optimistic outlook is supported by expected growth in same-store warehouse revenues and NOI, alongside controlled selling, general, and administrative expenses.

Operational and Market Challenges

Despite its strong performance, Americold faces challenges including fluctuating consumer demand and the complexities of managing extensive international operations. Moreover, the company must navigate the ongoing impacts of global economic conditions, including inflation and currency exchange rates, which could affect operational costs and profitability.

Conclusion

Americold Realty Trust Inc's first quarter of 2024 reflects a resilient business model capable of navigating market fluctuations and capitalizing on growth opportunities. With strategic investments yielding positive early results and a raised guidance for the year, Americold is well-positioned to maintain its leadership in the temperature-controlled logistics sector. Investors and stakeholders may look forward to continued growth and operational excellence as the company advances its strategic priorities.

For more detailed information and future updates, investors are encouraged to refer to the full earnings report and financial statements available on the company's website.

Explore the complete 8-K earnings release (here) from Americold Realty Trust Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance