Viatris Inc. (VTRS) Q1 2024 Earnings: Aligns with EPS Projections Amidst Strategic Shifts and ...

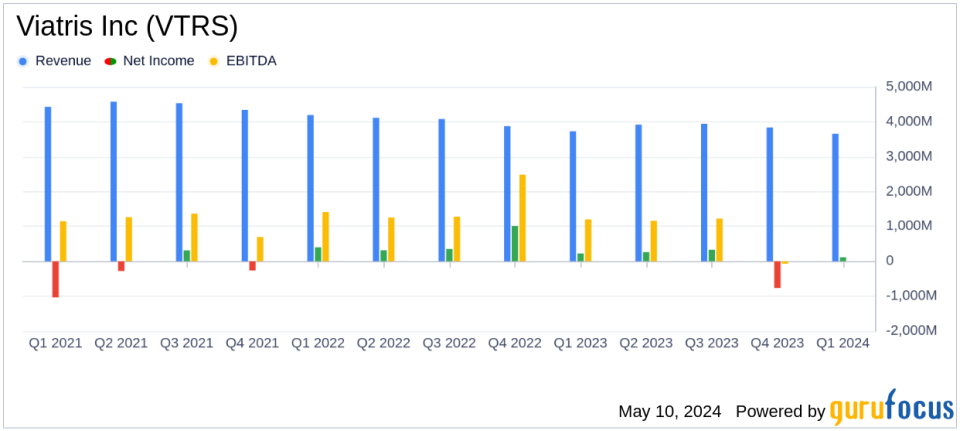

Revenue: Reported at $3.66 billion, slightly below the estimate of $3.69 billion.

Net Income: U.S. GAAP net earnings stood at $113.9 million, significantly below the estimated $804.57 million.

Earnings Per Share (EPS): Adjusted EPS matched the estimate at $0.67.

Free Cash Flow: Achieved $565 million, contributing robustly to financial flexibility and shareholder returns.

Quarterly Dividend: Declared at $0.12 per share, underscoring a commitment to returning value to shareholders.

Operational Revenue Growth: Marked the fourth consecutive quarter of growth, adjusted for divestitures.

Capital Return: $393 million returned to shareholders through dividends and share repurchases in the first quarter.

On May 9, 2024, Viatris Inc. (NASDAQ:VTRS) disclosed its first quarter earnings for 2024, showcasing a mix of strategic divestitures and solid operational performance. The company announced total revenues of $3.66 billion and adjusted earnings per share (EPS) of $0.67, aligning closely with analyst expectations. The detailed financial outcomes were revealed in their recent 8-K filing.

Company Overview

Viatris was established in November 2020 through the merger of Pfizer's Upjohn and Mylan. The company has quickly become a leading global manufacturer of generic and specialty drugs, serving over 165 countries. Viatris's portfolio is diverse, with approximately 40% of its total sales coming from generics and biosimilars, and the remaining 60% from legacy products like Lipitor and Viagra. The company focuses on therapeutic areas such as dermatology, ophthalmology, and gastroenterology for future growth.

Financial Performance Highlights

The first quarter of 2024 saw Viatris achieving a U.S. GAAP net earnings of $113.9 million with a reported EPS of $0.09. The adjusted EPS met the analyst estimates of $0.67. This period marked the fourth consecutive quarter of operational revenue growth on a divestiture-adjusted basis, reflecting the company's effective global commercial execution and successful new product launches.

Strategic Developments and Capital Allocation

During the quarter, Viatris completed the divestiture of its Womens Healthcare Business and progressed with the API divestiture, expected to close shortly. These strategic moves are part of Viatris's broader plan to streamline operations and focus on higher growth areas. The company also expanded its portfolio through the closure of the Idorsia transaction, enhancing its innovative assets.

Capital return to shareholders was robust, with $393 million returned through dividends and share repurchases. The Board of Directors declared a quarterly dividend of $0.12 per share, underscoring the company's commitment to delivering shareholder value.

Operational and Financial Metrics

Key financial metrics from the quarter include a strong adjusted EBITDA of $1.19 billion and a free cash flow of $565 million. These figures demonstrate Viatris's solid financial health and operational efficiency. The company's ability to generate significant cash flows has supported its strategic investments and shareholder returns.

Future Outlook and Guidance

Viatris has reaffirmed its 2024 financial guidance, projecting new product revenues to be between $450 million and $550 million. The guidance adjustment reflects the impacts of recent divestitures and acquired IPR&D, ensuring stakeholders have a clear view of the expected financial trajectory post these changes.

Conclusion

Viatris's first quarter results for 2024 reflect a company that is effectively navigating its transformational journey. Through strategic divestitures, focused operational growth, and robust financial management, Viatris is poised to continue delivering value to its stakeholders while adapting to the dynamic pharmaceutical landscape.

For detailed insights into Viatris's financials and strategic positioning, stakeholders are encouraged to view the full earnings presentation and supplementary materials available on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Viatris Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance